|

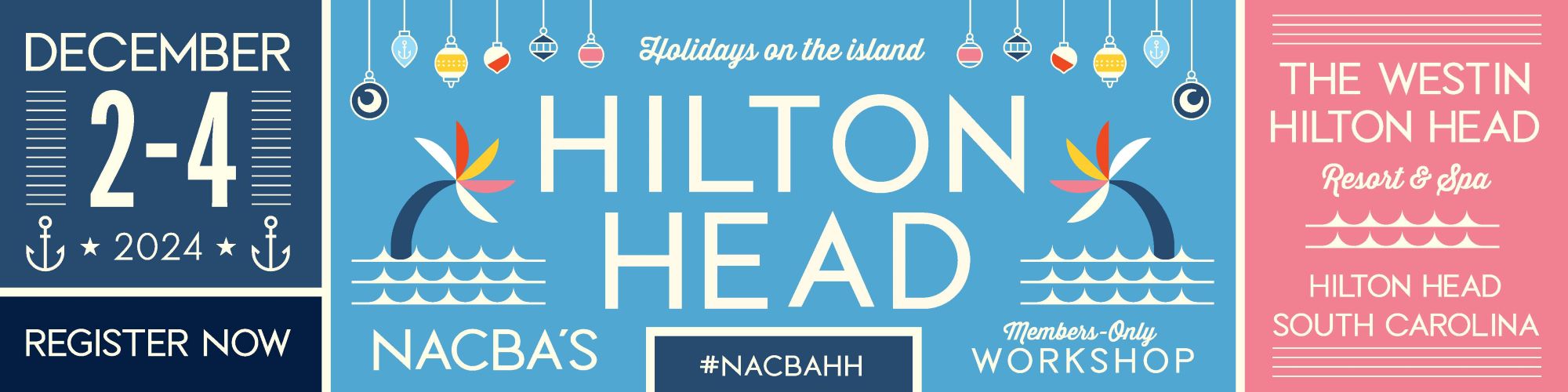

NACBA's Members-Only Workshop: #NACBAHH

Dec. 2-4, 2024

The Westin Hilton Head – Hilton Head, S.C.

Join NACBA for an unforgettable holiday event on Hilton Head Island! This December, earn your CLE credits while enjoying the serene beauty and festive spirit of this renowned destination.

Enhance your professional skills at our exclusive Members-Only Workshop, designed specifically for consumer bankruptcy attorneys. At #NACBAHH, you will:

1. Expand Your Knowledge: Participate in intensive sessions tailored to your professional needs.

2. Grow Your Practice: Gain valuable tools and resources to enhance your practice.

3. Network with Peers: Connect with fellow professionals and industry leaders.

4. And so much more!

Special Accommodation Rates

We've secured a special low rate of just $180 per night at The Westin, but hurry – this offer is available only until Friday, Nov. 1, 2024, or until rooms are sold out. Don't miss this exclusive opportunity to stay at a luxurious resort at an unbeatable price.

EARLY BIRD SAVINGS UNTIL JULY 12!

Member price: $799

Bundle and SAVE! Secure a NACBA membership and register for NACBAHH for $1,049

|

SAVE THE DATES! NACBA is rolling out the red carpet for our members in HOLLYWOOD! Save the dates for our 33rd Annual Convention. More information to come!

NACBA's 33rd Annual Convention

April 24-27, 2025

Loews Hollywood

Hollywood, CA

|

|

|

| |

Date: Thursday, Aug. 22, 2024

Time: 3-4 PM ET

Speakers: Jenny L. Doling, Esq. and Rachel Lynn Foley, Esq.

Member price: $25

Non-member Price: $75

Description: Bankruptcy is unique area of practice. We operate on flat fees, hourly fees, blended fee agreements, and “no look” fees. Our fees must be reviewed and approved by the U.S. Bankruptcy Court. Some bankruptcy attorneys require full payment to retain, while others offer payment plans. Some attorneys get paid electronically and others only accept cash or checks. Some attorneys only see clients in person while others run an all-virtual practice. However your firm operates, the fee agreement is one of the most important tools available to protect both the attorney and the client. This panel will address the various clauses bankruptcy attorneys should add to their fee agreements such as clauses addressing when a client no longer wishes to move forward with the case, or when a client’s circumstances have changed and the attorney must rework the case. There are limited scope clauses to consider for post-petition services such as adversaries, negotiating with a trustee on equity buybacks, objecting to claims, handling random audits, redemptions, reaffirmation agreements, and appeals. Don’t miss this opportunity to strengthen your retainer agreements.

|

In Mission Hen LLC v Lee, Case No. 23-4220 (9th Cir. 2023), the Ninth Circuit is considering whether the Ninth Circuit B.A.P. erred by concluding that a Chapter 13 plan may modify and bifurcate an undersecured lien secured by the debtor’s principal residence pursuant to 11 U.S.C. § 1322(c)(2).

|

In In re Cooper, Case No. 24-1084 (9th Cir. 2024) the Ninth Circuit is determining whether the Ninth Circuit B.A.P. erred when it held that the Social Security Administration (SSA) could recoup an overpayment of Social Security Disability Insurance (SSDI) benefits from Darrin Cooper’s ongoing SSDI payments, without violating the discharge injunction in bankruptcy.

|

The Supreme Court in a 5-4 decision on June 27, 2024, in Harrington v Purdue Pharma, Case No. 23-124 (2024) held that the Bankruptcy Code does not authorize a release and injunction that, as part of a Chapter 11 reorganization plan, effectively discharges claims against nondebtors without the consent of affected claimants.

|

In In re Feyijinmi, the 4th Circuit held that a debt for restitution ordered as part of a criminal conviction is nondischargeable under 11 U.S.C. § 1328(a)(3), even if the conviction was expunged or the restitution was later converted to a civil matter. Additionally, the State’s characterization of the debt on its proof of claim as “court fees” did not change its nondischargeable nature.

|

The National Consumer Bankruptcy Rights Center (NCBRC) is a 501(c)(3) organization dedicated to protecting the integrity of the bankruptcy system and preserving the rights of consumer bankruptcy debtors. NCBRC provides assistance either by working directly with debtors’ attorneys or by filing amicus briefs in courts throughout the country. Consider supporting NCBRC today!

|

NACBA is proud to partner with Arthur J. Gallagher & Co., one of the world’s leading insurance brokerages and risk management firms offering customized cost-effective insurance plans and services.

Lawyers Professional Liability and Business Insurance: Gallagher Affinity offers the resources to approach several insurance carriers on behalf of the member. We are also able to provide quotes for other business insurance needs.

Cyber Liability/Data Breach Insurance: Are you prepared if a data reach occurs? Who would you call? Gallagher Affinity's Cyber Liability Program starts at $299 Annually and offers multiple limit options and a 24/7 breach hotline.

Member Options Auto and Home Insurance Program: Everyone likes options. Member Options gives you the power to choose—all while saving you time and money. Get quotes from top-rated insurance carriers on Auto, Home, Renters, Pet insurance and more in a matter of minutes. Answer a few simple questions online or over the phone with our licensed insurance experts to compare multiple options that meet your specific needs.

|

|

|