Wholesale Prices Increase in December

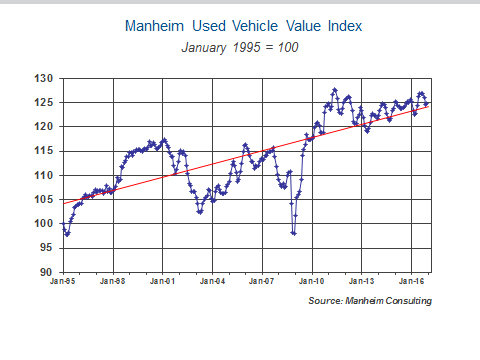

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased by 0.2 percent in December 2016. This brought the Manheim Used Vehicle Value Index to 124.9, a decline of 0.6 percent from a year ago.

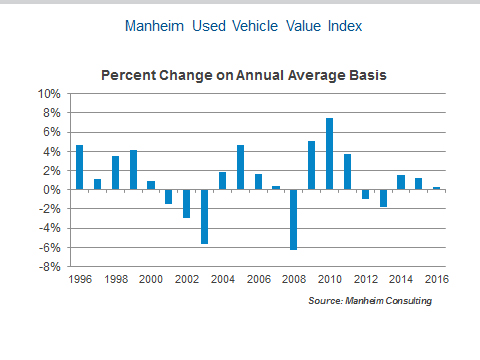

Despite significant increases in auction volumes in 2016, wholesale pricing was firm. On an annual average basis, the Manheim Index was even able to eke out a small gain of 0.3 percent, the third increase in a row. The most notable aspect of wholesale pricing in recent years has been the stability. After a sharp rise in wholesale pricing in 2009 and 2010 coming out of the recession, the absolute year-over-year change in pricing was less than two percentage points in each of the last six years. Statistically speaking, this period has shown the least volatility in wholesale vehicle pricing since the Manheim Index’s inception in 1995. In addition to macro-economic and industry factors, this stability has been driven by better, and more efficient, remarketing practices that have enabled commercial consignors to anticipate, respond to, and, thus, minimize impending swings in wholesale pricing.

New vehicle sales post another record. New car and light duty trucks sold at seasonally adjusted annual selling rate (SAAR) of 18.4 million in December. This pushed the full-year tally slightly above last year’s record.

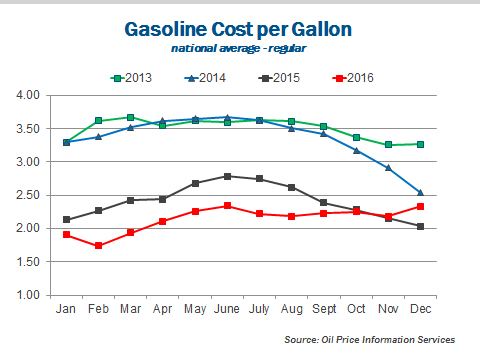

The incentive spend, which jumped significantly in November, remained high in December. There was encouraging news, however, when some manufacturers announced production cutbacks to better align inventories with demand. Nevertheless, competitive dynamics in the new vehicle market will likely put pressure on used vehicle residuals in the first part of 2017.

Used vehicle retail sales have their best year of the recovery. It is typical at this point in the automotive cycle for used unit volumes to accelerate at a faster pace than new vehicles sales, and that is what happened in 2016 – and most likely will again in 2017. Last year, used unit retail sales by dealers grew by more than four percent, their fastest pace of this recovery, while retail new vehicle sales were flat.

Growing wholesale supplies and lower auction prices will likely push used retail unit sales higher again 2017. With proper inventory management, it should produce another record profit year for used vehicle operations.

Rental risk prices off 4.4 percent from year ago. In December, a straight average of auction prices for rental risk units sold at auction topped the $17,000 mark for the first time ever, and was five percent higher than a year ago. However, after adjusting rental risk prices for broad shifts in market class and mileage, pricing was 4.4 percent below a year ago.

The average mileage on rental risk units sold in December (38,600 miles) was similar to recent months, but thirteen percent lower than a year ago. The overall condition grade of rental units sold also continued to improve.

Fleet Resale Prices: Cars Down, Trucks Up - The important midsize car segment of the commercial fleet market had a modest decline in pricing in 2016, despite having fewer miles at time of sale. This was reflective of the trend in the overall wholesale market. End-of-service pickups and vans, however, commanded strong pricing throughout the year. Many fleets now also have a larger number of the newer Euro-style vans coming out of service. They are popular in the wholesale market.

Earlier in this recovery, fleet managers availed themselves of opportunities to cycle out of fleets early to take advantage of higher wholesale prices. Interestingly, at the same time, some fleets were extending the service lives of their vehicles. As a result, the mileage on fleet units’ being remarketed became more dispersed. Recently, mileage dispersion has narrowed.

In 2016, the average mileage on end-of-service midsize fleet cars declined for the third consecutive year and slipped slightly below 70,000 miles. For pickup trucks, average mileage ticked down noticeably in 2016, and as some fleets cycled out early to take advantage of new exciting product offerings, the average mileage on pickups fell below 110,000 miles for the first time since 2011.

Fleet Management Companies Drive Remarketing Improvements - Fleet management companies (FMC) have been pioneers in using analytics to protect residual values – for example, studying the impact that various vehicle options have on resale value or determining the optimal service life for particular types of vehicles. FMCs have also been innovators as well as catalysts in moving the whole remarketing industry forward – for example, upstream selling and multiplatform listing.

All of this belies the common myth that fleet management companies are less interested in resale value since, generally, they do not carry the residual risk. The FMC/fleet manger client relationship, like most others in the remarketing world, is built on a true partnership working toward mutually beneficial goals.

Tom Webb is chief economist for Cox Automotive. Contact him at Tom.Webb@coxautoinc.com or follow him on Twitter at @TomWebb_Manheim.

Tom Webb is chief economist for Cox Automotive. Contact him at Tom.Webb@coxautoinc.com or follow him on Twitter at @TomWebb_Manheim.

NAFA Fleet Management Association

http://www.nafa.org/