Wholesale Used Vehicle Prices Decline Compared To February

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

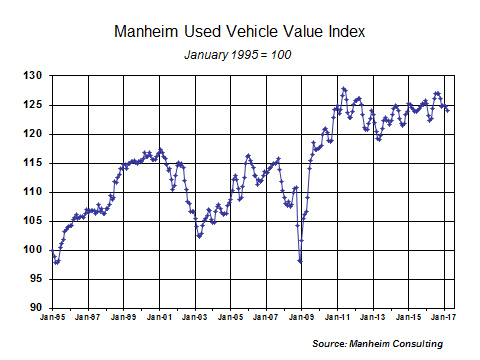

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 0.5 percent in March, relative to February. This brought the Manheim Used Vehicle Value reading to 124.1, which represented a 1.3 percent increase from a year ago. (Naturally, wholesale prices were up in March relative to February before the seasonal adjustment.)

Although used vehicle values have declined in five of the last six months, it has not been the collapse that many analysts have warned of for more than a year due to increasing wholesale supplies. And, in fact, what weakness we have seen is probably more a result of excessive new vehicle inventory, not used. At retail, the used vehicle market remains healthy, and dealers have needed only a modest decline in auction pricing to maintain acceptable inventory turn rates.

New vehicle environment continues to pressure used vehicle values. Franchised dealers in both February and March started the month with more than four million new units in stock. In February, hefty incentives were applied to that inventory, and the industry achieved a seasonally adjusted annual selling rate (SAAR) of 17.5 million. In March, available incentives were just as large; but the same sales pace failed to materialize. March’s SAAR (16.5 million) was the lowest since February 2015. Last month’s weak sales pace, plus less-than-needed production cuts, has left dealers with still too much new metal on the ground.

On the positive side, fleet deliveries were not pushed in March. Combined rental, commercial fleet, and government purchases of new vehicles were down thirteen percent in March, with the all-important rental segment down the most, with a fourteen percent decline. Granted, that was relative to a very high level a year ago.

In addition, the gap between new and used vehicle pricing continued to widen in March, which suggests market forces are making necessary adjustments. That, in turn, should moderate future swings to the downside.

Rental risk pricing eases on higher volume. The average price for rental risk units sold at auction in March remained down three percent year-over-year. (Prices were up relative to February, but less than the normal seasonal pattern would indicate.)

A straight average of auction pricing for rental risk units in March was up 3.5 percent from a year ago, reflecting a better mix of market classes and lower mileage. SUV/CUVs accounted for 33 percent of rental risk sales in March of this year versus only 25 period last March. The share accounted for by compact cars fell from 29 percent to 25 percent. Average mileage for rental risk units in March (at 36,800 miles) was ten percent below a year ago.

Rental risk volumes sold at auction in the first quarter were up considerably, even compared to last year’s high level. Unlike last year when dispositions were being driven by a high number of new units’ entering the fleet, this year’s off-rental volume was more the result of fleet rationalization. As such, off-rental auction volumes may weaken later in the year.

Used vehicle retail sales continue to grow. In the first two months of 2017, total used vehicle retail sales (including private-party transactions) were up five percent, with franchised dealer sales up six percent and independent sales up seven percent, according to NADA. Our channel checks indicate the gains continued in March.

CPO sales remained flat in March (-0.3 percent) and for the first quarter (+0.1 percent). Again, we suggest that CPO weakness relative to the overall market reflects the lack of potential gross profit lift for certain brands and market segments.

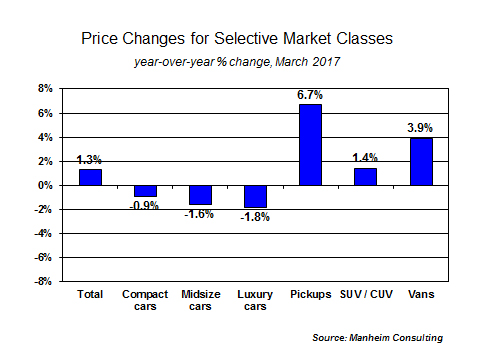

Pricing trends by market class. On a year-over-year basis, the same story holds: All car segments down, all truck segments up. In March alone, however, compact cars showed some relative strength, whereas SUV/CUVs and vans were weaker than the overall market.

Tom Webb is chief economist for Cox Automotive. Contact him at Tom.Webb@coxautoinc.com or follow him on Twitter at @TomWebb_Manheim.

Tom Webb is chief economist for Cox Automotive. Contact him at Tom.Webb@coxautoinc.com or follow him on Twitter at @TomWebb_Manheim.