June Adds Strength to Close Q2

By Mark Montague, DAT Solutions

Spot market pricing rebounded with a 10% bounce from mid-May through the end of June. The Los Angeles market led the charge, with the largest amount spent on truckload transportation, as recorded in DAT RateView. The Atlanta market also had a strong close, in the No. 3 position for outbound freight.

It’s typical for van freight volumes to increase on the lanes heading east out of West Coast markets, and this year was no exception. Although vans appeared to lose momentum out of both L.A. and Stockton in mid-June, volumes restarted in the past two weeks. One factor was the long-overdue, favorable growing conditions for California agriculture. As fresh produce is available for harvest, reefer capacity gets tied up, and those trucks don’t compete for van loads. Plus, not all agricultural products require refrigeration. Vented vans are often sufficient.

Expect this week to be busy, especially for reefers, as fresh produce and other commodities head to store shelves ahead of the Independence Day holiday weekend.

Atlanta and Memphis also had notable gains in June, while Chicago, Houston, and Seattle were mostly neutral compared to May.

|

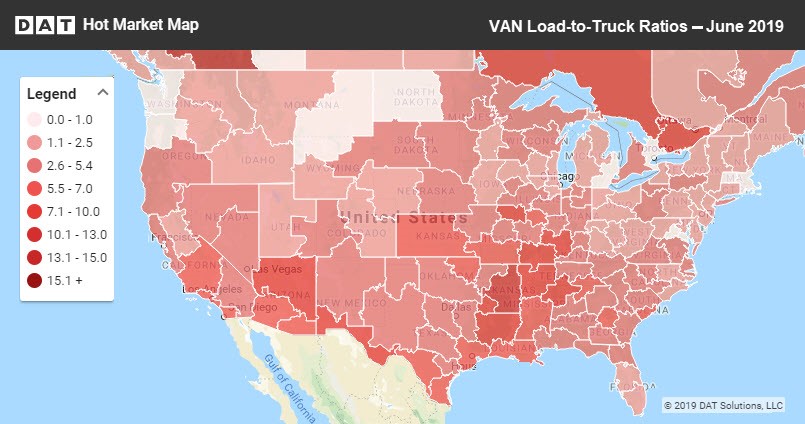

Load-to-truck ratios rose during June, with strength improving along the Southern band of states early in the month. By mid-month, California freight began to move in earnest, thanks to a long-awaited influx of fresh produce. Spring planting was delayed due to unfavorable weather conditions, so those harvests were postponed to late July. For more trend information, see www.dat.com/trendlines.

In the past week alone, Memphis was a standout, especially on the lane from Memphis to Columbus, OH, which is vital to the supply chain for retail and other sectors. That lane added 27 cents last week, rising to $2.51 per mile. The lane from Memphis to Chicago also got a boost, as did Chicago to Buffalo, and Buffalo to Allentown, PA. Allentown is often the last stop before final-mile deliveries to the largest population centers in the Northeast.

June PMI Confirms Spot Market Trends

As if to confirm the spot market trends, the Institute for Supply Management announced that their Purchasing Managers’ Index (PMI) was stable for June at 51.7 versus May at 52.1. Values above 50 indicate expansion, so May and June experienced slow growth.

The PMI components representing new orders, supplier deliveries, and inventories were down slightly, and prices took a 5% hit, month over month. Employment and production increased, with industrial production rising from 51.3 in May to 54.1 in June. These trends are favorable to spot market volume because spot freight is closely tied to industrial production, while contract freight generally supports consumption.