DAT Weekly Trendlines Report – Van Freight Stabilizes in Early October

Print this Article | Send to Colleague

| Week Ending Oct. 6, 2018 |

| Van Freight Stabilizes in Early October |

|

Spot market line haul rates are now only five percent higher for vans than they were a year ago, rising from $1.74 to $1.83 per mile not including the fuel surcharge. And the number of van loads that have moved in this time frame is nearly identical to 2017. You’d expect this season to be different from early October 2017, when Hurricanes Harvey and Irma still had a massive impact on supply chain operations. Plus, the ELD mandate hadn’t taken effect yet, and many small carriers were just getting started with the new devices. Business and economic conditions have changed in the past year, too. But freight has mostly "normalized” on the spot market. What is keeping rates and volume in check? The throttle is a significant increase in capacity, especially among small and mid-sized carriers. In other periods when carriers had pricing power, capacity expanded fairly quickly to bring the marketplace back into balance. Still to be seen is whether the coming holiday season and e-commerce demand result in a meaningful spike in rates during the fourth quarter. |

|

|

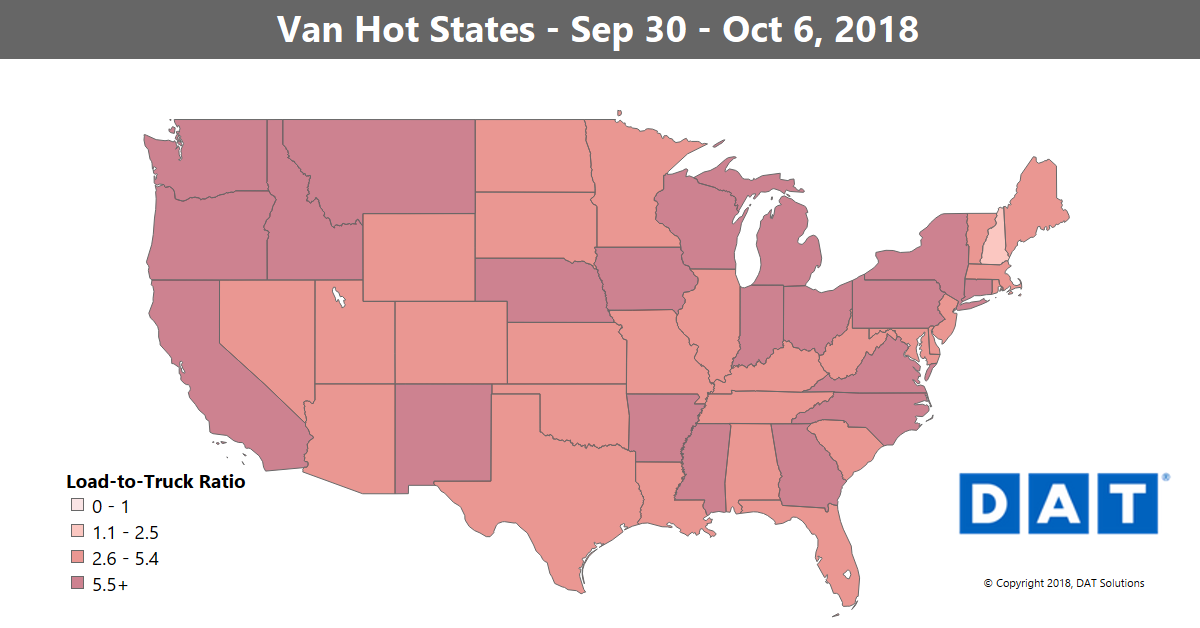

The load-to-truck ratio dropped 23 percent in the first week of October, to 5.6 loads per truck, which is still 29 percent higher than it was last year at this time. The national average was 7.1 loads per truck for vans in September. Despite the declining ratio, van rates rose 2 cents per mile to $2.17 in the week ending October 6, as a national average, compared to September levels. NOTE: The map depicts outbound load-to-truck ratios for dry van freight. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |