| Archive/Subscribe | TAPPI.org | Advertise | TAPPI Press Catalog | April 2016-2 |

Global Pulpwood Prices Decline through 4Q/15

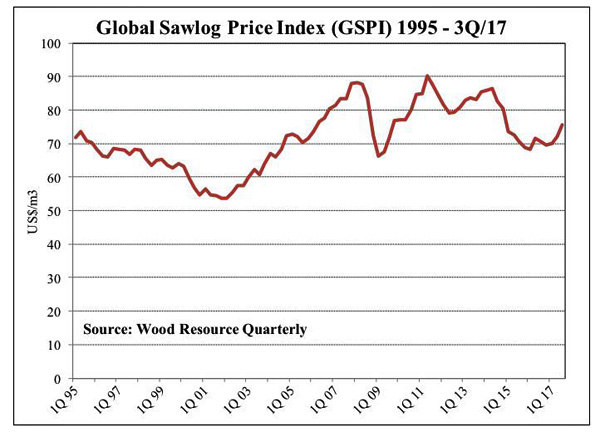

The Global Sawlog Price Index (GSPI) continued its two year decline in the 4Q/15 when the Index fell another 4.8% quarter-over-quarter. In just two years, the GSPI has fallen 21.6% due to combination of the strengthening of the U.S. dollar and diminishing demand for lumber in Asia, the MENA countries, and in Europe, according to Wood Resource Quarterly (WRQ), Seattle, Wash., USA. Sawlog prices in Europe have generally fallen faster than in other parts of the world, with the Central European prices decreasing by almost one-third in the past two years. In the 4Q/15, the European Sawlog Price Index (ESPI) dropped to $91.00/cubic meter, the lowest level since the 1Q/09.

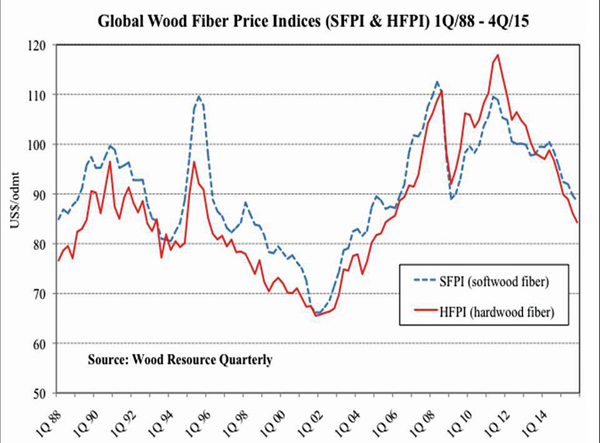

In the global pulpwood prices arena, hardwood fiber prices continued to fall in most of the major pulp-producing countries in the world in the 4Q/15. The biggest declines were seen in Brazil, Chile, Russia, France, Germany, and Indonesia. In most regions, the price adjustments were in both the local currencies and in U.S. dollar terms. The hardwood price index (HFPI) fell 2.2% from the 3Q/15 to $84.27/odmt.

With the exception of the U.S. South and New Zealand, softwood fiber prices were also down throughout the world in the 4Q/15. The declines ranged between 2% and 10% from the previous quarter. The softwood price index (SFPI) was $88.46/odmt, a reduction of 1.4% from the previous quarter.

Global market pulp production was 3.3% higher in 2015 than in 2014. Production was up in most regions with the exception of Western Europe. The biggest increases in pulp export in 2015 were in shipments from Brazil, Canada, the Netherlands, and Russia.

NBSK pulp prices have fallen during much of 2015 but started to find a bottom late in the year. Prices for hardwood pulp (HBKP) started to weaken during the 4Q/15 and prices in Europe were only $15-20/ton lower than those for NBSK.

North American overseas pellet exports increased for the second consecutive quarter in the 3Q/15, rising 15% from the previous quarter to reach a new record high of just over 1.6 million tons, according to WRQ’s sister publication North American Wood Fiber Review.

Although pellet production in Sweden has been fairly stable the past four years,importation has fallen by more than 50% from 2011 to 2015. In the local currency, pellet prices fell during the fall of 2015 and were 4% lower in the 4Q/15 than in the 4Q/14.

More information and subscription forms are available online.

|