DAT Weekly Trendlines Report – Reefer Demand Heats Up, but Rates Lose a Penny

Print this Article | Send to Colleague

| Week Ending Aug. 25, 2018 |

|

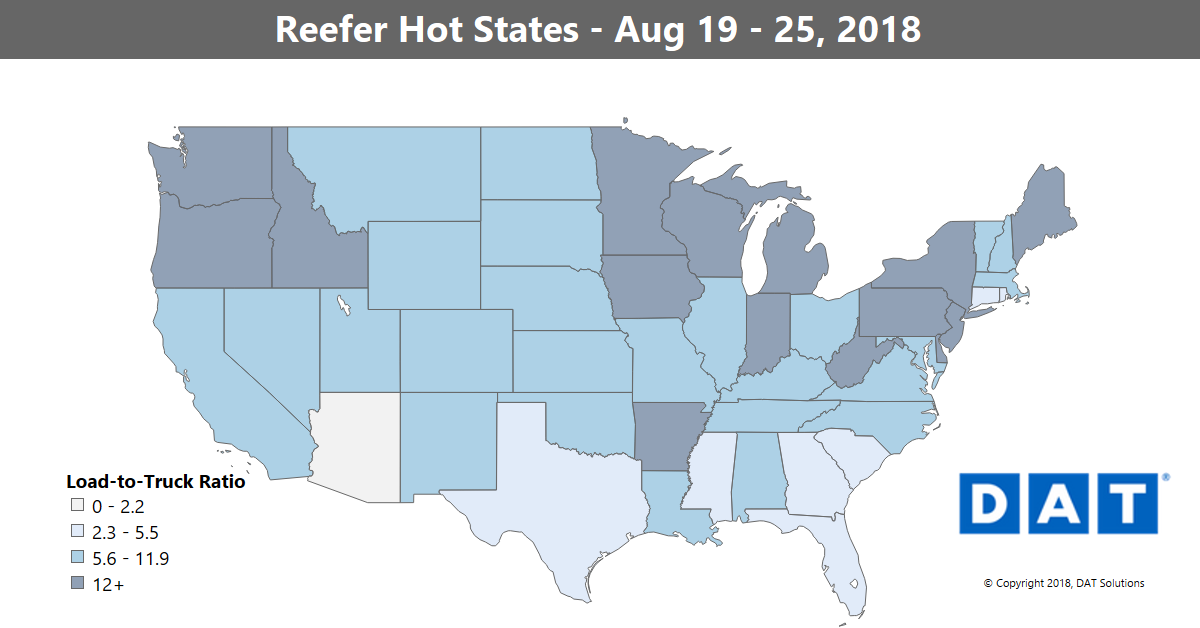

It could be a little tougher than usual to find refrigerated (“reefer”) equipment this week. The run-up to Labor Day weekend and the new school year typically leads to a surge in demand for transportation of fresh food. This year, the back-to-school grocery fest coincides with late-summer harvests. Apples, pears, onions, and potatoes are rolling out of orchards and fields in the Upper Midwest, Pacific Northwest, and parts of the Northeast, just as school cafeterias and busy parents are re-stocking fridges all over the country. That extra activity boosted the national average load-to-truck ratio 15 percent last week, an unusually big jump, from 8.3 to 9.6 loads per truck. In a surprising twist, however, the national average rate for reefers dropped a penny lower, to $2.49 per mile for the month to-date. That could be due to a higher proportion of long-haul lanes in the mix, and rates could rebound a few cents before the month ends on Friday. Meanwhile, reefer ratios and rates are back to where they were in May. Contract rates continue to rise for reefer equipment, up to $2.63 per mile including fuel as we approach the end of August. That’s the first time all year that contract rates are solidly above spot market rates for reefers, and that 14-cent gap could make it easier for 3PLs to negotiate with shippers and carriers alike. |

|

|

Reefer rates lost another penny to $2.49 per mile on the spot market. That’s the national average for the month to-date, in the week ending August 25. Contract rates now exceed spot market rates by 14 cents per mile, restoring a gap that all but disappeared in the past 12 months. The load-to-truck ratio rose 15 percent, to 9.6 loads per truck, with concentrated areas of tight capacity in the Pacific Northwest, Upper Midwest, and Northeast regions. NOTE: The map depicts outbound load-to-truck ratios for refrigerated (“reefer”) van freight. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |