DAT Weekly Trendlines Report - Holiday Weekend Adds to Tight Capacity for Longer Hauls

Print this Article | Send to Colleague

| Week Ending May 26, 2018 |

| Holiday Weekend Adds to Tight Capacity for Longer Hauls |

|

Van rates were unchanged at $2.15 per mile for the third consecutive week, as a national average, while reefers got a two-cent increase to an average of $2.51, for temperature-controlled freight movements. Flatbed rates set a new record at an average of $2.73. Rates got a boost from a one-cent uptick in the average fuel surcharge, accompanying the rising cost of diesel fuel at the pump. The load-to-truck ratios increased again for both equipment types, and rates are on the rise in high-volume lanes, two early signals of peak pricing in June. (Note that this may be a secondary peak, not quite up to the extraordinary rates recorded in January.) Some of the pressure last week may have been due to the holiday weekend, as many drivers would have been reluctant to accept long hauls after mid-week. Van Rates Rise in Key Markets Last week, the rate pressures also spread northward to Chicago and Columbus, where outbound rates added more than 2 percent compared to the previous week. |

|

|

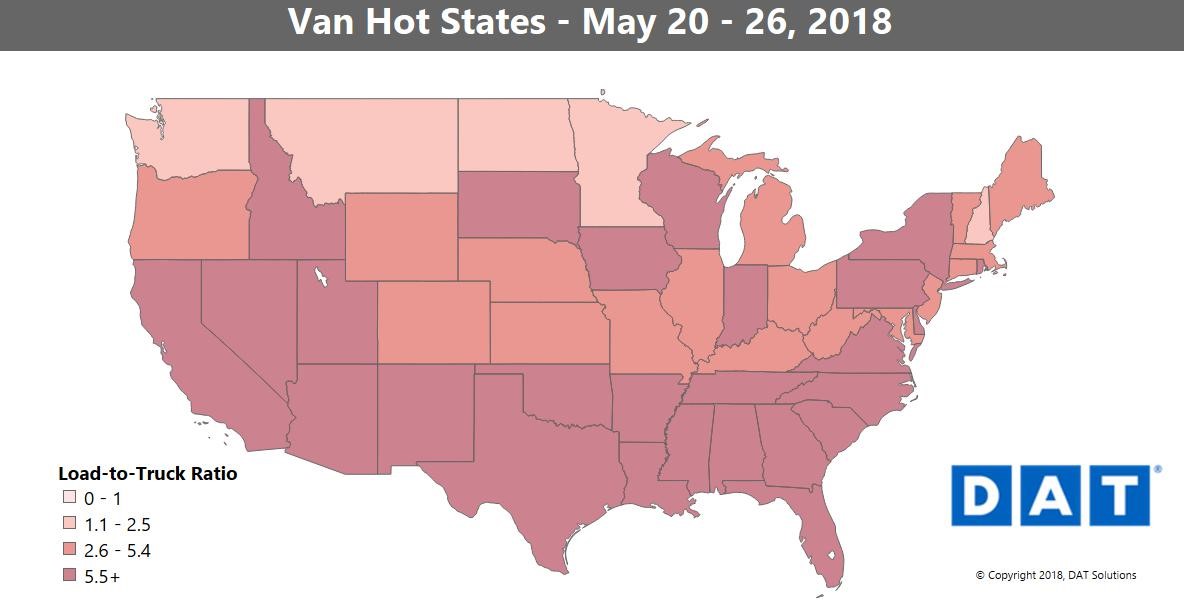

Demand for dry van freight transportation was most intense across the southern band of states, but major Midwest freight markets also saw rising rates, leading up to Memorial Day during the week of May 20 to 26. NOTE: The map depicts outbound load-to-truck ratios for dry van, for each of the 48 contiguous states, during that week. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |