PRACTICAL OBSERVATIONS

| Print this Article |

Having the money conversation with your kids

Having the money conversation with your kids

By John Eing

If you’re a parent of young children like me, then you’ve likely spent the better part of the last two years trying to take care of your clients, maintain your household, and homeschool your children. If you have very curious children, they may even have poked their heads in during Zoom meetings to ask questions like, “Dad what do you actually do for a living?”; “How much money do you make?”; and “How much money do you and mom have?”

Well, I wish I could say that as a CFP® professional I was able to answer these questions with poise and grace. Instead, I found myself struggling and instinctively responding, “That’s not a polite thing to ask.”

How to start a conversation

Upon reflection, I realized that my reaction perpetuated the cycle of treating the money conversation as being as taboo as politics, religion, or sex, instead of making the home a safe place for my children to develop a healthy “money story.” As a financial professional, I was determined to do better, so I investigated the best way to talk about money with my children, then ages 9 and 5. I remembered the children’s book The Four Money Bears, written by my friend Mac Gardner.

The book features Spender Bear, Saver Bear, Investor Bear, and Giver Bear. As his name implies, Spender Bear enjoys life, but spends more than he has. Saver Bear saves a lot, but she is unable to enjoy herself. Investor Bear invests his money, but takes too much risk and forgets to protect against the downside by having an emergency savings fund. Lastly, Giver Bear is generous with her money, winning the affection of those around her, but like Spender Bear does not have enough to take care of herself. I read aloud this book to my children as a way to start my “money conversation.”

I have three suggestions from my experience.

1. Know your money story and your clients’

Lessons around personal finances truly start at the home. Like many people, I was taught to not ask or talk about money. Hence, my kneejerk reaction discussed above. By being more constructive, starting with The Four Money Bears, I hope that I have created a positive money story for my own children, leading them to develop an abundant mindset around money.

At your next client meeting, consider discussing your client’s money story and how that might influence their children’s relationship with money.

2. Teach that you can spend, save, invest, or give money

After reading the book, my wife and I took cues from the story to discuss the different things we can do with money.

As for spending, the rise of easy shopping and fast shipping sites like Amazon makes it important to teach children about fixed and discretionary spending. Instead of letting my son know how much we made, I used the question instead to teach him about how much we needed to earn to cover “important expenses,” such as the mortgage, insurance, groceries, saving for his college education, our own retirement, and “fun expenses,” such as eating out, vacations, and buying toys and games.

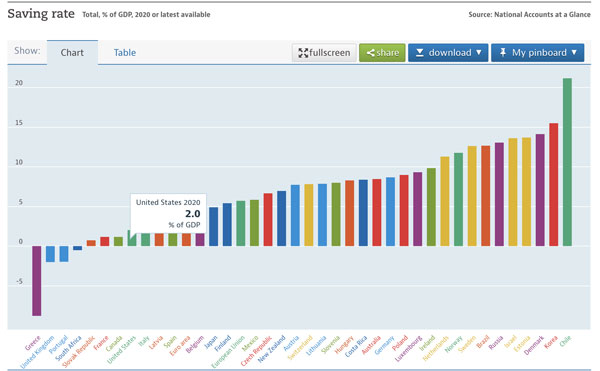

To start a discussion of saving, I showed them the “Saving rate” chart below1 and explained how we are one of the wealthiest nations on earth, yet we have one of the lowest savings rates in the world at 2% of gross domestic product. I asked them how much “fun” stuff could we do if we only saved $2 out of $100? The answer: “Not much.” I hope I instill in them that savings = fun.

We tackled investing by addressing the all-important question of what to do with the money. Here I let them flip through my copy of Dimensional Fund Advisors' annual matrix book to show them how money grows over time and the randomness of returns. While I was a bit skeptical at first, my kids seemed to gravitate toward the large size of the book and found the graphs in the book entertaining. That one experience did not turn my son or daughter into the next Eugene Fama. However, hearing the observations they made and the questions they asked reminded me again that it is never too early to start teaching children about investing.

To discuss charitable giving with my children, I referred back to “Money and culture: red envelopes, traditions, and a golden teaching opportunity,” my April 2021 NAPFA Advisor article. I reminded them how we donated one-third of our red envelope money. This year, I will set up a share jar for our family where we can put giving ideas into the jar throughout the year, and then randomly draw an idea from the jar toward year-end to make a charitable gift.

3. Put it all together

Throughout this process, I let my children know that essentially what “Daddy” does for work is help people take care of their money so they are saving, spending, investing, and giving in a smart and thoughtful way. Because financial lessons begin in the home, be it through observation or education, we as financial planners are in a great position to make a big impact on the lives of our clients and our communities by sharing basic personal financial planning techniques and resources in an age-appropriate way with our clients and their children.

Here are three ways I suggest we share our knowledge:

- Engage: Offer to speak about money with your clients’ children or to speak at a school, church, or other community center (following all local COVID-19 precautions, of course).

- Educate: Share age-appropriate resources like The Four Money Bears book for younger children or a course such as “Money Vehicle,” created by my acquaintance, former NFL player Jedidiah Collins, for an entertaining online course, which may appeal to teenagers or college students.

- Empower: Consider offering pro bono financial planning services to a local nonprofit organization, as a fundraiser at a school, or to someone whom your clients know who needs financial advice but can’t afford it. You can also volunteer through NAPFA’s Consumer Education Foundation.

Finally, in case you need one more excuse to speak to your children or your clients’ kids about money, April happens to be Financial Literacy Month. I can think of no better time to start.

John Eing, CPA, MBA, CFP®, is a partner and chief strategy officer at Quantum Financial Advisors in California and a member of its investment committee. He co-chairs the NAPFA Diversity, Equity, and Inclusion Initiative.

1. © OECD (2022), Saving rate (indicator). doi: 10.1787/ff2e64d4-en (Accessed on 23 January 2022)

image credit: istock.com/kate_sept2004