A Look at Tax Reform Proposals through the AGC Lens

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

Last week, President Trump released his long-awaited proposal to cut taxes. Both Trump’s proposal and the previously-released House blueprint for tax reform have commonalities with AGC’s goals for tax reform. There is still a long way to go before tax reform is reality, but AGC believes Republicans in Congress and the President are at a good starting point.

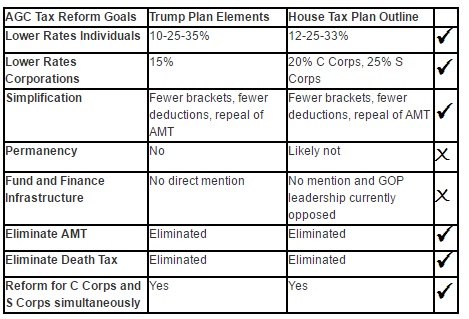

AGC goals include: lower rates, simplification, permanency, fund and finance infrastructure, eliminate AMT, eliminate Death Tax, and reform C-corps and pass-through companies simultaneously.

The chart below shows where the president’s plan and the House proposal align with AGC’s goals (and where they do not).

Rate reduction is baked in and simplification is a focus of all proposals on the table today. However, there is still much work to be done on ensuring Congress connects tax reform with infrastructure investment. Fixing the Highway Trust Fund and providing funding for infrastructure in conjunction with tax reform is the main focus of the Transportation Construction Coalition Fly-In, May 16-17, 2017.

Additionally, there is still a lot of fine tuning that must be worked out including, determining whether repeal of the Death Tax will include a step-up in basis or how the president’s plan will differentiate between business income and wages. The president’s plan also did not specify his position on tax exempt municipal debt. Stay tuned.

For more information, contact Jeff Shoaf at shoafj@agc.org or (202) 547-3350.