Faced with poor share performance and a struggling paper business, Wausau Paper, Mosinee, Wis., USA, has launched a series of restructuring initiatives designed to renew the focus on its towel and tissue and specialty papers businesses. The restructuring actions, which include the sale of noncore timberlands (see article in Tissue & Toweling section below) and the closure of the Brokaw, Wis., uncoated free sheet mill, come after years of struggling financial performance and at a time where Wausau has undertaken a significant capital investment ($220 million) to expand its tissue operations.

Wausau’s restructuring actions will not only enable a greater focus of resources and time on its more profitable businesses, but also cash proceeds generated from the actions will help to finance the tissue investment.

Historical Performance –Catalyst for Change

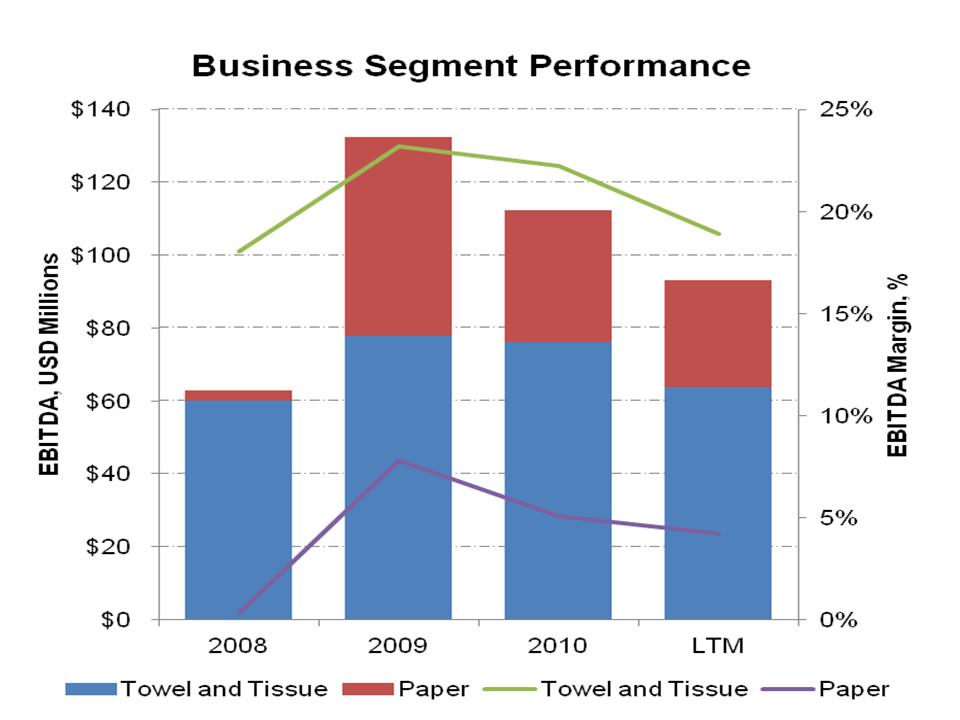

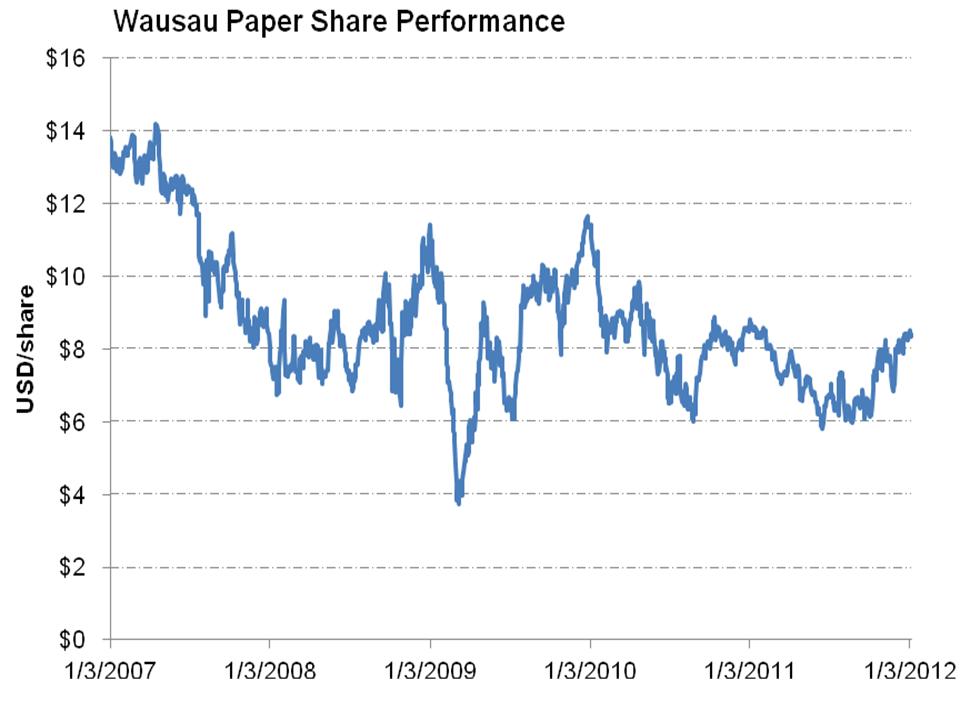

Key stakeholders, including the largest shareholder Starboard Value, have been pushing for a shift in strategic direction for some time now as the low-margin paper business significantly underperforms the tissue operations and share price performance has returned little value to shareholders. Since 2007, Wausau shares have lost nearly 40% of their value.

Closure of the Brokaw mill marks Wausau’s exit from print and color papers and is expected to generate $20 million from the sale of the brands to Neenah Paper and the liquidation of working capital. The closure, expected to be completed by the end of the first quarter, will eliminate operating losses and help to improve performance of the paper business.

Source: Thomson Reuters, Company Reports

Sale of Noncore Timberlands

Wausau’s sale of its remaining timberlands will generate $42.9 million and will be used to help finance the tissue project in Harrodsburg, Ky. The $220 million tissue expansion project represents more than half of Wausau’s current market capitalization and could increase debt levels in the short term. Management also has estimated that full benefits of the project will not be realized until 2017. Under these conditions, using the cash proceeds to finance the project should help reduce the risk of the project.

Key Take-Away – Are the Actions Enough?

The restructuring actions are a step in the right direction for Wausau Paper and will enable the company to allocate more capital and resources to its higher performing businesses. The actions appear to be well received by investors and in recent trading history Wausau’s share price performance has accelerated, increasing by 32% since the end of September.

Despite these changes, the investor community has advocated that Wausau exit its paper business entirely and become a pure-play tissue producer, citing that this would return the most value to shareholders and result in a higher valuation of the company. Investors have also pushed for changes at the board of directors and management level. With the annual shareholder meeting fast approaching, it will be interesting to see if more changes will be demanded.

By Lindsay Gervais, Consultant at Pöyry Management Consulting. Contact: Lindsay.gervais@poyry.com

TAPPI

http://tappi.org/