NAPFA SPRING CONFERENCE PREVIEW

| Print this Article |

Learn More at the NAPFA Spring Conference!Massi De Santis will present on “Using Asset Allocation to Protect Spending in Retirement” on Friday, May 12, at the NAPFA Spring Conference. The presentation will go into details on how to apply this approach to retirement planning. |

The Value of a Dynamic Asset Allocation in Your Plan

By Massi De Santis

In the quest to maximize the value of a client’s resources, advisors often overlook a dynamic asset allocation that changes with the investor’s circumstances and goals. While financial advisors recognize the value of dynamic financial plans, in which goals and financial resources should guide spending and portfolio allocation decisions, their asset allocation decisions are often relatively static, depending primarily on investor preferences and time horizons. However, linking asset allocation more explicitly to investor goals and preferences can be a nontrivial source of value.

What Is a Dynamic Asset Allocation Strategy?

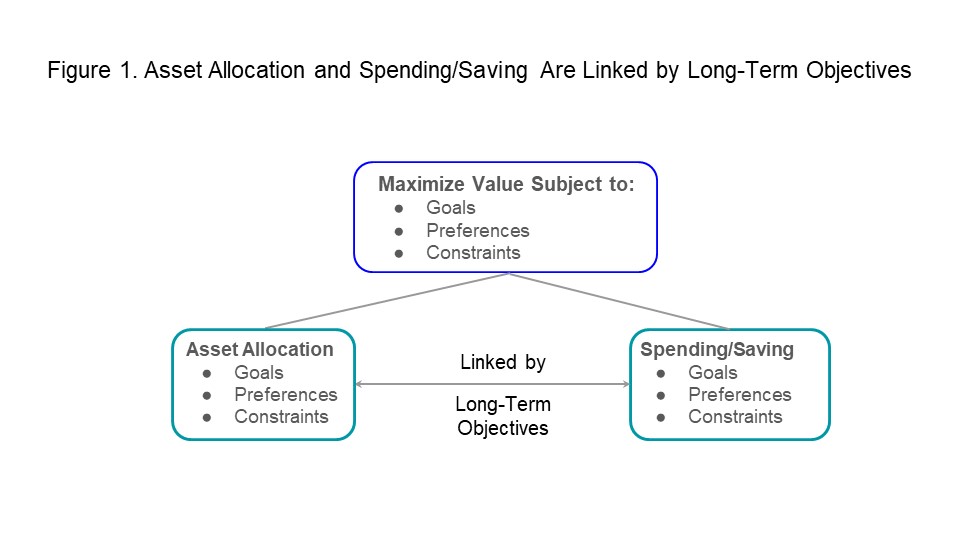

An allocation strategy is dynamic when it is linked to the investor’s goals, preferences, and financial resources. The same elements that we expect to guide saving and spending decisions in a financial plan should guide how much is invested in broad asset classes like stocks and bonds. Figure 1 illustrates this concept.

Consider, for example, the problem of a retired couple who is deciding how much to spend from a portfolio every month. The couple is accustomed to a certain spending level and would like to benefit from future increases in spending but is very averse to substantial downward adjustments. Several dynamic spending strategies have been devised for this problem as an improvement to the popular 4% rule, including the required-minimum-distribution (RMD) strategy, the guardrail strategy, and the allowed-reduction strategy. However, these strategies are typically simulated and presented using static asset allocations, most commonly a portfolio of stocks and bonds, like a 60/40 portfolio.

How to Link Allocation and Spending Strategies to Investor Goals and Preferences

How can we create a dynamic spending and portfolio allocation plan for the retired couple above? Suppose the couple is 65 and has a portfolio valued at $1 million and a retirement horizon of 30 years. With their advisor, the couple splits the portfolio into two hypothetical parts. One part—the “committed wealth”—is devoted to generating the current level of desired income, while the other is “surplus wealth” that can be used for future increases in spending. One way to determine the appropriate split is to compute the capital required to achieve a desired level of income with a low-risk portfolio. For example, if 75% of the portfolio was invested in bonds yielding 3.5%, it could generate about $3,300 a month ($40,000 per year) from principal and interest for 30 years. If the couple is comfortable with this initial income level, their commitment/surplus split is 75/25.

Under some relatively common assumptions, our research shows that the optimal allocation in this example is a multiple of surplus wealth. For example, the couple may be comfortable with an initial 60/40 allocation to stocks and bonds. The 60% in stocks is 2.4 times the 25% surplus wealth at the beginning of the 30 years. While the 2.4 multiple can be based on investor preferences and remains constant, the size of the allocation to stocks changes over time to reflect changes in surplus wealth due to market returns.

Dynamic Adjustments in Spending and Allocation

The 75/25 split between committed wealth and surplus wealth is the constant in this example. If the surplus value increases to a level higher than 25% of the portfolio, spending can increase until the ratio of commitment to surplus is brought back to 75/25.

Suppose the return in year one is positive, and the portfolio is still valued at $1 million after withdrawing $40,000. With 29 years left, 75% of the portfolio can now generate $3,400 a month. The asset allocation stays the same at 60/40 because surplus wealth is kept at 25%.

Suppose, in contrast, that returns are negative and, after year one, the portfolio value is $900,000. Surplus wealth is now about 20%. In this case, consumption is kept constant at the $3,300 per month level, while asset allocation is moved closer to 50/50 (2.4 x 20% = 48%). Consumption never needs to decline with this strategy because if surplus wealth approaches zero, the portfolio is entirely invested in low-risk bonds.

The lesson is that both spending and the amount of risk that is taken in the portfolio are directly related to surplus wealth. If surplus wealth is above an investor-specific threshold (25% in this case), spending is increased, and the portfolio is invested at the maximum level of risk for the investor. If surplus wealth is below the threshold, spending is kept constant, and asset allocation becomes more conservative.

Why This Matters

The increase in efficiency from the dynamic strategy can be useful to investors in two ways. First, the dynamic strategy allows initial spending levels that are appreciably higher relative to a static strategy. Thus, while potentially rising over time, spending can be smoother than under a static strategy. Second, the dynamic strategy can eliminate the risk that a downward spending adjustment will be needed to avoid future failure, which can happen under static allocation strategies. While retirees can find ways to reduce spending if needed, most of them would prefer avoiding cuts.

The main reason for the gain in efficiency is that the dynamic strategy only subjects the surplus wealth portion of the portfolio to risk, and risk is reduced when necessary to protect spending. When surplus wealth is low, a static allocation takes too much risk, thus increasing the likelihood that a downward adjustment will be made. Similarly, when surplus wealth is high, risk can be increased relative to a static strategy to take advantage of growth opportunities.

It is important to notice that other retirement spending patterns are consistent with this framework. For example, some retirees may prefer to have a u-shaped spending pattern, or others may want to emphasize discretionary versus nondiscretionary spending. And retirement is not the only potential application. The approach can be used for other goals, like education spending, starting a business, or the purchase of a home. The general principle of a dynamic strategy is to link spending and saving strategies to asset allocation. Breaking the goals between a desired and a flexible component is a promising way to accomplish this.

Massi De Santis, Ph.D., CFP®, is an economist specializing in financial planning and behavioral economics. He is a wealth advisor and founder of DESMO Wealth Advisors LLC and a lecturer of finance and economics at Texas State University.

image credit: istock.com/metamorworks