DAT Weekly Trendlines Report - June Spot Rates Will Set a New Record, if Trend Persists

Print this Article | Send to Colleague

| Week Ending June 16, 2018 |

| Inspection Blitz Adds to Pressure on Capacity and Rates |

|

Roadcheck is behind us, but rates continue to rise, and the upward trajectory will likely lead to record highs for the month. For now, the national average van rate of $2.30 per mile for the rolling month to-date exceeds the previous record of $2.24 per mile in January. That six-cent gap could widen some more, but even if it doesn’t, June is on track to exceed January’s record. Outbound rates rose by more than 3 percent on major lanes originating in Los Angeles and Stockton, while rates rose 5.6 percent on high-volume lanes leaving Memphis, to an average of $3.06 per mile. Rates were up 2.4 percent on top lanes out of Atlanta, as well. Several key markets had double-digit increases in outbound volumes, as well, signaling strength in carrier pricing. Notably, volumes increased sharply in four of the largest and most important freight markets in the country: Los Angeles and Atlanta, as noted above, but also Chicago and Dallas, where last week’s rate increases were under 2 percent, but could rise more before the end of the month. Interestingly, the national average load-to-truck ratio fell 8.4 percent for vans last week, as more trucks became available after Roadcheck, but at 10.3 loads per truck, the ratio is still crazy high. |

|

|

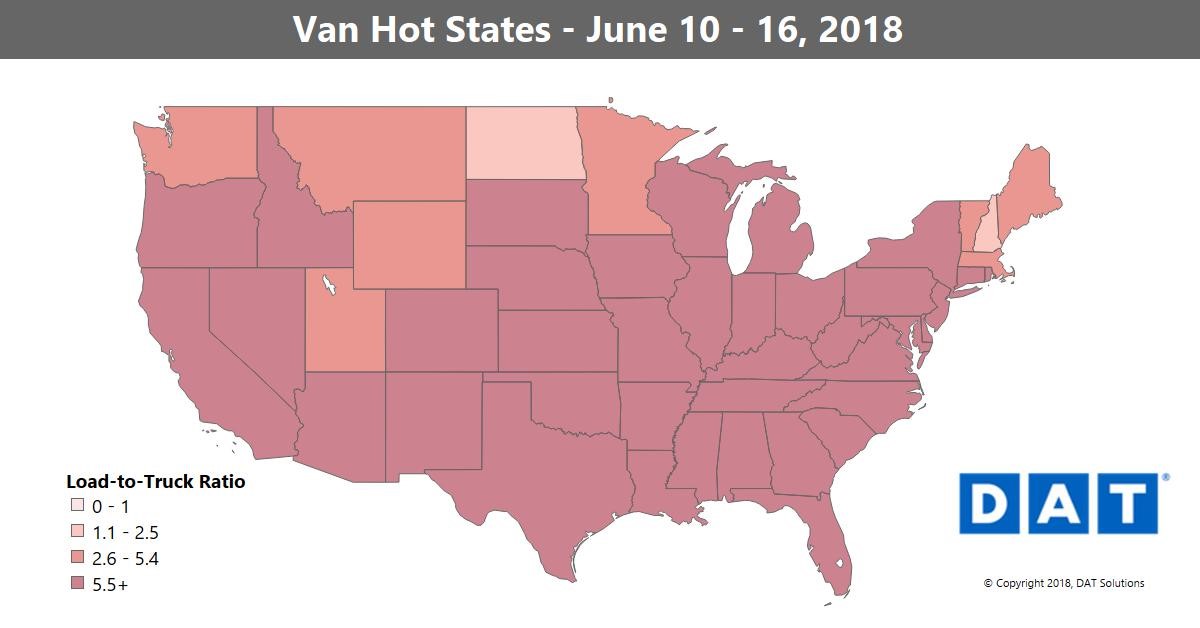

By mid-June, more trucks are available, but demand for van equipment remains strong. Load-to-truck ratios and rates have peaked in June in previous years, and 2018 appears to be following that seasonal trend. NOTE: The map depicts outbound load-to-truck ratios for dry van. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |