The Streak Continues

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

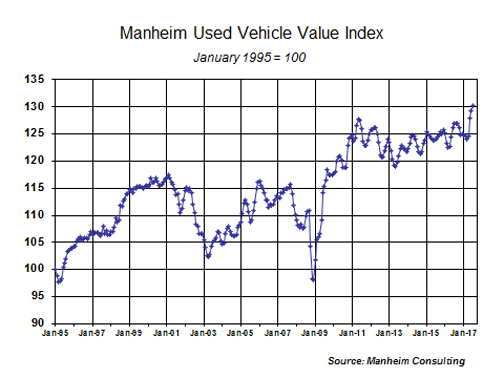

The Streak Continues. Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.75 percent month-over-month in July. This brought the Manheim Used Vehicle Value Index to 130.3, which was a record high for the third consecutive month and a 2.6 percent increase from a year ago.

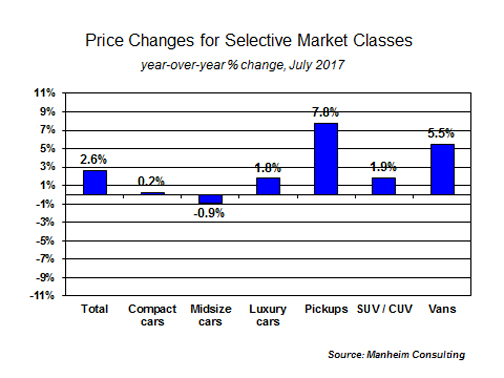

The Streak Continues. Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.75 percent month-over-month in July. This brought the Manheim Used Vehicle Value Index to 130.3, which was a record high for the third consecutive month and a 2.6 percent increase from a year ago.On a year-over-year basis, the mid-sized car category saw the largest decline (down 0.9 percent) in July, while pickups and vans saw gains greater than the overall market. Other car segments like compacts and luxury saw gains in July too.

Wholesale market values continue to show strength despite concerns that increasing off-lease maturities would result in a used vehicle supply glut and rapidly declining used car values. Instead, used vehicle sales are growing, driven by double-digit year-over-year growth in sales of vehicles less than four years old. Increased demand is absorbing the higher supply of newer vehicles.

New vehicle sales continue to slide relative to record sales in 2016. July new sales volume slipped seven percent year-over-year with one less selling day compared to July 2016. Cars continue to fall out of favor with consumers as sales in July fell fourteen percent compared to last year with all car segments having sales declines. However, even light trucks fell three percent year-over-year but are up four percent year-to-date. New vehicle sales year-to-date are down three percent compared to last year.

Combined rental, commercial, and government purchases of new vehicles were down 25 percent, due to a sharp decline of new sales into rental (down 39 percent). Retail sales were down five percent in July.

The best news from the new vehicle market is that inventories of new vehicles at dealer lots fell below four million units and are at the lowest level of the year.

Used retail sales softened in July with one less selling day. According to Cox Automotive estimates, retail used car sales were down 0.2 percent year-over-year in July. Franchised dealers enjoyed year-over-year growth in July at 0.5 percent compared to independents, which were down 0.7 percent. Year-to-date, retail used car sales are up 3.7 percent, with franchised and independents up 2.7 percent and 4.5 percent, respectively.

Certified Pre-Owned (CPO) sales fell in July (-3 percent) but are up 0.6 percent year-to-date. CPO sales of light trucks jumped four percent as increasing SUV/CUV/pickup inventory coming off-lease is lining up with strong consumer demand. The passenger car share of CPO sales came in at 49 percent for July, as SUV/CUV/pickups began to dominate just as they have since 2013 in the new vehicle market.

The U.S. economy remains strong. According to the first estimate from the Bureau of Economic Analysis, the U.S. economy grew 2.6 percent in the second quarter. Consumer spending on both durable and non-durable goods drove most of the growth in the second quarter. Consumer confidence strengthened to the second-highest level in sixteen years in July (only higher month was March).

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.