|

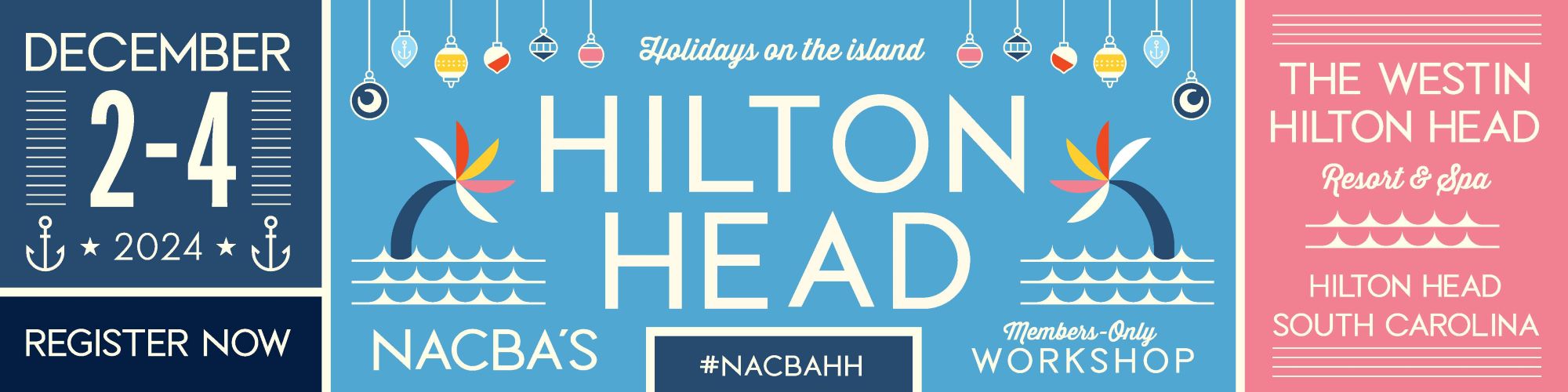

Join NACBA for an unforgettable holiday event on Hilton Head Island! This December, earn your CLE credits while enjoying the serene beauty and festive spirit of this renowned destination.

Discover Hilton Head Island

Hilton Head Island is celebrated for its pristine white-sand beaches, breathtaking natural beauty, and welcoming, family-friendly atmosphere. With pleasant weather from November through March, it's the perfect time to explore the enchanting Lowcountry landscape.

What to Expect

Enhance your professional skills at our exclusive Members-Only Workshop, designed specifically for consumer bankruptcy attorneys. At #NACBAHH, you will:

-Expand Your Knowledge: Participate in intensive sessions tailored to your professional needs.

-Grow Your Practice: Gain valuable tools and resources to enhance your practice.

-Network with Peers: Connect with fellow professionals and industry leaders.

-And So Much More!

Special Accommodation Rates

We've secured a special low rate of just $180 per night at The Westin, but hurry – this offer is available only until Friday, Nov. 1, 2024, or until rooms are sold out. Don't miss this exclusive opportunity to stay at a luxurious resort at an unbeatable price.

NACBA's Members-Only Workshop is your ultimate partner in practice. Reserve your place now to ensure you don't miss out on this exceptional event.

|

SAVE THE DATES! NACBA is rolling out the red carpet for our members in HOLLYWOOD! Save the dates for our 33rd Annual Convention. More information to come!

NACBA's 33rd Annual Convention

April 24-27, 2025

Loews Hollywood

Hollywood, CA

|

The magic of the holidays will be at NACBA's Members-Only Workshop! Join us at the Plant Riverside District for a festive celebration you won't forget.

Immerse yourself in the spirit of the season with a European-style outdoor holiday market, a Festival of Trees, live performances, photos with Santa, and a delightful array of holiday-themed food and drink options.

Tickets: $75 required for each person, including children. Includes round-trip transportation from Savannah to the hotel.

NACBA's private coaches will ensure comfortable round-trip transportation to and from the Plant Riverside District in Savannah. Once there, you'll have the freedom to explore the enchanting city at your leisure.

We look forward to celebrating holidays on the island with you at NACBAHH!

|

|

|

| |

Date: Thursday, Aug. 22, 2024

Time: 3-4 PM ET

Speakers: Jenny L. Doling, Esq. and Rachel Lynn Foley, Esq.

Member price: $25

Non-member Price: $75

Description: Bankruptcy is unique area of practice. We operate on flat fees, hourly fees, blended fee agreements, and “no look” fees. Our fees must be reviewed and approved by the U.S. Bankruptcy Court. Some bankruptcy attorneys require full payment to retain, while others offer payment plans. Some attorneys get paid electronically and others only accept cash or checks. Some attorneys only see clients in person while others run an all-virtual practice. However your firm operates, the fee agreement is one of the most important tools available to protect both the attorney and the client. This panel will address the various clauses bankruptcy attorneys should add to their fee agreements such as clauses addressing when a client no longer wishes to move forward with the case, or when a client’s circumstances have changed and the attorney must rework the case. There are limited scope clauses to consider for post-petition services such as adversaries, negotiating with a trustee on equity buybacks, objecting to claims, handling random audits, redemptions, reaffirmation agreements, and appeals. Don’t miss this opportunity to strengthen your retainer agreements.

|

Date: Aug. 15, 2024

Time: 3-4 PM ET

FREE MEMBER BENEFIT

Speakers:

Kiran Bellubbi, Founder & CEO of Noodle

Jenny L. Doling, Esq., LL.M., J. Doling Law, PC

Chad Van Horn, Esq., Managing Partner at Van Horn Law Group

Ben Matthews, Esq., Partner at Benjamin R. Matthews & Associates

Description: Join us for a moderated discussion between attorneys, technologists and NACBA leaders to help guide you through the newest developments in AI for bankruptcy law and how it can benefit your practice. We'll explore how AI can streamline Chapter 7 and 13 case management, ethical considerations around AI in bankruptcy law, the challenges that practices may face in implementing new AI technology and how to overcome them.

|

Summary: Jon Oberg filed a False Claims Act lawsuit in 2007 against various student-loan companies, alleging they submitted false claims to the Department of Education. The companies moved to file summary judgment materials under seal, which was temporarily granted. The case eventually settled, and the sealed documents were not revisited. In 2023, Michael Camoin, a documentary filmmaker, later requested access to these sealed documents, claiming a right to access under the First Amendment, but the magistrate judge denied Mr. Camoin’s request, concluding that the documents did not play an adjudicative role since the case settled before summary judgment was decided. On appeal, the Fourth Circuit held that the First Amendment right of access applies to documents filed in connection with summary judgment motions, regardless of whether the court ruled on the motions. This right of access attaches upon the filing of the documents and is intended to ensure transparency and public understanding of judicial proceedings.

|

Abstract: This Comment posits that the proposed FRESH START Through Bankruptcy Act of 2021 is the most viable solution to the student loan crisis and would address it in two primary ways. First, it would eliminate the need for student loan borrowers to satisfy the “undue hardship” standard, and would make discharge attainable—provided the debtor has already been in repayment for at least ten years. Second, it would address the underlying issues of “credentialism” and increased tuition costs, at least in part, through a “clawback” provision aimed to increase institutional accountability.

|

Abstract: Amid the COVID-19 pandemic, the U.S. Department of Education implemented administrative forbearance for student loan payments from March 13, 2020, to Sept. 1, 2023. This unexpected policy, affecting all eligible loans and preventing anticipatory plans or selective participation, ensures a sample free from selection bias or endogeneity. This study investigates the impact of student loan relief on home purchases using the 2022 Survey of Consumer Finances. We find that among the households with a student loan, those benefiting from relief were 71% more likely to purchase homes. Our findings suggest that student loan payments hinder homeownership and subsequent wealth accumulation.

|

Make the most of your NACBA membership and leverage the benefits offered by NACBA's Listserv, formally called NACBA Connect. Whether you're seeking insights, sharing your expertise, or simply connecting with like-minded professionals, NACBA Connect is your go-to resource.

NACBA Connect offers members the unique opportunity to pose bankruptcy-related questions and receive real-time insights from their peers nationwide. It is the premier virtual community that connects the finest consumer bankruptcy attorneys together, ready to share their expertise and wisdom. Whether you're a new practitioner seeking guidance or a seasoned professional navigating complex cases, NACBA Connect caters to all levels of expertise. It's a space where both straightforward and challenging questions find responsive and insightful solutions.

Why NACBA's Listserv Matters for Your Bankruptcy Practice:

1. Instant Collaboration: Enjoy the ability to engage with colleagues across the country in real time, fostering a culture of collaboration and shared learning.

2. Expert Advice: Pose both easy and hard questions to tap into the collective knowledge of some of the best consumer bankruptcy attorneys in the nation.

3. Virtual Community: Become part of a supportive network of professionals who share similar experiences and challenges, creating connections that extend beyond geographical boundaries.

|

|

|