An Optimistic Outlook for Trucking in 2019

Print this Article | Send to Colleague

By Peggy Dorf, DAT Solutions

Are we really on the brink of a freight recession? I've seen plenty of gloom-and-doom forecasts and analyses from some very smart people, but I'm not buying it.

I look at the data, and I see a continuing pattern of growth in freight volumes, both in the spot market and in the U.S. truckload segment overall. Trucking freight tonnage is up, according to the ATA's not-seasonally adjusted index, and more spot market loads are moving this year than in the first five months of 2018.

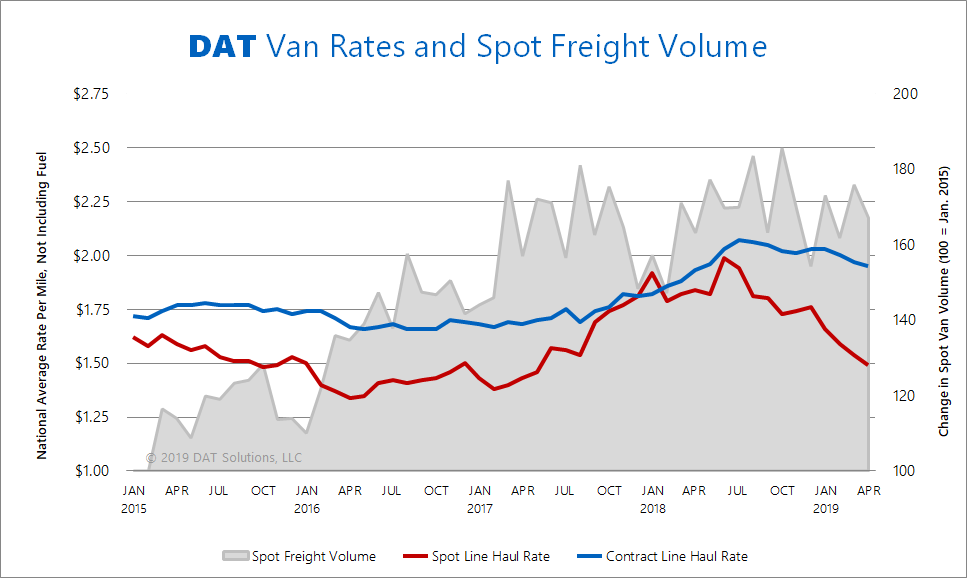

Granted, the growth is slow and gradual, in the range of 2% to 4% compared to last year, and spot rates have reverted to 2017 levels after last year's record highs. But contract rates are only a few cents lower than they were in 2018. This is not going to be another peak year for carriers, but it's not a crisis, either.

Spot market rates have been drifting down since July 2018, but the volume of van loads is increasing gradually, year over year.

Many carriers and freight brokers are surprised to learn that volumes are holding up so well. This year feels like a struggle because some companies are growing rapidly, but others are hurting. For companies that bid on shipper freight directly, low spot rates can lead to new business opportunities. For non-asset intermediaries, lower rates mean reduced costs, which helps the bottom line. There's not as much upside for small, asset-based companies that depend entirely on spot freight, however.

It's the capacity, stupid

If freight volume is greater than it was in 2018, why are rates looking like 2017? To paraphrase a long-ago presidential advisor: "It's the capacity, stupid."

Tight capacity drove rates up in 2018. In response, asset-based carriers re-invested 2018 profits back into their businesses, buying record numbers of trucks and trailers, and improving driver compensation and working conditions, to handle additional volume. By the beginning of 2019, the new trucks were being delivered, and driver retention had improved significantly, so there were more trucks available. Meanwhile, small fleets adapted to the use of ELDs, and drivers regained lost productivity.

Demand didn't grow as fast as capacity, however, as seen in the load-to-truck ratios on DAT load boards. That’s why spot rates fell in the second half of 2018, and contract rates followed, but more slowly and gradually.

Load-to-truck ratios have declined sharply since July 2017, and spot rates followed the same trend.

Load-to-truck ratios have declined sharply since July 2017, and spot rates followed the same trend.

2020 headwinds: Tariffs, bad weather, and ELDs (again)

What will happen to freight in the next 12 to 18 months? It depends. There is still potential for continued growth in the freight economy. Unemployment remains at record lows, wages are rising, and interest rates are fairly stable. There is uncertainty around trade issues, and if tariffs increase between the U.S. and its most important trading partners, prices are likely to rise on a long list of goods and services. Some items may become more scarce in the short term.

Eventually, either the U.S. will renegotiate those trade agreements and reduce the tariffs, or American companies will find alternative sources for business-critical materials, parts, and finished goods. Either way, most of the trade-related issues could well be resolved before the end of the year.

On the other hand, new home construction is slowing down, which is never a good sign. Can we blame the weather? It has certainly been a crazy year so far, with late-winter snow and ice, bomb cyclones, flooding, and multiple tornadoes – plus the upcoming hurricane season. Those weather patterns ate up a lot of productivity in the first half of 2019, and the impact will be with us for a while. Midwestern agriculture won't recover this year, and California cherries may be ruined due to late spring rainstorms.

ELDs could be an issue again in 2020, as the clock runs out – literally and figuratively – on fleets that were permitted to continue logging drivers' hours for two more years on a less-exacting electronic onboard recording device (EOBRD.) If the EOBRD phase-out leads to capacity shortfalls, freight rates could bounce back early next year.

Overall, I remain cautiously optimistic about the strength of the freight economy going into 2020. Rates may be lower, but there are still plenty of opportunities for profitable growth.