| Archive | Subscribe | Printer Friendly | Send to a Friend | www.agc.org |

|

Federal Contractors Conference

Tuesday, January 19 from 2:00 p.m. to 3:00 p.m. ET

Register today for this AGC-member complimentary webinar on the regulatory road ahead for the construction industry. Every year the president and federal agencies issue a barrage of new executive orders and regulations with which your construction business must comply. The Biden Administration is expected to continue this trend. What can the construction industry expect from the new administration? What’s the fate of the previous administration’s regulatory agenda? Register for this webinar with the seasoned AGC regulatory team to learn the answers to these questions and more.

Blocks up to 37% tax increase by allowing deductibility

AGC blocked a surprise federal tax increase of up to 37 percent on Paycheck Protection Program (PPP) loan forgiveness, benefiting tens of thousands of construction firms. AGC was able to secure a provision in the year-end COVID-relief and government funding bill enacted Dec. 27, 2020 that overturned the IRS position barring deductions for PPP loan-forgiven business expenses. In addition, the association secured provisions providing for expedited loan forgiveness for PPP loans less than $150,000, expanded additional expense categories for PPP loan forgiveness and more. For a detailed analysis of what was included in the year-end bill from a construction industry perspective, click here.

Federal Agencies

Addresses Americans with Disabilities Act & other legal concerns for employers

The EEOC has released COVID-19 vaccination-related guidance, including critical information about legal concerns employers should know if they choose to mandate vaccinations for employees. The guidance can be found in the EEOC’s existing resource on COVID: What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws. AGC supports construction firms’ ability to freely choose the best approach for their individual businesses as well as their employees.

Vulnerable to rollback in new administration

AGC continues to track and comment on several environmental regulatory actions relevant to construction that the Trump Administration advances in the final days of the term, including those impacting species and Clean Water Act (CWA) permitting. Several of these actions are vulnerable to change during a Biden Administration, either through legal challenges, administrative actions and delays, or revision through the regulatory process.

Tax credits for voluntarily providing leave temporarily extended

The U.S. Department of Labor’s Wage and Hour Division (WHD) announced additional guidance to provide information about protections and relief offered by the Families First Coronavirus Response Act (FFCRA). The FFCRA’s paid sick leave and expanded family and medical leave requirements expired on December 31, 2020.

Upcoming Events

January 26-28, 2021 January 28, 2021 / 4 – 6:30 p.m. February 9, 2021 February 24-26, 2021 AGC News

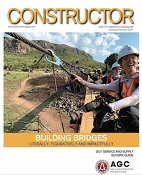

When it comes to AGC’s work with Bridges to Prosperity, an enterprise aimed toward ending the poverty caused by rural isolation, it’s literal, it’s figurative and it’s impactful. Read how AGC members stepped forward to help and in doing so gained unforgettable life experiences. That story and more, including Construction Outlook 2021, Site Security, Boosting the Built Environment can be found in the latest issue of Constructor magazine.

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

Most contractors expect demand for many types of construction to shrink in 2021 even as the pandemic is prompting many owners to delay or cancel already-planned projects, meaning few firms will hire new workers, according to survey results released recently by AGC of America and Sage Construction and Real Estate. The findings are detailed in The Pandemic’s Growing Impacts on the Construction Industry: The 2021 Construction Hiring and Business Outlook Report.

|

||||