SCA in Australia and New Zealand—Partnership with Pacific Equity

Print this article | Send to Colleague Print this article | Send to Colleague

SCA announced late last week that it is divesting 50% of its tissue and personal care business in Australia and New Zealand (see news item in Issue Spotlight section below). The transaction creates a new joint venture with Pacific Equity Partners, a major investment firm in the Australasia region. SCA will receive proceeds of SEK 3,200 million ($484 million), which represents an Enterprise Value to EBITDA ratio of approximately 6.5x. This compares with the overall company, which currently trades at nearly 7x EBITDA.

SCA entered the Australia and New Zealand tissue markets with the acquisition of Carter Holt Harvey’s tissue and hygiene operations in 2004. Now, seven years later, SCA has made the decision to partner with local competence to better develop the business. The following analysis examines market conditions that may have driven SCA to partner with Pacific Equity.

AUSTRALIA AND NEW ZEALAND: TISSUE INDUSTRY SNAPSHOT

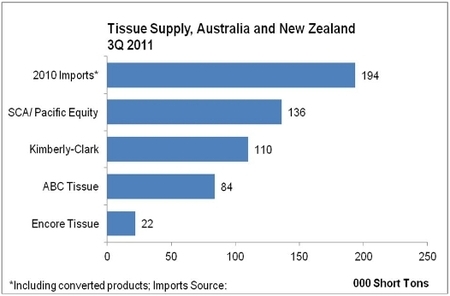

The tissue industry in Australasia is characterized by a small number of large producers. Given a combined population of only ~36 million people, the region represents one of the smallest tissue markets in the developed world. Consumption in 2010 was only ~400,000 short tons.

From a trade perspective, Australasia is a very unique region for tissue markets. It is a market in which overseas imports are a significant part of overall tissue consumption. This phenomenon of intense competition from low cost imports from China and Indonesia has presented a significant and ongoing challenge to local producers.

In 2010, New Zealand and Australia imported a combined total of 194,000 short tons of parent rolls and converted tissue products. This exceeds the total capacity of the largest local producer (now a joint venture between SCA and Pacific Equity Partners) by nearly 60,000 tons. Interestingly, Asia Pulp & Paper also established a converting footprint in Australia through its subsidiary, Solaris Paper, in 2007. Asia Pulp & Paper supplies this converting operation with parent rolls produced at their facilities in Indonesia; a strategy the company also employs in the U.S.

In 2008, SCA and Kimberly-Clark took legal action, claiming that tissue exporters in China and Indonesia were guilty of price dumping in Australasian markets. Competition from imports eased after the Australian Customs and Border Protection Service ruled in favor of K-C and SCA and imposed significant antidumping duties on key players such as Asia Pulp & Paper. However, at the end of 2010, the anti-dumping duties were lifted and imports rebounded, continuing on an accelerated growth path. Under these competitive conditions, SCA’s tissue business in Oceania was struggling to maintain target profitability levels, and requires investment to develop a more competitive business.

KEY TAKE-AWAY

The decision to partner with Pacific Equity Partners enables a more attractive financing for further investment in the business as well as increases the speed of the development of the operations. It also gives SCA access to local know-how. The decision to partner is not an exit strategy, but a means of improving the Australasia business in a financially attractive manner that mitigates risks.

By Lindsay Gervais, Consultant at Pöyry Management Consulting. Contact: lindsay.gervais@poyry.com

|