| Monday, March 5, 2012 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

February Auto Sales To Surpass 1,050,000 Units Says Kbb.com

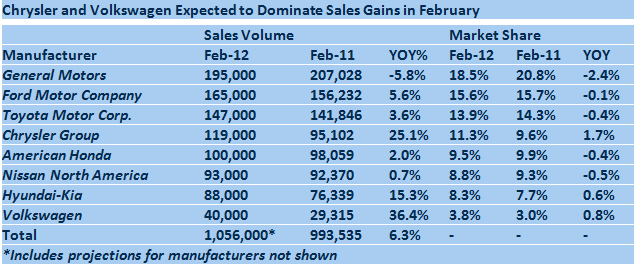

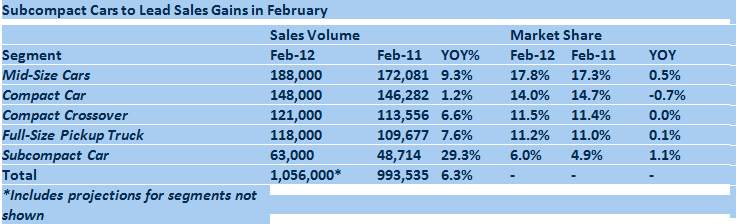

Kelley Blue Book's www.kbb.com, a provider of new car and used car information, projects new-vehicle sales to surpass 1,050,000 units and reach a 13.8 million Seasonally Adjusted Annualized Rate (SAAR) for February 2012, improving 6.4 percent from the same time last year. Kelley Blue Book's www.kbb.com, a provider of new car and used car information, projects new-vehicle sales to surpass 1,050,000 units and reach a 13.8 million Seasonally Adjusted Annualized Rate (SAAR) for February 2012, improving 6.4 percent from the same time last year. February sales were aided by increased inventory levels, improved access to credit, attractive finance offers available to consumers and one additional selling day due to the leap year. New-vehicle sales have remained above 13.6 million SAAR since November 2011; however, the site believes the annualized sales pace will slow after April, as pent-up demand is satisfied from Toyota and Honda’s inventory shortfalls. "From a pure volume perspective, in the months ahead sales will continue to exceed last year’s figures, but this year there may be more volatility from month-to-month than in 2011," said Alec Gutierrez, Senior Market Analyst of Automotive Insights for the site. "Sales were remarkably flat from May through November 2011, due to the production woes faced by Toyota and Honda. Now that they are producing vehicles at full capacity, a return to traditional seasonal patterns is likely through 2012." Consumers shopping in March will find an improved selection of vehicles available as a result of increased production in January. Manufacturers ramped up production in anticipation of President’s Day sales promotions and the onset of the spring selling season beginning in March. As of February 1, there were nearly 2.5 million vehicles available for sale on dealer lots; equivalent to a sixty-six days’ supply of vehicles overall. This is a significant improvement from the fifty-two days’ supply of vehicles available as of January 1. The most significant inventory gains came from General Motors, Ford, and Chrysler, each with greater than eighty days’ supply of vehicles available for consumers. This compares to a more than fifty days’ supply for Toyota, Honda, and Nissan, while Hyundai and Kia only have a thirty days’ supply of vehicles overall. In the next month, car shoppers will be able to negotiate the best savings by focusing on domestic vehicles, given the abundant supply currently available for sale. According to Autodata, domestic manufacturers spent more than $1,000 per unit more on incentives in January compared to their Japanese and Korean counterparts, a trend that continued in February. Chrysler Expected to Top Manufacturer Sales Gains; General Motors to Retain Volume Lead Kbb.com expects Chrysler to post another strong performance in February; however, the pace of improvement should slow in the months ahead. In addition, with the exception of General Motors, Kelley Blue Book projects all automotive manufacturers to post year-over-year sales gains in February. General Motors continues to report declines due to a sharp reduction in incentive spending, down sixteen percent in January according to Autodata, as well as increased competition from aggressive new redesigns. General Motors has several new introductions that should help boost sales later in the year, including the redesigned 2013 Chevrolet Malibu and all-new Cadillac ATS and XTS. "The Chrysler 200 didn’t sell in significant volume until March 2011, so Chrysler’s growth should level off beginning next month," said Gutierrez. "Later in the year, Chrysler should experience another boost with the launch of the all-new Dodge Dart, a much-needed entrant into the already competitive compact segment. Strong sales are expected in the compact and subcompact categories, especially as fuel prices continue to rise."  Subcompacts Gaining Traction as Consumers Take Notice of Rising Fuel Prices In terms of year-over-year growth, the site projects subcompacts to lead all other segments, especially with fuel prices surpassing $3.50 per gallon, nationally. "Although traditionally viewed as a budget segment reserved for those consumers willing to accept fewer amenities, cheaper materials and less than an awe-inspring driving experience, today’s subcompacts compare favorably to many compacts or mid-size sedans," said Gutierrez. "The Nissan Versa, Chevrolet Sonic, Ford Fiesta, Hyundai Accent, Honda Fit, and Toyota Yaris all are excellent examples of either all-new or redesigned products that many consumers would be happy to call their own. Each of these vehicles offers 40 mpg or more on the highway and would make an excellent choice for anyone looking to save a few bucks at the pump." The mid-size category was a strong performer in January, and Kelley Blue Book anticipates February will be another solid month for the Camry-led segment. The Toyota Camry topped sales gains in January on the strength of its 2012 redesign. This is a segment to watch in 2012, especially with redesigns coming later in the year for the Honda Accord, Ford Fusion, Nissan Altima, and Chevrolet Malibu.  Rising Fuel Prices, Economic Risks Remain a Concern Rising fuel prices and a slow economic recovery both stand as potential road blocks to continued improvements in new-vehicle sales. Oil prices are an immediate concern, with the current tensions in Iran and potential for additional military conflict in the Middle East. Oil prices closed at a nine-month high of nearly $105 on Monday (February 20, 2012), while fuel prices have continued to climb for the past sixty days. Gas prices are up nearly $0.40 per gallon year-over-year and have increased steadily since late December. Although fuel prices remain high, current projections by the Energy Information Administration (EIA) place average fuel prices in 2012 only slightly above the highs experienced in 2011. If conflict in Iran is avoidable, Kbb.com is hopeful that fuel prices will remain below the $4.00 highs of last year. In the worst case scenario, high fuel prices could slow the pace of the economic recovery and vehicle sales along with it. The pace of the U.S. economic recovery remains very slow, and according to a recent forecast published by the Congressional Budget Office (CBO), the United States can expect much of the same through at least 2013. According to CBO estimates, the official unemployment rate, currently at 8.3 percent, will increase to 9.2 percent by the fourth quarter of 2013. In terms of overall economic output, Gross Domestic Product (GDP) is expected to show a scant annual increase of 2.2 percent in 2012, while 2013 will bring an even smaller 1.1 percent gain in GDP overall. Given the expectations for weak economic growth during the next several years, the site expects the pace of the new-vehicle sales recovery to slow. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |