| Monday, February 22, 2011 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Remarketing Strategy

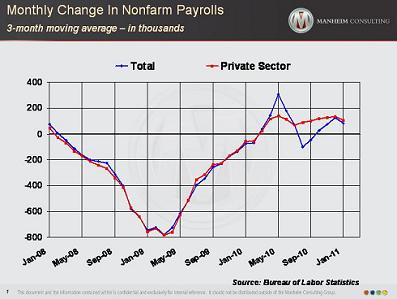

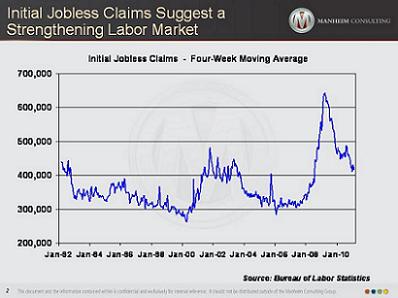

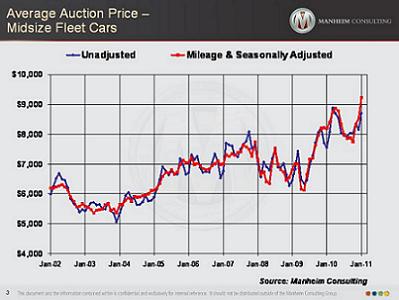

Sometimes there is good news contained within the bad. And, sometimes the two are so twisted up it's hard to tell which side will eventually carry the day. January's employment report fell into both camps. The increase in nonfarm payrolls (only 36,000) was far below expectations and far below what would normally be needed to keep the unemployment rate from rising.  But, a smaller number of active job-seekers resulted in a declining unemployment rate – from 9.4 percent in December to 9.0 percent in January. It had been 9.8 percent in November. To us, the declining unemployment rate offers little comfort; we find the doughnut (total employment) to be a better predictor of used vehicle demand, than the hole (the unemployment rate). Fortunately, January's weak employment gain can be written off as weather-related. What can't be written off, however, were the disappointing job gains last November and December, especially given the rebound in retail sales during the fourth quarter. We remain optimistic that significant employment gains are nigh, but will revisit the issue if concrete signs do not appear soon. One positive indicator was the February 10 report showing that initial jobless claims fell to 383,000. The four-week moving average will soon be testing the 400,000 mark, a level not seen since mid-2008.  Another positive sign comes from closer to home, in the automotive business. Dealer bids at auction are based on their assessment of current and future retail demand. And, in the overwhelming number of cases, their assessments are spot-on. In January, dealer bidding pushed the Manheim Index to a new high. And, a mileage- and seasonally adjusted index of pricing for end-of-service midsize fleet cars jumped even more. This vehicle segment is very reflective of mainstream America. And, right now, that reflection is bright.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |