Port Metrics: Baltimore, Germany

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

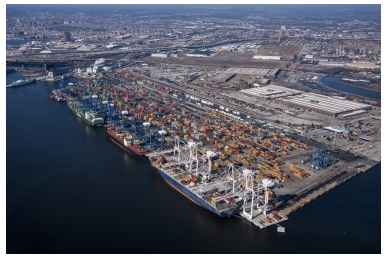

Baltimore: Journal of Commerce Study Names Port and Its Seagirt Marine Terminal Most Efficient in First Half of 2015

An independent analysis conducted by the Journal of Commerce (JOC) recently named the Port of Baltimore and its Seagirt Marine Terminal the most efficient port and container terminal in the country during the first six calendar months of 2015. Seagirt averaged 75 container moves per hour per berth, according to JOC.

The JOC port productivity numbers are compiled by international shipping lines, not by individual ports or marine terminals.

The JOC’s port productivity rankings factored in elements such as a ship’s arrival time at a berth, the number of container moves per hour, and a ship’s departure time from that berth.

Seagirt Marine Terminal, Baltimore’s primary container facility, includes 11 cranes – four of them super Post-Panamaxers capable of spanning 22 container rows – and 50-foot MLW berth depth.

Earlier this year Maersk Line began calling Seagirt Marine Terminal. Additionally, Wallenius Wilhelmsen Logistics, the port’s largest roll on/roll off customer, signed a new 30-year contract with the Maryland Port Administration.

The port had a record year in 2014 with 29.5 million tons of international cargo valued at nearly $53 billion crossing the docks of both its public and private marine terminals.

Seagirt Marine Terminal

Photo/Maryland Port Admnistration

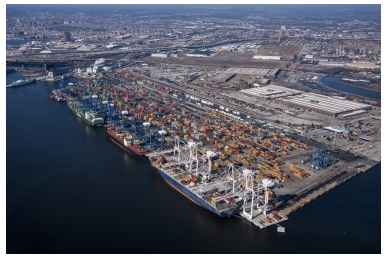

An independent analysis conducted by the Journal of Commerce (JOC) recently named the Port of Baltimore and its Seagirt Marine Terminal the most efficient port and container terminal in the country during the first six calendar months of 2015. Seagirt averaged 75 container moves per hour per berth, according to JOC.

The JOC port productivity numbers are compiled by international shipping lines, not by individual ports or marine terminals.

The JOC’s port productivity rankings factored in elements such as a ship’s arrival time at a berth, the number of container moves per hour, and a ship’s departure time from that berth.

Seagirt Marine Terminal, Baltimore’s primary container facility, includes 11 cranes – four of them super Post-Panamaxers capable of spanning 22 container rows – and 50-foot MLW berth depth.

Earlier this year Maersk Line began calling Seagirt Marine Terminal. Additionally, Wallenius Wilhelmsen Logistics, the port’s largest roll on/roll off customer, signed a new 30-year contract with the Maryland Port Administration.

The port had a record year in 2014 with 29.5 million tons of international cargo valued at nearly $53 billion crossing the docks of both its public and private marine terminals.

Seagirt Marine Terminal

Photo/Maryland Port Admnistration

Germany: First Half 2015 Port Cargo Traffic Down 0.1%

Some 151.8 million metric tons of ocean-borne cargo moved through Germany‘s seaports during the first six months of 2015, down just 0.1 percent from the prior year total, according to data reported by the federal statistics agency Statistische Bundesamt.

The decline was due entirely to a 1.0 percent drop in import cargo, to 85.4 million tons from 86.2 million tons in January-June 2014. Year-on-year grains of 0.8 percent and 4.9 percent, respectively, were posted by German export and domestic cargo tonnage.

Germany’s container trade took an even deeper plunge, down 2.2 percent, from 7.9 million to 7.7 million TEUs. A major factor was shrinking volumes with Germany’s top overseas container trade markets – Russia (-14.5 percent); China (-8.1 percent), and the United States (-7.3 percent).

An encouraging exception was the performance of Germany’s new North Sea container port, JadeWeserPort Wilhelmshaven. The port, which began operation in late 2012, experienced a nearly 400 percent jump in throughput, to 191,000 TEUs from just 39,000 in first half 2014.

The attachment has detail.