| Monday, October 25, 2010 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Dealers Remain Focused On Used Vehicles; A Positive Trend For Remarketers

By Tom Webb Each quarter, I have the opportunity to share insights into the economy and the used car market with a group of automotive industry analysts from around the country. Our most recent call generated discussion of several topics I believe would be of interest to NAFA Members. Given the bleak economic backdrop of the past several months, I opened the call by pointing out the noteworthy fact that retail used vehicle sales have held steady of late, and that dealer margins and inventory turns remain supportive to profits. For fleet managers making remarketing decisions in this environment, it's important to note that: * Even though used vehicle sales volumes were not spectacular in September, low inventories, low incentives, and a smooth model-year transition meant that used vehicle prices declined less than their normal seasonal pattern would suggest. * Along the same lines, modestly higher used vehicle retail sales and improved financing opportunities for dealers on their used vehicle transactions are helping to support their bidding activity at auction.

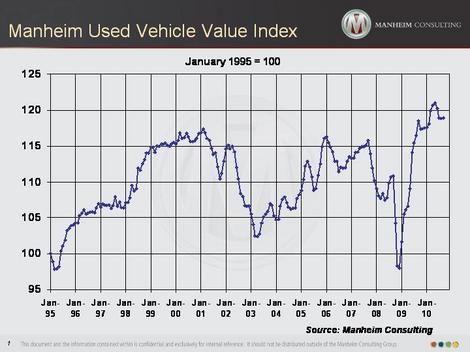

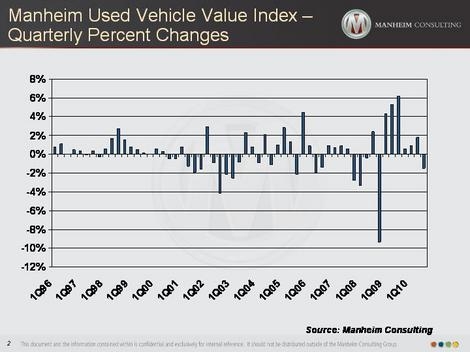

We're experiencing a greater stability in wholesale pricing, and I expect this will be an ongoing trend. After seeing a big decline in the fourth quarter of 2008, there was a bounce-back in the first three quarters of 2009 and, for each of the last four quarters, much more moderation in terms of price movement. In fact, we're back to the normal channel of plus or minus 2-percent movement, which is a very healthy thing for the market. For fleet cars specifically, the average auction price for end-of-service midsize fleet cars rose from August to September and remained above its year-ago level. End-of-service pickups showed an even stronger increase, even when adjusting for lower average miles.

At the same time, we're seeing other, related trends at auction. Newer-model vehicles have been in relatively low supply at auction in recent years, both because of a lack of rental vehicles coming back into the market and low off-lease volumes. Although off-lease volumes will continue to decline through 2012, that will be somewhat offset by a higher level of late-model vehicles coming from dealer consignments. In addition, off-rental volumes at auction have already started to rise.

Finally, I'd like to leave you with a point I made on the conference call that perhaps sheds new light on the relationship between new and used vehicle prices: the point being that in some respects I think it's misleading for a lot of people to get concerned about some relationship of used vehicle pricing to new vehicle pricing. The more important component is monthly payments.

So, for example, if a manufacturer were to put out a $199 a month lease deal with $0 down and offer it to people with low FICO scores, certainly late-model used vehicles of the same make and model are not going to fare well at all. What we really should be concentrating on are monthly payments, and the related incentive activity. Trends in this area have been encouraging in terms of the impact on the used vehicle market, because the relatively low level of new vehicle inventory allows franchised dealers to remain focused on selling used. It also obviously frees up a lot of working capital to floor used vehicles, and it certainly makes the selling of those used vehicles much more profitable. All told, it has a very positive impact on buyers at auction, which is good news for fleet managers and other consignors. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |