May Proves Surprisingly Strong

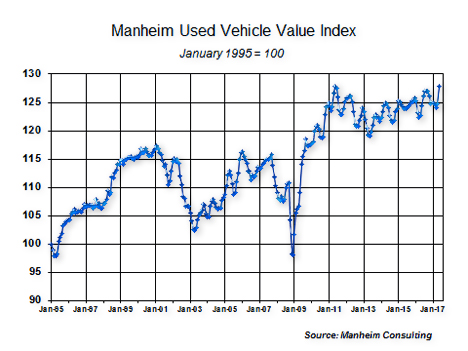

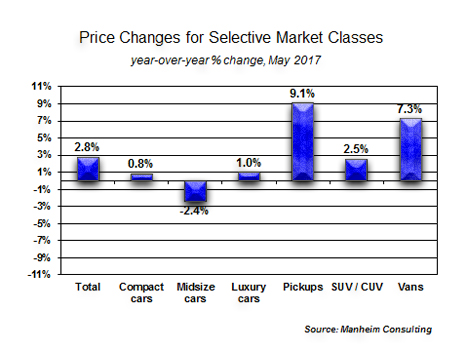

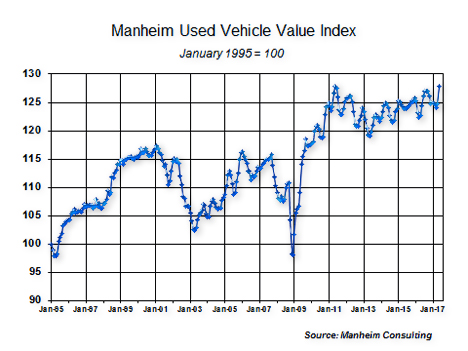

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 2.6 percent month-over-month in May. This brought the Manheim Used Vehicle Value reading to 127.9, which was a record high and represented a 2.8 percent increase from a year ago.

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 2.6 percent month-over-month in May. This brought the Manheim Used Vehicle Value reading to 127.9, which was a record high and represented a 2.8 percent increase from a year ago.

On a year-over-year basis, the mid-sized car category saw the largest decline (down 2.4 percent) in May, while pickups and vans saw gains greater than the overall market.

The May index result challenges concerns that increasing wholesale supplies from near peak-off lease volumes and rising rental volumes would lead to rapidly declining used car values. Indeed, the opposite appears to be happening. Higher commercial volumes at auction are providing the used vehicle market with quality and choice that offers a compelling value to consumers.

Dealers responded to the consumer demand for used vehicles by purchasing the most vehicles at Manheim for the month of May since 2008. Year-over-year growth in sales outpaced the growth in inventory, which helped result in the record high index value. A slightly younger mix of vehicles also likely contributed to the record index level.

New vehicle market continues to struggle in 2017. Franchised dealers have had more than four million new units in stock for the last four months. The May new sales volume slipped 0.5 percent year-over-year even with one extra selling day compared to May 2016. New vehicle sales year-to-date are down two percent compared to last year.

Combined rental, commercial, and government purchases of new vehicles were down fifteen percent, due primarily to a sharp decline of new sales into rental (down 24 percent). Retail sales were up three percent in May, helping push retail sales into slightly positive territory for the year (+0.1 percent).

Used CPO sales strengthened in May. Registration data indicate that used vehicle sales were weak in the first quarter, but wholesale buying trends and CPO sales in May point to improving momentum. CPO sales ticked up sharply in May (+7 percent), leading to a year-to-date gain of 1.6 percent. CPO sales of light trucks jumped sixteen percent as increasing SUV/CUV/pickup inventory coming off-lease is lining up well with consumer demand. The passenger car share of CPO sales came in at 49 percent for May, as SUV/CUV/pickups began to dominate just as they have since 2013 in the new vehicle market.

Rental risk pricing eases on higher volume. The average price for rental risk units sold at auction in May was down two percent year-over-year; rental risk prices were down one percent compared to April.

SUV/CUVs accounted for 29 percent of rental risk sales in May of this year versus 25 percent last May. Compact cars’ share fell from 31 percent to 27 percent. Average mileage for rental risk units in May (at 38,900 miles) was nine percent below a year ago.

Low unemployment, rising wages, and high confidence keep retail demand strong. Consumer confidence remains near a sixteen-year high, according to the May data from the Conference Board. Consumers remain positive about the economy due to strong labor conditions that are resulting in earnings’ rising faster than inflation. Likewise, stock indices and home prices continue to support growth in household wealth. The unemployment rate in May fell to 4.3 percent, a sixteen-year low.

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.

NAFA Fleet Management Association

http://www.nafa.org/

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 2.6 percent month-over-month in May. This brought the Manheim Used Vehicle Value reading to 127.9, which was a record high and represented a 2.8 percent increase from a year ago.

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 2.6 percent month-over-month in May. This brought the Manheim Used Vehicle Value reading to 127.9, which was a record high and represented a 2.8 percent increase from a year ago.