By Lindsay Gervais

TAD and new competing technologies have set new standards for product quality in the tissue industry. Currently, 2.7 million tons of TAD capacity is operational in North America, with new machines ramping up in the near term. This represents nearly 30% of total tissue capacity.

In this article, Pöyry takes a closer look at the competitive landscape and market environment for TAD products.

Competitive Landscape

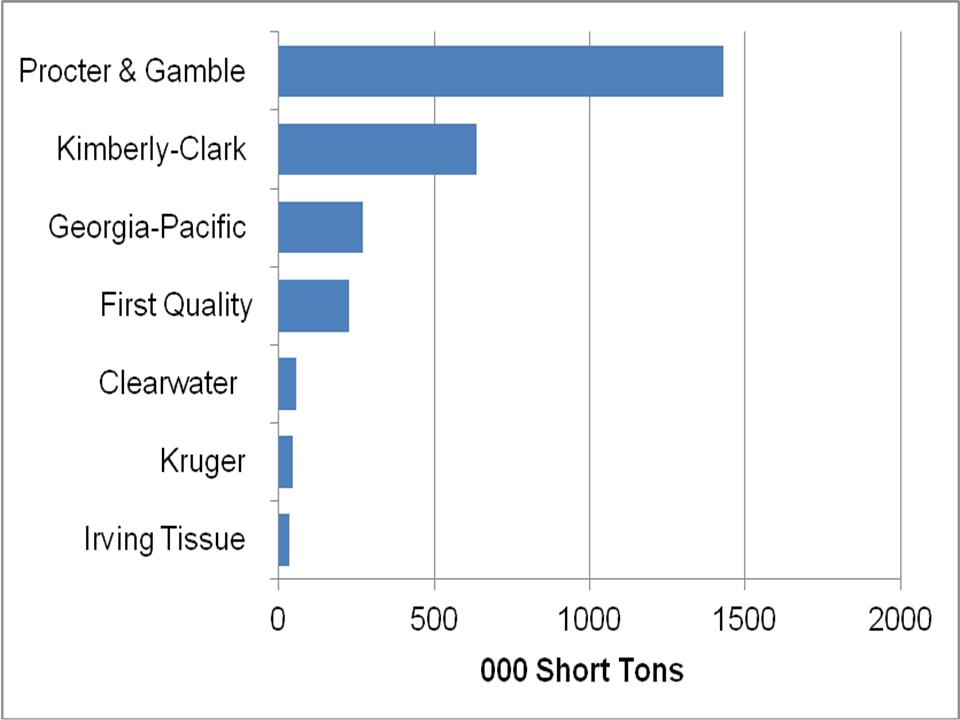

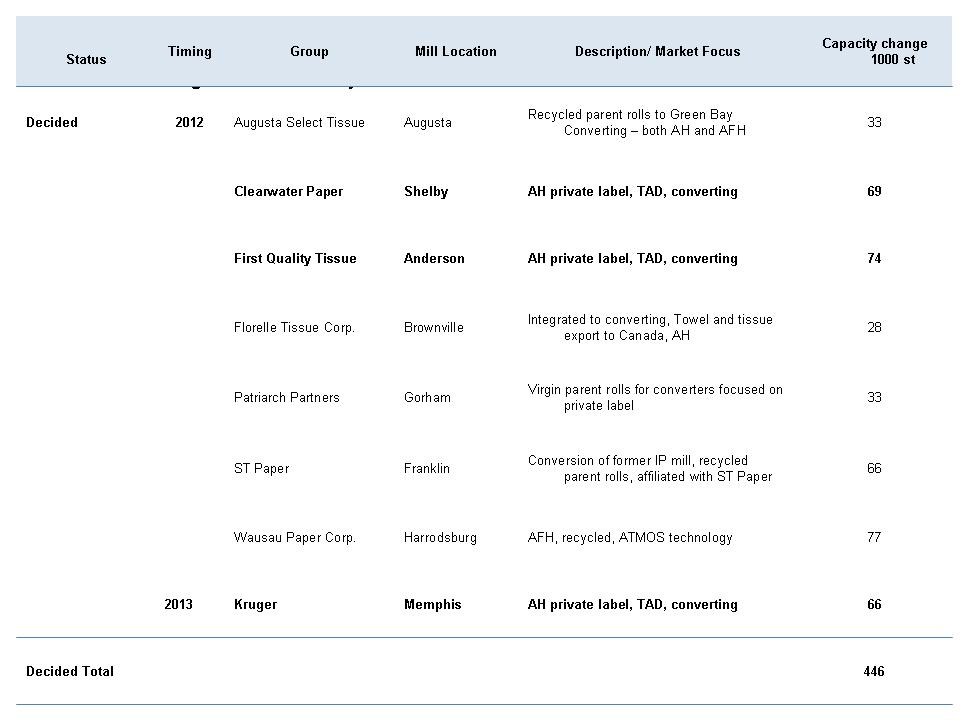

Currently, there are 45 tissue machines with TAD technology in the U.S. Procter & Gamble, producer of national brands Bounty and Charmin, is the leading producer of TAD products, with approximately 1.4 million tons. Investments by Clearwater Paper (Shelby, N.C.), First Quality Tissue (Anderson, S.C.), and Kruger (Memphis, Tenn.) will add an additional 209,000 tons between 2012 and 2013. Based on decided products only, this will bring TAD’s share of domestic capacity to approximately 31%.

Figure 1: TAD Capacity by Company

Figure 2 – Decided Projects – Tissue Investments

Branded producers continue to have a greater share of TAD capacity. Procter & Gamble, Georgia-Pacific, and Kimberly-Clark combined represent 87% of TAD capacity. While some branded producers supply small volumes to the private label market, Clearwater and First Quality are the leading private label producers in the TAD arena.

Key Take Away

TAD products have grown to 30% of total tissue capacity and are now sold into diverse market segments in the tissue industry. TAD products, though traditionally branded, have penetrated the private label market space through investments by Clearwater and First Quality. Improved quality in private label products have been one of the fundamental drivers of growth in private label.

Lindsay Gervais is a Consultant at Pöyry Management Consulting. Contact: lindsay.gervais@poyry.com

TAPPI

http://tappi.org/