The Manheim Used Vehicle Value Index Increases for Fourth-Straight Month

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

By Jonathan Smoke

By Jonathan SmokeCox Automotive

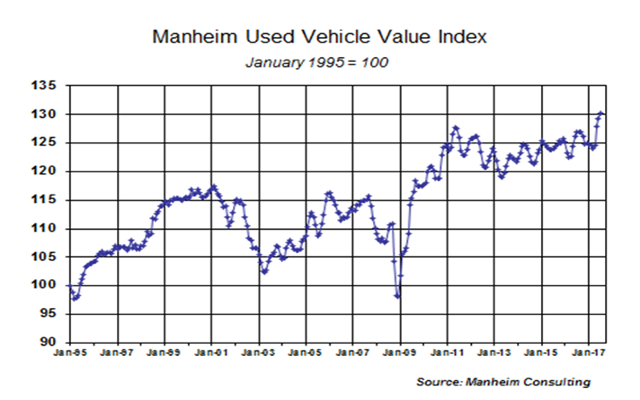

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.75 percent month-over-month in August. This brought the Manheim Used Vehicle Value Index to 131.3, which was a record high for the fourth consecutive month and a 3.4 percent increase from a year ago.

The Manheim Used Vehicle Value Index measures used vehicle prices through statistical analysis, helping to indicate pricing trends for consumers.

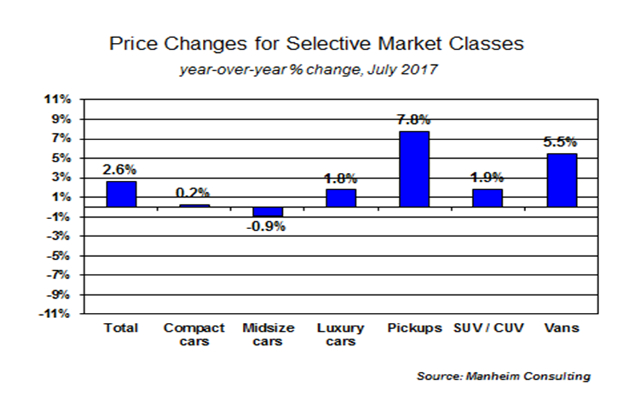

On a year-over-year basis, the mid-sized car category saw the largest decline (down 0.2 percent) in August, while pickups and vans saw gains greater than the, overall market. Other car segments like compacts and luxury saw gains in August too.

Wholesale market values continue to show strength, as a result of growing retail demand. Most of the increase in used vehicle sales is coming from double-digit year-over-year growth in sales of vehicles less than four years old.

Rental risk pricing improves in August. The average price for rental risk units sold at auction in August was up one percent year-over-year, which was the first year-over-year increase since July 2016. Rental risk prices were up three percent compared to July. Average mileage for rental risk units in August (at 41,700 miles) was two percent above a year ago.

Wholesale market values continue to show strength, as a result of growing retail demand. Most of the increase in used vehicle sales is coming from double-digit year-over-year growth in sales of vehicles less than four years old.

Rental risk pricing improves in August. The average price for rental risk units sold at auction in August was up one percent year-over-year, which was the first year-over-year increase since July 2016. Rental risk prices were up three percent compared to July. Average mileage for rental risk units in August (at 41,700 miles) was two percent above a year ago.

New vehicle sales continue to underwhelm in 2017. August new sales volume slipped two percent year-over-year with one more selling day compared to August 2016, but much of the decline was caused by Hurricane Harvey’s impact on Southeast Texas. Cars continue to fall out of favor with consumers as sales in August fell nine percent compared to last year, with all major car segments having sales declines. Light trucks outperformed cars in August and were up two percent year-over-year. New vehicle sales year-to-date are down three percent compared to last year.

Combined rental, commercial, and government purchases of new vehicles were down four percent, due to a decline in new sales into the rental market (down 11 percent), though some major OEMs pushed fleet sales in August. Retail sales were down two percent in August.

New vehicle inventories remained below four million units and are at the lowest level of the year.

Used sales softened in August. According to Cox Automotive estimates, used car sales also declined in August. The August used SAAR declined five percent to 38.1 million units from July’s 40.1. Used sales are up 1.2 percent year-to-date, but are expected to finish the year up three percent from a strong finish further supported by replacement demand in southeast Texas.

CPO sales fell in August (-1 percent) but are up 0.3 percent year-to-date. The passenger car share of CPO sales came in at 49 percent for August, as SUV/CUV/pickups began to dominate just as they have since 2013 in the new vehicle market.

Replacement demand in Hurricane Harvey’s aftermath. Cox Automotive estimated that the total vehicles damaged by Hurricane Harvey across the storm’s path will total 320,000 to 580,000 vehicles, which would be the most vehicle damage recorded in the U.S. from a hurricane. Replacement demand combined with a reduction in available supply will cause wholesale inventories to tighten for the next two to three months. Supply will be pulled from other regions, so the impact to the wholesale market will be widespread, providing additional support for continued wholesale price gains for at least the next two months.

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.