|

||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | ||||||||||||

| October 2025 | ||||||||||||

|

IIAV News

2025 YOUNG AGENTS CONFERENCE

Calling all young agents—your future starts in Williamsburg! There’s still time to invest in your future! Join us at the IIAV Young Agents Conference for engaging speakers, industry insights, and invaluable networking with peers from across the state. Build relationships, gain knowledge, and strengthen your career foundation. REGISTER NOW OR IN-PERSON!

October 9th, 2025 | Unchecked fraudulent litigation drives up costs for all Americans and undermines trust in justice, new research shows.

As a member of IIAV you have access to the Trusted Choice® library of social media graphics to inform customers of cyber risks.

The Workplace Advisors

Along with leaves starting to fall and the aroma of pumpkin spice filling the air, signs of Halloween are everywhere. While others see spooky or fun symbols of the holiday, they made us reflect on some of the scariest HR stories we have heard recently. The Workplace Advisors

Question: We offer paid holidays to employees. Are we required to pay holidays to all employees? Answer: In most cases, holiday pay is a benefit employers can offer voluntarily (although a couple of states require certain holidays), which means you can establish any criteria you want as to which employees are eligible as long as you are consistent. For example, you can offer holiday pay to all employees, only regular employees, and/or only full-time employees while also defining the number of hours to be considered full-time. You can also decide which holidays you observe and which of those, if any, you will pay for. While many companies observe six common ones (New Year's Day, Memorial Day, 4th of July, Labor Day, Thanksgiving, and Christmas), some companies offer added days such as the Friday after Thanksgiving or the day before or after Christmas (which can differ from year to year depending on when the holidays fall in the week). Other companies observe only one or two holidays a year because their industry (e.g., retail, hospitality, and janitorial) typically expects them to work on holidays. Some companies expand the benefit by offering flex holidays to allow employees time off for their personal religious, cultural, or lifestyle priorities (i.e., Passover, Kwanzaa, or participating in a cancer walk). Even if you close the company for a holiday, you do not need to pay non-exempt employees for these holidays, but you can. Whatever you decide to offer, you should draft a comprehensive policy that includes who is eligible, observed holidays, whether they are paid or unpaid, and whether employees will receive any extra pay for working on an observed holiday. September 22, 2025

A recent amendment to a state law potentially widens employers’ exposure to personal injury and wrongful death liability. Virginia Financial Service Corporation has been providing Agency E&O coverage in Virginia for over 50 years, utilizing strategic carrier partnerships specifically designed to meet the needs of Virginia agents. This means you have options.

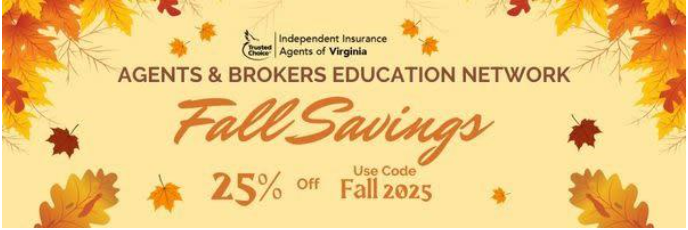

The 25% ABEN Fall Savings is Available only to IIAV Members

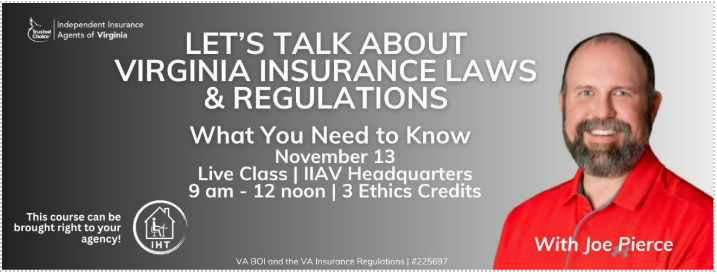

For additional course options, use the IIAV Education Calendar. |

||||||||||||