Appetite for Debt

Print this Article | Send to Colleague

Agencies with over $100 million in revenue have twice the debt level of other groups and source debt from more diverse providers. Their average debt is 4.1 times Pro Forma EBITDA; other revenue bands do not exceed 1.7 times.

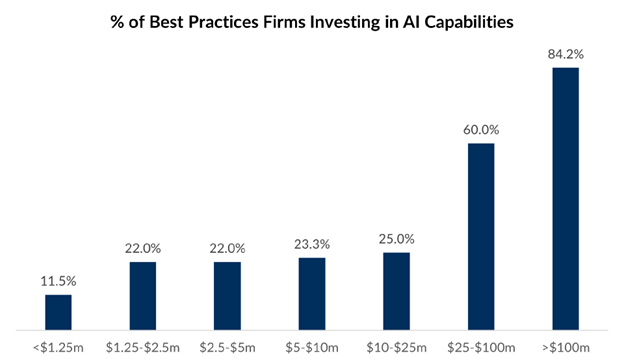

Source: Reagan Consulting’s 2025 Best Practices Study

Firms with revenue exceeding $100 million are leveraging their balance sheets to take on debt to perform acquisitions, attract and retain top talent, and reinvest in their operations to drive faster growth. These activities contribute to total agency growth (organic plus acquired growth) with firms over $100 million leading total growth at 14.5%. Organizations not fully utilizing debt should assess opportunities for growth and whether taking on additional debt could accelerate that growth.

Looking at these trends, it’s clear that agencies of all sizes are finding new ways to adapt and grow in a changing industry. While larger agencies might have some unique strategies and resources, there are takeaways and ideas here that can help firms at every level. As the release of the new Best Practices Study approaches, agencies will have the opportunity to analyze the findings, benchmark their performance, and strategically plan for continued success in an evolving landscape.

The Best Practices Study is available!