In the Spotlight: A Closer Look at Kimberly-Clark’s Restructuring Initiatives

Print this article | Send to Colleague Print this article | Send to Colleague

This report by Pöyry Management Consulting is the sixth in an on-going series that draws on expertise from Pöyry’s global offices to update readers on the opportunities and challenges facing tissue producers today. The first report in August 2010 issue of Over the Wire-Tissue Edition focused on changing consumer behavior in North American tissue markets .The second report in October 2010 examined the impact of Clearwater Paper’s acquisition of Cellu Tissue on the tissue market in North America. The third report in November 2010 issue explored supply side perspectives and global tissue trade. The fourth report in December 2010 analyzed which tissue makers in North America are in the best financial position to pursue growth initiatives. The fifth report in January 2011 updated readers on the domestic tissue markets in China with the latest available data on consumption and growth rates.

This sixth and latest report looks more closely at Kimberly-Clark’s recent restructuring initiatives aimed at boosting company profitability. K-C’s new strategy, which includes the disposal of several facilities and construction of at least one new one, was implemented in response to increasing competitive pressures in domestic and international consumer tissue markets.

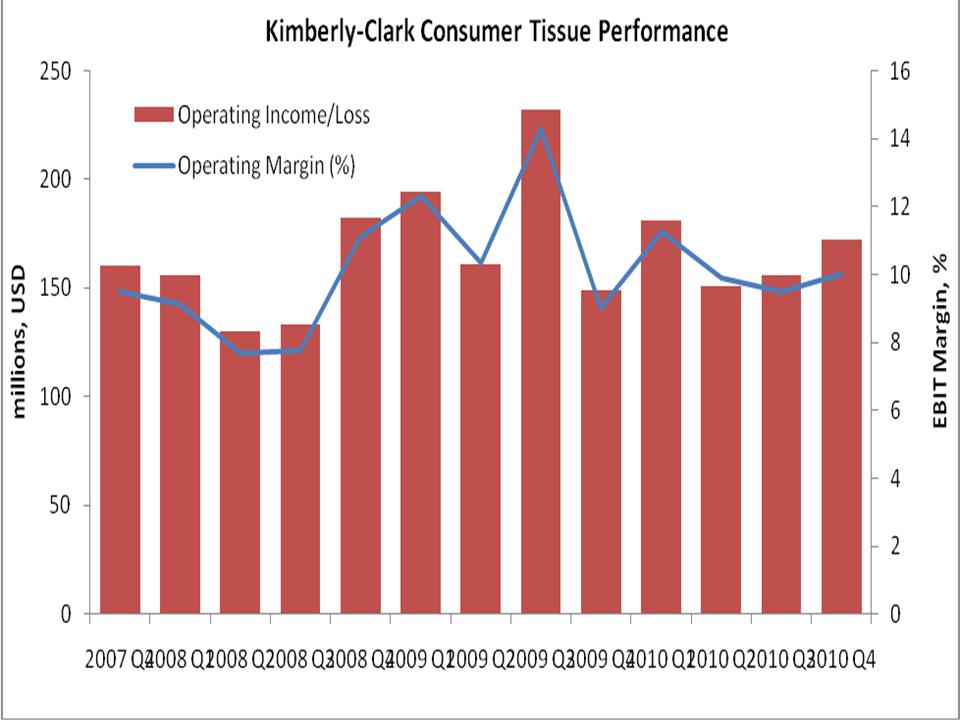

Kimberly-Clark’s tissue business has been under pressure as a result of intense competition from private label products and cost inflation. For consecutive quarters, the operating margin for the consumer tissue business has been stagnant. In response to these pressures, Kimberly-Clark announced that management will implement several restructuring initiatives designed to improve profitability.

Strategic Restructuring Actions

The announced restructuring initiatives will involve selling or closing five or six facilities, existing remaining private label product offerings, and transferring production to lower cost facilities. The facilities targeted for sale or closures include the Everett, Wash., mill and one mill in Australia, which are both integrated to pulp. K-C is pursuing a sale of the Everett mill in the U.S., which produces 228,000 metric tons of tissue per year and is integrated to bleached softwood sulfite pulp. The mill will be sold as a whole, despite direct competition from a new owner with its consumer tissue business. Two machines with a combined capacity of 135,000 metric tpy at the Millicent, South Australia, mill were shutdown, primarily due to competition from Asian imports. After a sale of the Everett mill, K-C will no longer be integrated to pulp.

In addition to these actions, the company has announced a $250 million investment in Brazil to construct a new plant and two distribution centers.

The restructuring initiatives are in line with K-C’s strategy to focus on its high quality, branded products, move away from being a commodity paper company by exiting its pulp operations, and grow in emerging markets where underlying population trends are more favorable. The company expects that the initiatives will improve operating margins by 1.5%.

The Impacts

The sale of the Everett mill may present an opportunity for both North American and foreign investors looking to add significant (228,000 metric tpy) tissue capacity to their business. Tissue machine No. 5 has TAD technology capabilities and its integration to pulp may make it an attractive investment because of where pulp prices are right now. The mill actually has the capability to sell 45,000 metric tpy of market pulp.

The Everett mill is a strong geographic fit with Clearwater’s assets. However, given the recent acquisition of CelluTissue, it may be unlikely for Clearwater to initiate another significant acquisition. Other players who may be interested include those with a presence on the West Coast – Cascades, Georgia-Pacific. However, G-P does not have TAD technology and Cascades is primarily a recycled producer. A clear, logical owner is difficult to identify.

|