By Lindsay Gervias

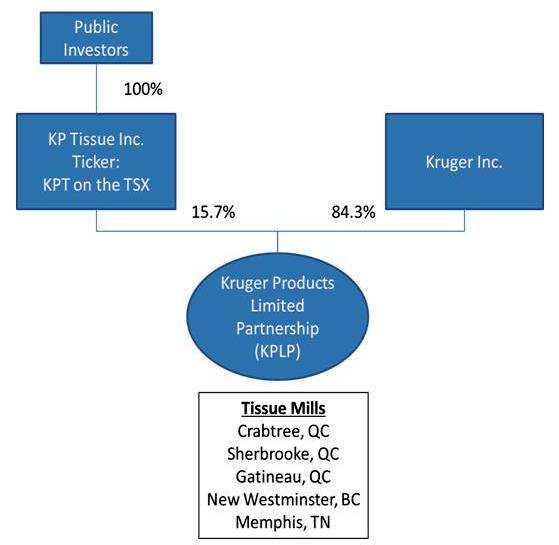

In October of last year, Kruger Products announced an Initial Public Offering (IPO) to carve-out the tissue business, generating total gross proceeds of $140 million. The IPO entity (KP Tissue Inc.) now has an equity interest in a newly-formed limited partnership, Kruger Products Limited Partnership (the tissue business), with the parent company, Kruger Inc., retaining majority ownership in the partnership.

Figure 1: Corporate Structure (Source: Company Prospectus )

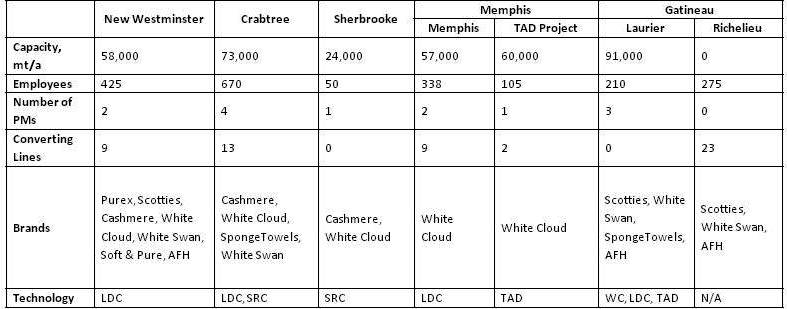

The new limited partnership, KPLP, consists of four tissue manufacturing facilities in Canada and one in the U.S. (the Memphis, Tenn., tissue mill). This excludes Kruger’s international tissue operations in Colombia, Peru, Venezuela, and Trinidad and Tobago.

LDC – Light Dry Crepe SRC-Single Recrepe WC – Wet Crepe TAD – Through Air Dried

Table 1: KPLP - Tissue Manufacturing and Converting Operations (Source: Company Prospectus)

Kruger’s Position in Tissue – a Snapshot

Based on ACNielsen data, Kruger Products Limited Partnership (KPLP) has a leading position in Canada across key At-Home product segments in bath (34% dollar market share), facial (31% dollar market share), and paper towels (23% dollar market share). Additionally, KPLP has an estimated 24% market share in the Canadian Away-From-Home business.

In the U.S., the business is primarily focused on supplying White Cloud products, which are sold exclusively through Walmart. Kruger is committed to growing the high quality At-Home private label business. The partnership generated $129 million in EBITDA on sales of $903 million (EBITDA margin 14%) during the year ended Sept. 23, 2012.

Rationale for IPO

The proceeds generated by the IPO will be used, in part, to finance the tissue expansion underway at the Memphis, Tenn., mill. Approximately $50 million of the net proceeds will help fund the new TAD machine at the Memphis mill, approximately a $320 million investment, and $40 million was distributed to Kruger Inc., the parent company, to finance the other Kruger businesses, some of which continue to struggle with declining demand and financial performance. The remaining proceeds will be used to repay debt, pay IPO transaction fees, and for general corporate purposes. The IPO also effectively separates the tissue business, a growing segment, from other Kruger businesses, including newsprint, printing and writing papers, and containerboard, which are flat or declining markets in North America. Interestingly, other diversified tissue companies, including both Clearwater and Wausau Paper, have been under pressure by large shareholders to separate the tissue business as a means to unlock the value from this growth segment.

Key Considerations

Lindsay Gervais is a Consultant at Pöyry Management Consulting. Contact: lindsay.gervais@poyry.com

TAPPI

http://tappi.org/