5 Simple Ways Brokers Can Improve Their Credit Score

Print this Article | Send to Colleague

by Pat Pitz, DAT Solutions

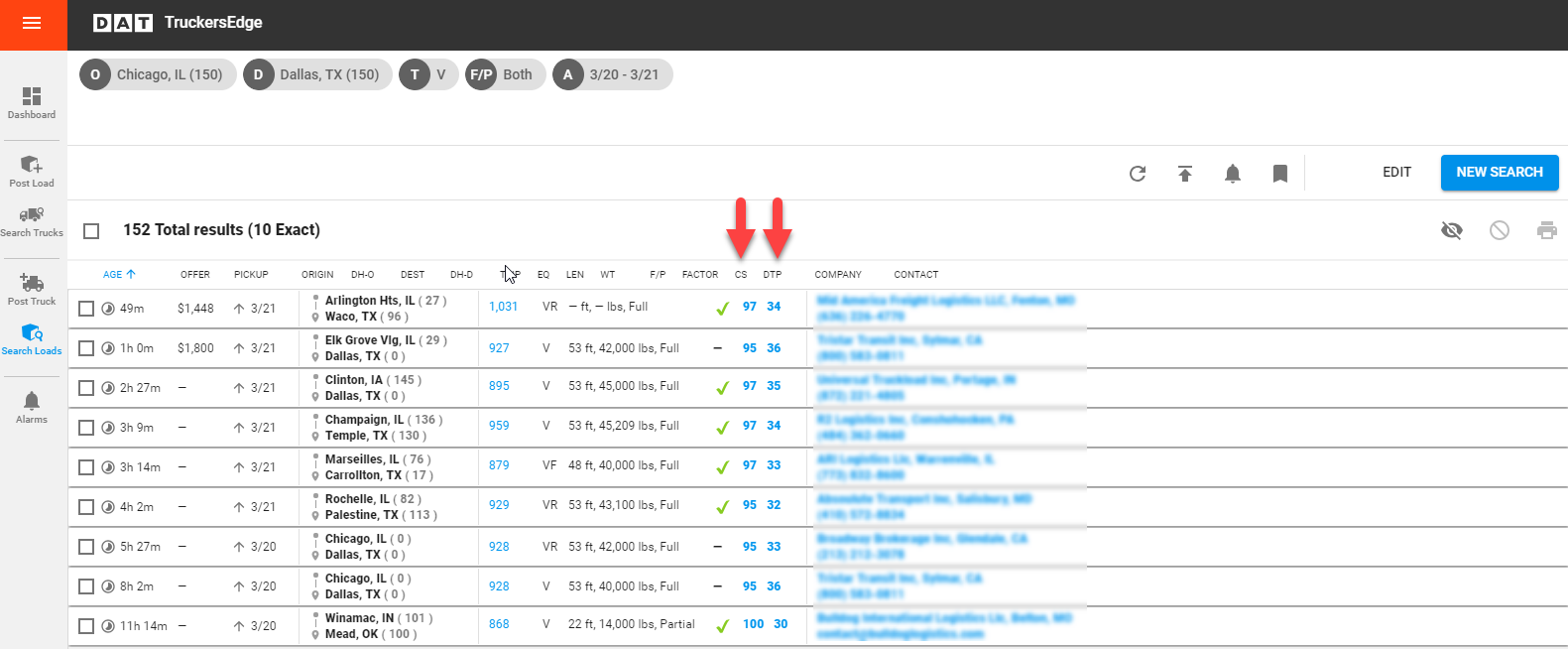

When carriers search for loads on a load board, they'll often get dozens of results, especially on popular lanes. So how can a broker create a load post that will stand out from the pack?

Posting an attractive rate will help, but beyond that, carriers want to work with brokers they can trust. And an important gauge of that trust is the broker's credit score and days to pay, which are often shown within the load posting. That's why it's critical that brokers maintain good scores. But how do they do that?

"Anything a broker can do to cut the time between invoice and payment will help," says Andrea Rogers, Vice President, Ansonia Credit Data, which provides the credit score and days to pay data to DAT Solutions. She offers these five tips.

|

1. Receive invoices electronically - Make sure you're set up to receive invoices from carriers and other companies via email rather than mail. List your email boldly on the load confirmation to make it easy for the carrier and factoring companies to read.

2. Pay your bills electronically - Pay companies using an electronic funds transfer system such as ACH or eCheck to cut out mail delays.

3. Check email and mail every day - If you are set up to receive invoices through email, make sure you — or your accounting department — check the email for invoices at least once a day. Same goes for postal mail.

4. Track down missing paperwork - If you don’t receive all the necessary paperwork from a carrier in a timely manner, be proactive and track it down.

5. Grow your business steadily - Just as with personal credit, too many sudden creditors reporting data and/or inquiries into your credit can be a red flag. Your credit is something you build over time – it doesn't happen overnight.

|

A brokerage's credit score and days to pay are featured prominently in load posts in DAT load boards. Shown is the DAT TruckersEdge load board for Owner-Operators.

Common Mistakes

Rogers says that one of the biggest mistakes Ansonia hears about is that if a broker doesn't receive the required paperwork from the carrier, they think they don't have to pay it yet. "Delaying will negatively affect the broker's credit score, so they need to track down whatever is missing," she says. When it comes to paperwork, here are some of the most common things that cause delays:

• Illegible Bills of Lading - This is especially true for BOLs captured with a cell phone.

• Bills of Lading missing pages - All pages need to be submitted, not just the page the receiver signs• Missing lumper receipts - Make sure the driver turns them in with the other paperwork.

• Load confirmations not signed

What's a good credit score?

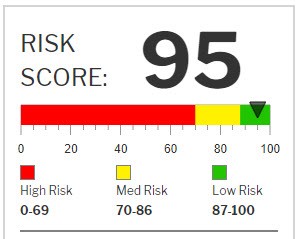

The credit score provided by Ansonia gauges a company’s creditworthiness and is based on a number of criteria, including the number of days to pay, payment trends collected from data contributors, alerts, bankruptcies, collection agency activity and other credit indicators. At Ansonia, a credit score of 87 and above is considered low risk, while credit scores below 70 are seen to be riskier.

|

(Pat Pitz is the editor of the DAT broker newsletter.)