HEALTHCARE

| Print this Article |

Making The Most of Medicare Open Enrollment: A Short Guide for Financial Advisors

By Cole Craven

It’s the most wonderful time of the year—depending on who you ask. If you ask me, a self-proclaimed “health insurance guy,” one of the best times of the year is coming soon: Medicare Open Enrollment.

However, I’m not blind to the fact that for many, Medicare Open Enrollment is a stressful time with many questions and (what seems like) few answers. And it’s no wonder! Between not-so-user-friendly platforms, confusing health insurance jargon, misleading Medicare marketing, and the complexity of finding the ideal coverage for their specific needs, preferences, and goals, where are Medicare enrollees supposed to turn for reliable help?

Well, 65% of clients expect insurance advice from their advisor, and another study revealed that 40% of respondents reported they look for insurance advice as a product/service beyond core investment management.

Translation? Medicare enrollees expect their financial advisor to help them navigate Medicare enrollment and coverage.

To many financial advisors, this isn’t necessarily a surprise but it is something they dread as fall creeps closer and their inboxes fill with questions from clients about Medicare coverage and its coordination with Social Security, IRMAA calculations, and more.

The good news is that you, the financial advisor, don’t need to be a Medicare expert to help clients optimize their coverage during Open Enrollment. You just need to save or print this short guide to keep handy during the Open Enrollment season.

#1: Be Proactive

Advisors need to identify clients for whom Medicare Open Enrollment is relevant.

A quick way to do so is to find all the clients in your CRM who are 65 and older. If you want to take an advanced approach to healthcare planning, you can create a custom field for “type of insurance” in your CRM to make this easier. You’ll want to contact the clients your CRM identifies and let them know the Open Enrollment period is coming up, and you’re available as a resource to help them identify their optimal coverage options and make the entire process easier. You can also reach out to clients who aren’t 65 but who might have a parent or older loved one who is Medicare-eligible; this can be a great strategy for generating referrals from your existing clients.

It’s important to be proactive with your Open Enrollment outreach because if you’re not talking to clients about Medicare, someone else is—someone who doesn’t care about the financial and retirement plan you and your client have worked so hard on, and who might even steal away your client’s business (e.g., annuities, life insurance, etc.) Or, if you’re not proactively letting clients know you can help them navigate Open Enrollment, they’ll tackle it on their own and potentially choose less-than-ideal coverage for their needs, preferences, and goals. At the end of the day, you’re missing an opportunity to add value to your client-advisor relationships and potentially risking fiduciary oversight if you don’t proactively engage clients about their Medicare coverage during Open Enrollment.

But before you start emailing clients, let’s go over the important information you need to know.

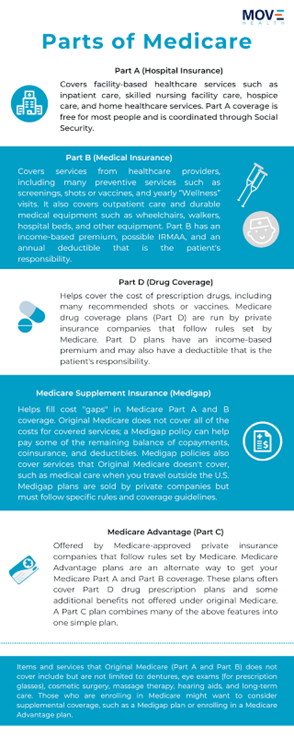

#2: Your Cheat Sheet to the Parts of Medicare

If you only print out or save one part of this article, let it be this: a cheat sheet to the parts of Medicare!

You are likely aware that clients can choose between Original Medicare and Medicare Advantage. Original Medicare includes Parts A, B, D, and a Medicare Supplemental (“Medigap”) plan. A Medicare Advantage plan is a single, all-in-one plan that covers Parts A and B, and often D too, from a single private insurance company.

- Part A (Hospital Insurance): Medicare Part A covers services like hospital inpatient care, hospice care, home healthcare, and some types of skilled, inpatient nursing home care (excluding long-term care). This coverage is typically free for enrollees.

- Part B (Medical Insurance): Medicare Part B covers preventive and medically necessary services that diagnose or treat medical conditions. Examples of these services include doctor's visits, some outpatient services, some mental health services, and prescribed durable medical equipment.

- Medicare Supplement (“Medigap”): Medigap supplements Parts A and B by paying for some of the costs for covered healthcare services and supplies, including copayments, coinsurance, and deductibles. Some Medigap policies also offer additional coverage on services not covered by Parts A and B.

- Part D (Prescription Drug Coverage): Medicare Part D aids in covering the cost of prescription medications. This coverage is technically optional but penalties will apply if a Medicare enrollee delays coverage when they become eligible for it.

- Part C (Medicare Advantage): Medicare Advantage plans offer an alternative way to get the same coverage found under Parts A and B (Original Medicare) plus additional coverage, including coverage for the 20% Parts A and B don’t cover. Medicare Advantage Plans, which are often bundled with Part D, are provided by Medicare-approved private insurance companies. Individuals typically have dozens of Medicare Advantage Plans to choose from, depending on the state they live in.

#3: Help Clients Optimize Their Coverage

Now that you know the basic parts of Medicare, let’s talk about how you can help clients choose their optimal coverage. The easiest way is to partner with a healthcare planning company, like Move Health, to take the heavy lifting of Medicare optimization and enrollment off your shoulders.

But if you want to know a few basic questions to ask clients to help them narrow down their plan options, use the list below. You can schedule time to meet with clients to go through the questions below with them, or simply email them the list of questions:

- Are your current doctors and specialists in the plan’s network?

- Is your current pharmacy in-network?

- Are your current prescription medications in-network?

- Have you started a new medication or therapy within the last year?

- What’s the maximum amount you’re willing to spend in a year on out-of-pocket expenses?

- Are you comfortable with needing a referral from your primary care doctor to see a specialist? Or would you rather be able to see a specialist whenever you want to?

- How much are you willing to pay in monthly premiums?

- Would you prefer a higher monthly premium but a lower cost for individual medical services received, or would you prefer to pay less each month in premiums but have a higher cost responsibility when you receive medical care?

- Do you have any preferences for insurance carriers?

- Are you expecting any large medical events within the next year, such as a planned surgery?

In Conclusion

The idea of guiding clients through Open Enrollment might be overwhelming, but if you’ve made it to the end of this guide, you’re already one step closer to confidently embracing Open Enrollment for the great planning opportunity it is. A quick recap:

- Use your CRM to identify clients who are 65+ or who have loved ones who are 65+. Reach out and let them know Medicare Open Enrollment begins October 15, and you’re here to help them.

- If you’re not helping clients during Open Enrollment, who is? Don’t lose fiduciary oversight.

- Clients can choose between Original Medicare and Medicare Advantage. Using the questions in this guide can help you and your clients determine which is their optimal option, and which plans within those options are ideal for them.

Happy Open Enrollment!

Cole Craven is Managing Partner and Head of Growth at Move Health, the only end-to-end healthcare planning solution for financial advisors and their clients.

image credit: Adobe Stock Images