STRATEGIC PLANNING

Designing Ambulatory Pricing Strategies in a Competitive Marketplace

As ambulatory care continues to expand, pricing and cost strategies must also evolve. How do hospitals and health systems ride this new wave of care delivery to remain competitive?

Dan Clarin, Managing Director and Co-Leader of the Strategy and Business Transformation practice at Kaufman Hall, a Vizient company, a featured speaker on “Designing Ambulatory Pricing Strategies in a Competitive Marketplace” at SHSMD Connections 2025, explains how surgical procedures once performed solely in inpatient hospital settings are now regularly performed in outpatient clinics and ambulatory surgery centers (ASCs). Cost and convenience are driving forces behind this shift, he says, which is making hospitals and health systems rethink traditional pricing practices.

“In addition to building new capabilities for the future, hospitals will need to deliver care in a different setting at a different level of efficiency,” Clarin notes. “To compete in an ambulatory environment, health care organizations must have a different cost structure in the outpatient setting because the price that they are going to be able to compete on is going to necessarily be lower.”

Forces Driving the Ambulatory Shift

According to Clarin, the transition to ambulatory care is largely driven by industry, payor, and consumer factors and expectations, including:

Value-based care, site-neutral payments, and payment reform. Federal and commercial payors are steadily expanding alternative payment models, and the total cost of care favors ambulatory settings, Clarin notes. By 2030, the majority of health care payments in the United States are projected to flow through advanced alternative payment models. If the same procedure can be done safely in an ASC at half the cost, payors are naturally going to push for more procedures to be ASC-based. This shift has been taking place since 2019 as new procedures have been approved by the Centers for Medicare & Medicaid Services to be performed in the ASC setting; hospital Medicare revenue is also affected by site-neutral payments.

“Hospital outpatient rates are often much higher than ASC rates,” Clarin says, “and with site-neutral payments, that advantage is steadily eroding.”

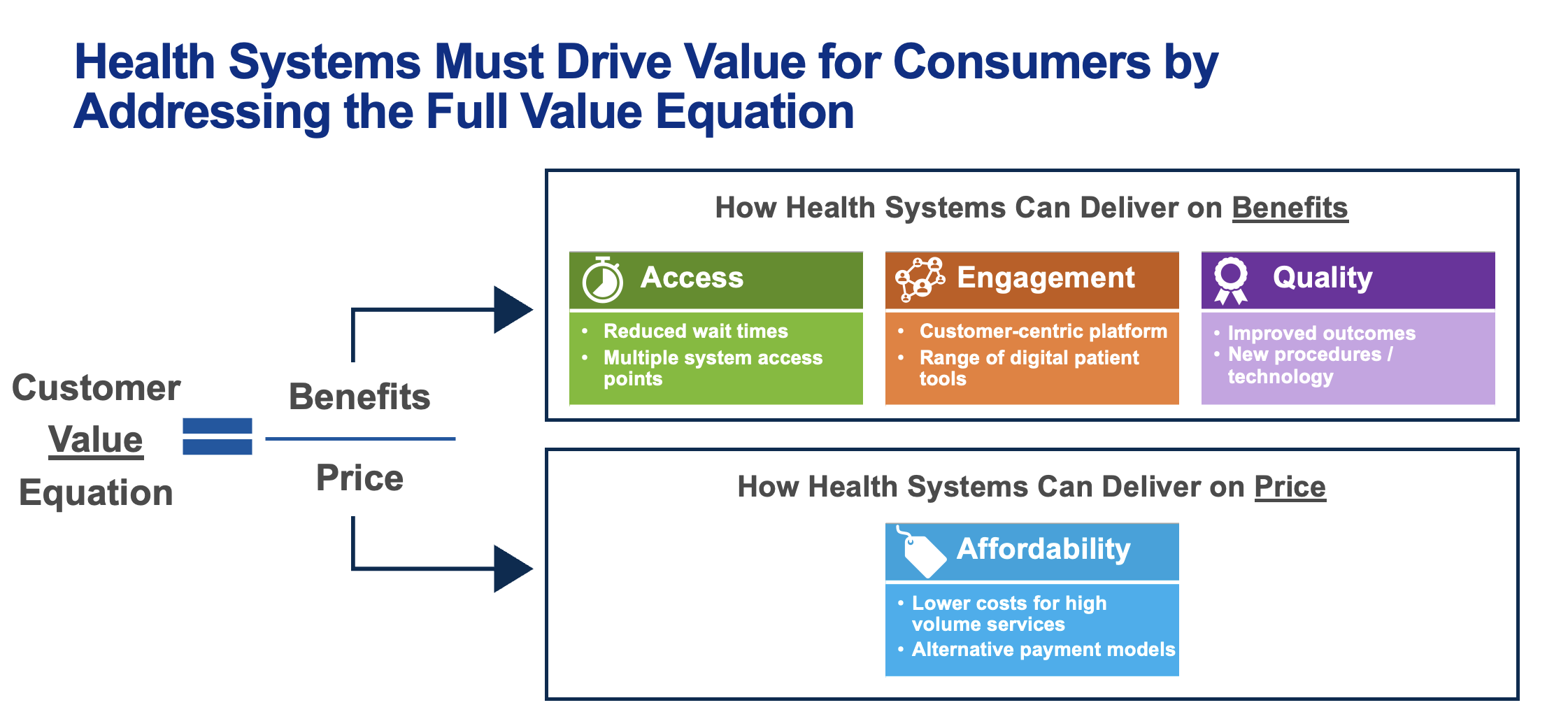

Consumer price sensitivity and employer cost pressures. Patients are also taking a more active role in choosing where they receive care, especially individuals with high-deductible health plans through their employers (Figure). These consumers are incentivized to compare prices, particularly when there is a meaningful difference in out-of-pocket costs. High-deductible insurance plans are becoming more of a standard rather than an exception, and many employer plans are steering consumers toward more cost-effective options.

“Over the past 10 to 15 years, less than 20% of people with private insurance had a high deductible, and today it’s almost 60%. Consumers with incentives toward more cost-effective care report that they are shopping around for outpatient services,” Clarin says.

For hospitals, this means price transparency and competitive positioning are no longer optional.

“We’ve learned that there is a meaningful difference in terms of what people are willing to pay for different services and in different settings,” he adds.

Designing Competitive Pricing Strategies

Yesterday’s pricing strategy no longer works in today’s health care climate. Clarin cautions that the “robotic approach” of raising charges annually and negotiating payor contracts without much regard for competitive dynamics or consumer behavior is no longer sufficient.

Elements of a modern ambulatory pricing strategy should consider external market factors and required internal changes. This entails taking several important steps:

- Conducting a market gap analysis. Health systems need to understand how hospital outpatient department rates compare with ASC rates locally while also considering payor reimbursement, regulatory dynamics, and the prevalence of freestanding ambulatory competition in the market.

- Service differentiation. Not all services present the same opportunities. Clarin notes that orthopedics and gastroenterology, for example, may support bundled surgical pricing or offer differentiation based on outcomes or surgical expertise compared with more commoditized services like imaging and endoscopy.

- Cross-functional alignment. Pricing decisions are affected by managed care contracts, cost models, and revenue cycle operations. Clarin explains that successful organizations bring these groups together under a shared strategy so that pricing, contracting, and operations reinforce one another.

“Your organization’s competitive situation will dictate how much flexibility you have with value proposition and pricing,” Clarin says. “For some systems, the flexibility is high; for others, it is limited and requires urgent change.”

Pricing changes, however, cannot succeed without operational alignment. Hospitals must design operating models that reflect lower ambulatory reimbursement, Clarin stressed.

“That means rethinking the physician complement, clinical staffing, and the overall operating standards in ambulatory settings,” he notes. “You can’t run an ASC like a hospital outpatient department. You have to adopt a different model, with efficiency and standardization at the core.”

This includes adopting a “focus factory” approach for surgery centers, where there are one or two specialties for maximum efficiency, clinicians work at the top of their license, there are consistent operating standards, and there is dedicated leadership for ambulatory facilities. Clarin adds that the approach also requires deliberate planning around hospital backfill strategies to replace volumes that have moved to outpatient settings.

Strategic Options for Health Systems

Clarin outlines several options health systems can pursue to remain competitive, such as:

- owning and operating ASCs, which provide control but also demand alignment with cost and efficiency standards;

- establishing joint ventures with surgeons to keep them engaged and invested in the system;

- forming third-party partnerships that leverage expertise from dedicated ASC operators; and

- creating payor and employer collaborations to establish bundled payments or direct-to-employer contracts.

A range of options for health systems evaluating ambulatory opportunities exists, and should be explored to align with a system’s overall strategy, Clarin adds.

The question for leaders now is how, not when, health systems can adapt to the new ambulatory environment without losing revenue. Clarin emphasized that a shift in mindset will allow hospitals to respond more strategically and run more efficiently.

“Health systems that align their ambulatory pricing strategies with their overall managed care goals will be best positioned to thrive in the changing health care landscape,” Clarin says. “Those who wait will find themselves playing catch-up in a marketplace that is moving quickly toward value, efficiency, and consumer choice.”