| Monday, May 23, 2011 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Fleet Vehicle Prices Remain Strong In Rising Wholesale Market

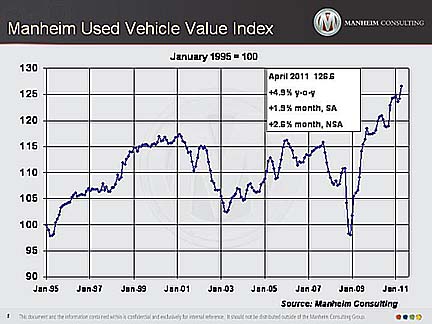

April's figures weren't quite as good, but didn't miss the mark by much – on a mix, mileage, and seasonally-adjusted basis, prices for these vehicles were at their second-highest levels ever. Anyone who has recently spent any time at auctions, in person or online, knows that prices aren't strong just for fleet vehicles. In fact, adjusted wholesale prices for all vehicles rose 1.9 percent in April over the previous month, taking the Manheim Used Vehicle Value Index to a record-high level of 126.6, the second time this year (January being the other) that the Index, launched in 1995, has set a record.  Why are fleet managers, and other consignors, earning such high prices in the lanes? The contributing factors, in both the new and used markets, are straightforward:

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |