| Monday, September 17, 2012 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Tom Webb: The Summer Doldrums In Used Fleet Sales

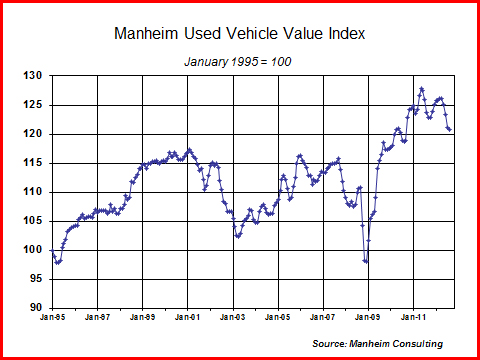

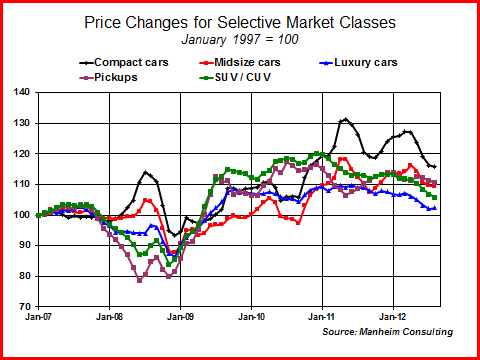

For all vehicles, wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined for the fifth consecutive month in August. This brought the Manheim Used Vehicle Value Index to a level of 120.7, down 2.4 percent from a year ago.  August’s monthly decline (-0.4 percent) was substantially less than what occurred in each of the prior three months. A further downward realignment in wholesale prices would be consistent with current market conditions; but the adjustment will likely be less severe going forward, and prices will probably show periodic upticks along with the declines. As a historical perspective, note that wholesale prices are still up twenty-four percent from their trough in the fourth quarter of 2008, and down six percent from the record high reached in May 2011. Trends in wholesale pricing varied by vehicle age. Despite rising gas prices, residuals for compact and midsize cars continued to fall a faster rate than did the overall market. That was a result of increased pressure from the new vehicle market. Compared to the overall market, compact and midsize cars have a larger share of their auction sales accounted for by late-model units, which are strongly impacted by new vehicle incentives. In August, wholesale pricing weakened noticeably for those models with significant model-year closeout programs in effect. Similarly, our ongoing analysis of changes in average mileage by price tier suggests that the greatest pricing strength has recently been for vehicles in the lower and middle price points – in other words, those less impacted by the new vehicle market.  Prices for off-rental units decline again. Reflecting the weakness in late-model used vehicle pricing (and that for higher-priced units), the average auction price for rental risk units slipped again in August. Average mileage was also lower than in both July and a year ago.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

|

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |