| Monday, May 21, 2012 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Tom Webb: 2012 Car Sales - Indicator Or Outlier?

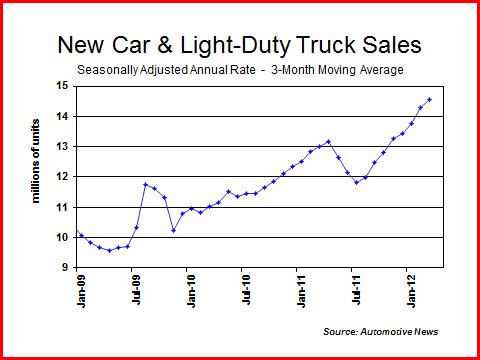

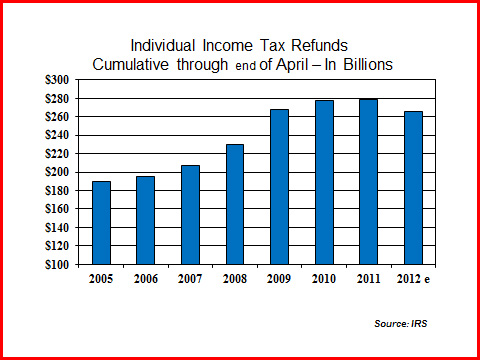

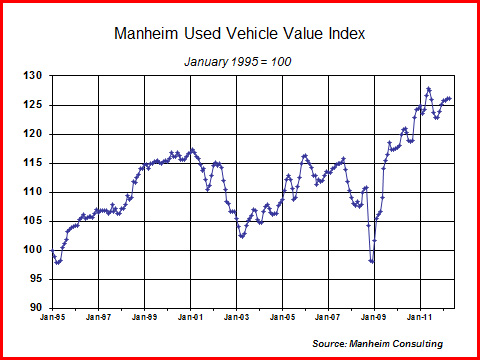

The trend continued in April. Even as most economic indicators pointed towards slower growth in the economy, new and used vehicle retail sales continued to show strength (building upon first-quarter new and used vehicle sales which were the best since 2007), used vehicle operations produced growing profits, and bidding activity at auction remained solid. Retail vehicle sales remain strong - and profitable. New cars and light-duty trucks sold at a seasonally adjusted annual rate of 14.4 million in April, up from 14.3 million in March. Due to a strong February, the sales pace for the first four months was 14.5 million, which, even after recent upward revisions, is still on the high side of most full-year forecasts. Auto manufacturers reported strong overall operating margins as exceptionally good performance in the U.S. offset the weakness in Europe. The number of new units sold in commercial fleets rose by twenty percent in first four months of 2012.  Used vehicle sales continue run of quarterly gains. Used vehicle retail volumes posted further gains in April and year-to-date. In fact, the seven publicly traded dealership groups have had eleven consecutive quarterly gains in used unit retail volumes. Profits have reached record levels on fast inventory turns and increased operating efficiencies. This, despite the fact, the total dollar amount of individual income tax refunds is down this year for the first time in many decades.  Manheim Index Inches Down in April. Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined marginally in April. The Manheim Used Vehicle Value Index now stands at 126.1 versus 126.2 in March. In April, year-over-year comparisons came up against much harder comps and, as a result, the overall Index as well as many segments showed annual declines in pricing even though valuations remained near historic highs. Hertz, Avis Budget, and Dollar Thrifty each reported record first quarter earnings. Those profits were in large part driven by lower vehicle depreciation expense as a result of higher wholesale values.  Is the industry becoming overly optimistic? The strength of new vehicle sales in the first quarter not only prompted analysts and manufacturers to revise up full year 2012 forecasts, but to also provide higher guidance for 2013 and beyond. Many glibly speak of the 16/17-million new unit sale years quickly returning. There is no doubt that an aging vehicle parc, increased credit availability, and new product introductions are providing a solid foundation for new vehicle sales, but optimism should be checked with realism. Given the changing demographics of buyers and long-term shifts in ownership patterns, is there any reason to believe that new vehicle sales will exceed their previous peak before U.S. employment does? Total U.S. employment is now down 5.2 million from the peak reached in January 2008. Even with gains of 200,000 per month, it will take twenty-six months (May 2014) to get back to that earlier level.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

|

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |