Shareholder Population

Print this Article | Send to Colleague

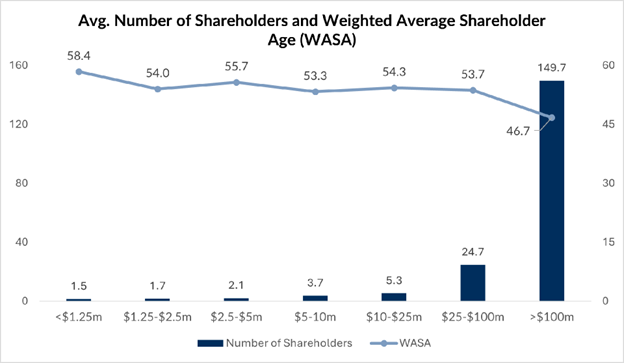

A key distinction between firms in the over $100 million revenue band and those in the other six revenue bands is the average number of shareholders. Best Practices firms exceeding $100 million in annual revenue average ~150 shareholders—an amount six times greater than that observed in the $25–$100 million band. Notably, these larger firms also maintain a Weighted Average Shareholder Age (WASA) that is approximately seven years younger than their counterparts in smaller bands. This data highlights the strategic importance that high-performing large agencies place on extending equity ownership to top talent. By broadening shareholder participation, these firms can attract and retain top talent, supporting both leadership continuity and sustained growth.

Source: Reagan Consulting’s 2025 Best Practices Study

Another important consideration for firms committed to internal perpetuation is expanding their shareholder base. As valuation multiples continue to rise, agencies that restrict ownership to a limited group may find themselves with fewer options when planning for succession. Broadening equity participation is not only a strategic move for talent retention, but also a practical perpetuation necessity.