DAT Weekly Trendlines Report – Hurricane Michael Stalls Regional Freight

| Week Ending Oct. 13, 2018 |

|

Hurricane Michael barreled into the Gulf Coast of Florida last Wednesday and swept through Georgia, the Carolinas and into Virginia with high winds and heavy rainfall. Thankfully, the area of first landfall was not heavily populated, but the destruction was nearly total in those small coastal communities. In our own industry, we saw freight flows stall, as regional markets shifted to an emergency footing, and relief supplies were pre-positioned at warehouses just beyond Michael’s path. This week, we're getting a longer look at Michael's impact on our industry, starting with a 10 percent reduction in van freight moves nationwide, due largely to the storm. Major routes were cut off last week, including I-10 from Jacksonville west toward Houston, and parts of I-75 from Florida to Atlanta and points north. Because Michael accelerated suddenly from a tropical depression to Category 4 hurricane, it’s likely that some assets were stranded in Florida when the storm hit. Even if you don’t operate facilities or assets in a storm zone, events of this magnitude can disrupt your business in the markets you serve. Some of those disruptions may still be ahead of us, as pent-up demand from recent weeks adds to holiday freight, driving rates up to an end-of-year peak. We’ll see how this plays out in the coming weeks, with regular assessments of market conditions. |

|

|

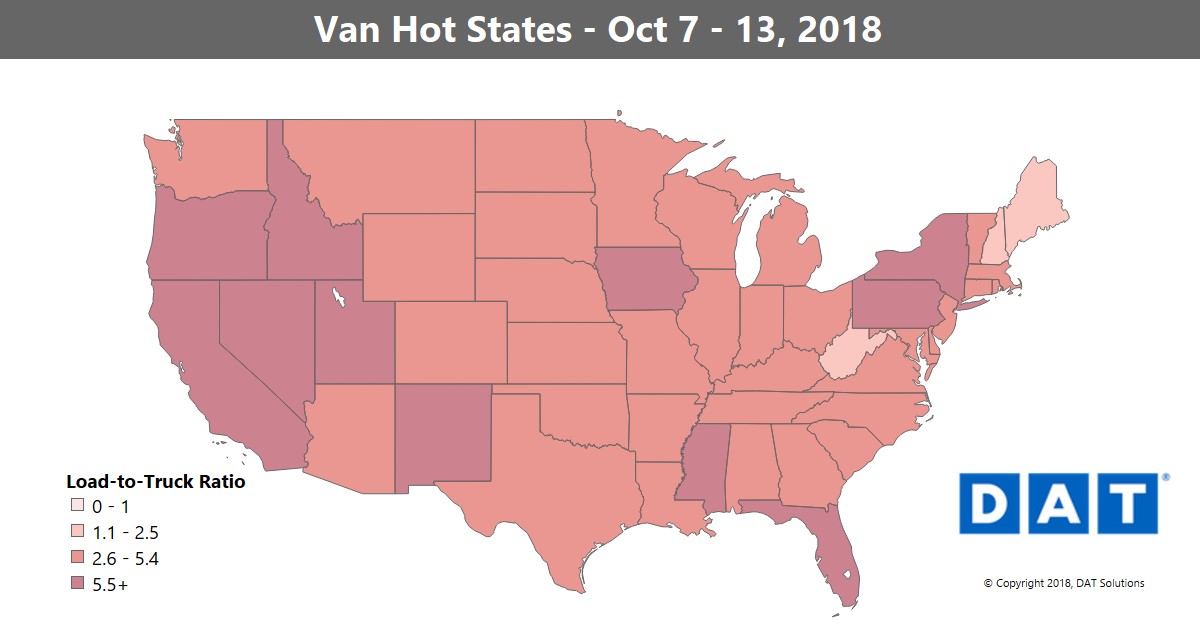

The load-to-truck ratio dropped 16 percent in the week ending October 13, to 4.7 loads per truck, due largely to disruptive influence of Hurricane Michael. Van rates slipped to $2.13 per mile for the month to-date, which is two cents lower than the September average. NOTE: The map depicts outbound load-to-truck ratios for dry van freight. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |