|

|||||||||||||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | |||||||||||||||||||||||

| April 2023 | |||||||||||||||||||||||

IIAV Member Resources

Trusted Choice® has launched TechCompare, an online platform designed to help members find and connect with top technology vendors, each with a unique focus and expertise, to grow their agency.

The site features a full collection of service providers like Catalyit, Client Circle and more, that specialize in helping to strengthen agency's sales and marketing, operations and customer experience. These vendors offer services in digital marketing, search engine optimization, social media, website development and other key areas.

State & National News

The National Association of Insurance Commissioners (NAIC) released data on life/fraternal and property/casualty insurers in March. The reports provide market share information and identify leading insurance writers in several key lines of business. The reports were updated throughout March, reflecting data filed by insurers. The full 2022 Market Share Reports for Life/Fraternal Groups and Companies and 2022 Market Share Reports for Property/Casualty Groups and Companies will be available this summer and will contain more in-depth information.

Food For Thought

Over 40% more applications for a new business in Virginia were filed in 2022 compared to 2019, according to a U.S. Chamber of Commerce analysis of U.S. Census Bureau data. Over 123,000 new business applications were filed in Virginia in 2022, compared to just over 88,000 new business applications in 2019. The U.S. Chamber projects 6% of these applications will become an employer business. Nationally, new business applications nearly doubled in 2020 and 2021 as entrepreneurs sought solutions to problems posed by the pandemic — a record 5.4 million new business applications were filed in the United States in 2021, closely followed by 5.1 million applications in 2022. The figures for Virginia underscore the strength of Virginia’s business climate across the Commonwealth, as at least 21 new business applications were filed in every county and independent city in 2021.

The issue with her report? She claimed the same things had been stolen the next year. The investigation alleges: In December 2021, Brewer claimed to have had her apartment broken into with multiple items stolen. She took pictures of the aftermath and reported the missing items to her renter’s insurance with Coalition Against Insurance Fraud (CAIF) member Liberty Mutual, and submitted a police report with Durham, North Carolina. From this claim, she earned just over $9K to replace her stolen items. Almost exactly a year later, she submitted another police report and insurance claim with a new insurance provider, another CAIF member, Assurant Insurance. When filling her report, she used the same exact photos from her previous reports and reported all of the same exact items were missing from her apartment. Earlier this month Brewer was arrested and charged with two counts of insurance fraud, one count of obtaining property by false pretense, and one count of attempting to obtain property by false pretense.

IIAV News

Upcoming Events

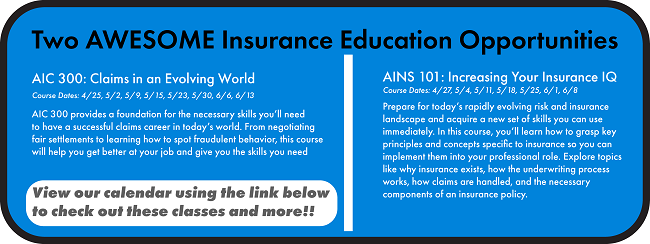

Education

|

|||||||||||||||||||||||