Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900084&issueID=106064 to view the full article online.

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900085&issueID=106064 to view the full article online.

October 9th, 2025 | Unchecked fraudulent litigation drives up costs for all Americans and undermines trust in justice, new research shows.

“Frivolous lawsuits and fraud in the courts minimizes faith in the civil justice system and harms litigants, small businesses, and everyday Americans,” said Tiger Joyce, ATRA’s president. “Lawsuit abuse leads to higher costs for everyone, while individuals with legitimate cases may see justice delayed or compensation depleted when settlement money is siphoned by unsupported mass tort claims.”

Excess litigation in the U.S. costs $367.8 billion annually and results in a “tort tax” of $1,666 per person, or $5,215 per family.

The report categorizes questionable lawsuit filings into two main buckets:

- Personal injury claims from auto accidents or falls; and,

- Mass tort litigation.

Visit https://atra.org/fraud-on-the-rise-new-atra-report-exposes-systemic-lawsuit-abuse-in-civil-courts/#:~:text=Unchecked%20fraudulent%20litigation%20drives%20up,outlines%20solutions%20to%20address%20abuse. to view the full article online.

|

Visit https://trustedchoice.independentagent.com/content-to-share/?Keyword to view the full article online.

Along with leaves starting to fall and the aroma of pumpkin spice filling the air, signs of Halloween are everywhere. While others see spooky or fun symbols of the holiday, they made us reflect on some of the scariest HR stories we have heard recently.

Visit https://theworkplaceadvisors.com/scary-hr-stories-real-workplace-nightmares/ to view the full article online.

Question: We offer paid holidays to employees. Are we required to pay holidays to all employees?

Answer: In most cases, holiday pay is a benefit employers can offer voluntarily (although a couple of states require certain holidays), which means you can establish any criteria you want as to which employees are eligible as long as you are consistent.

For example, you can offer holiday pay to all employees, only regular employees, and/or only full-time employees while also defining the number of hours to be considered full-time.

You can also decide which holidays you observe and which of those, if any, you will pay for. While many companies observe six common ones (New Year's Day, Memorial Day, 4th of July, Labor Day, Thanksgiving, and Christmas), some companies offer added days such as the Friday after Thanksgiving or the day before or after Christmas (which can differ from year to year depending on when the holidays fall in the week). Other companies observe only one or two holidays a year because their industry (e.g., retail, hospitality, and janitorial) typically expects them to work on holidays.

Some companies expand the benefit by offering flex holidays to allow employees time off for their personal religious, cultural, or lifestyle priorities (i.e., Passover, Kwanzaa, or participating in a cancer walk).

Even if you close the company for a holiday, you do not need to pay non-exempt employees for these holidays, but you can.

Whatever you decide to offer, you should draft a comprehensive policy that includes who is eligible, observed holidays, whether they are paid or unpaid, and whether employees will receive any extra pay for working on an observed holiday.

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900101&issueID=106064 to view the full article online.

September 22, 2025

In brief

- Virginia law now allows employer liability for intentional employee misconduct

- Applies when victims are vulnerable under state definitions

- Legal standard includes a four-part test for employer negligence

- Impacts industries like health care, caregiving, and assisted living

A recent amendment to a state law potentially widens employers’ exposure to personal injury and wrongful death liability.

Visit https://www.naylornetwork.com/via-nwl/assets/NewLaw.pdf to view the full article online.

Virginia Financial Service Corporation has been providing Agency E&O coverage in Virginia for over 50 years, utilizing strategic carrier partnerships specifically designed to meet the needs of Virginia agents. This means you have options.

- Local support from an experienced insurance team

- Successfully serving Virginia insurance agents for over 50 years

- Exclusive Carrier Relationships

- Multiple E&O Carrier Options (Admitted and Non-Admitted)

- Risk Management & Additional Services

Visit https://www.iiav.com/Products/Pages/ForYourAgency/ProfLiability/default.aspx to view the full article online.

|

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900107&issueID=106064 to view the full article online.

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900108&issueID=106064 to view the full article online.

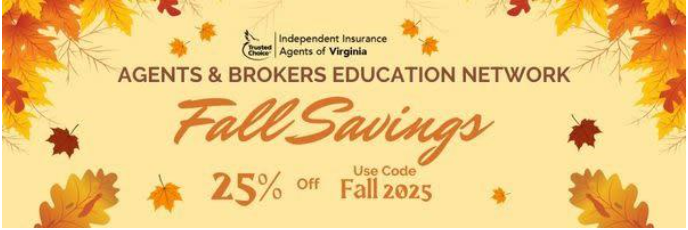

The 25% ABEN Fall Savings is Available only to IIAV Members

Click on the course name for full details

- Builders Risk and Contractors Equipment - 10/20/2025

- Premium Auditing - What Every Agent Must Know - 10/21/2025

- How To Thrive In An Ever-Changing Work Environment - 10/29/2025

- Cybersecurity Risk and Insurance Are ...- 10/29/2025

For additional course options, use the IIAV Education Calendar.

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=900109&issueID=106064 to view the full article online.