|

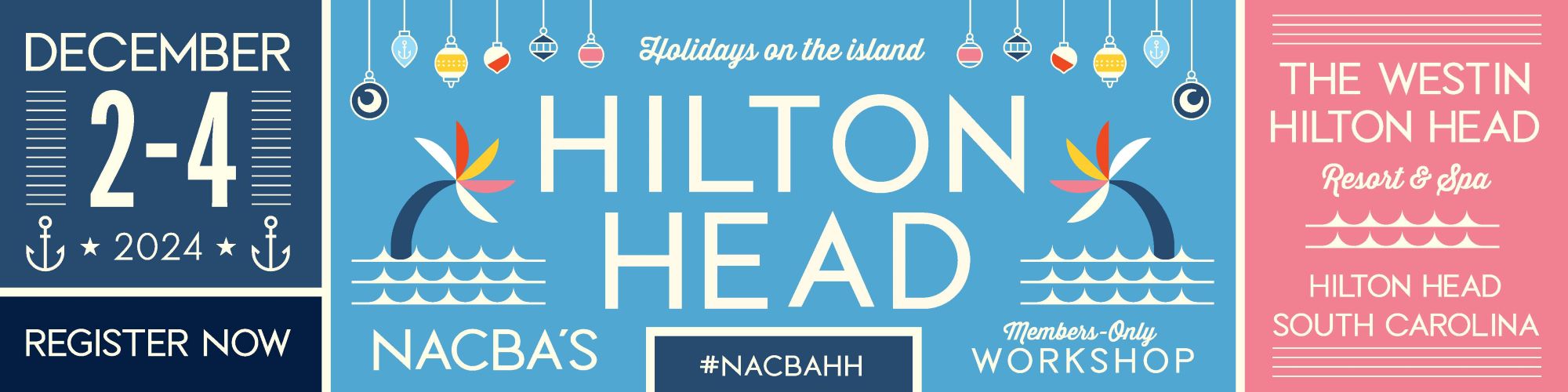

NACBA's Members-Only Workshop: #NACBAHH

Dec. 2-4, 2024

The Westin Hilton Head – Hilton Head, S.C.

Join NACBA for an unforgettable holiday event on Hilton Head Island! This December, earn your CLE credits while enjoying the serene beauty and festive spirit of this renowned destination.

Discover Hilton Head Island

Hilton Head Island is celebrated for its pristine white-sand beaches, breathtaking natural beauty, and welcoming, family-friendly atmosphere. With pleasant weather from November through March, it's the perfect time to explore the enchanting Lowcountry landscape.

Enhance your professional skills at our exclusive Members-Only Workshop, designed specifically for consumer bankruptcy attorneys. At #NACBAHH, you will:

1. Expand Your Knowledge: Participate in intensive sessions tailored to your professional needs.

2. Grow Your Practice: Gain valuable tools and resources to enhance your practice.

3. Network with Peers: Connect with fellow professionals and industry leaders.

4. And so much more!

Special Accommodation Rates

We've secured a special low rate of just $180 per night at The Westin, but hurry – this offer is available only until Friday, Nov. 1, 2024, or until rooms are sold out. Don't miss this exclusive opportunity to stay at a luxurious resort at an unbeatable price.

EARLY BIRD SAVINGS UNTIL JULY 12!

Member price: $799

Bundle and SAVE! Secure a NACBA membership and register for NACBAHH for $1,049

|

SAVE THE DATES! NACBA is rolling out the red carpet for our members in HOLLYWOOD! Save the dates for our 33rd Annual Convention. More information to come!

NACBA's 33rd Annual Convention

April 24-27, 2025

Loews Hollywood

Los Angeles, Calif.

|

|

|

| |

Date: Thursday, Aug. 22, 2024

Time: 3-4 PM ET

Speakers: Jenny L. Doling, Esq. and Rachel Lynn Foley, Esq.

Member price: $25

Non-member Price: $75

Description: Bankruptcy is unique area of practice. We operate on flat fees, hourly fees, blended fee agreements, and “no look” fees. Our fees must be reviewed and approved by the U.S. Bankruptcy Court. Some bankruptcy attorneys require full payment to retain, while others offer payment plans. Some attorneys get paid electronically and others only accept cash or checks. Some attorneys only see clients in person while others run an all-virtual practice. However your firm operates, the fee agreement is one of the most important tools available to protect both the attorney and the client. This panel will address the various clauses bankruptcy attorneys should add to their fee agreements such as clauses addressing when a client no longer wishes to move forward with the case, or when a client’s circumstances have changed and the attorney must rework the case. There are limited scope clauses to consider for post-petition services such as adversaries, negotiating with a trustee on equity buybacks, objecting to claims, handling random audits, redemptions, reaffirmation agreements, and appeals. Don’t miss this opportunity to strengthen your retainer agreements.

|

Jurisdiction: Bankr. E.D.N.C.

Summary: Disregarding (with gratuitous scorn) a long-standing case law from its own jurisdiction, including In re Alexander, 344 B.R. 742, 752 (Bankr. E.D.N.C. 2006), the bankruptcy court held that even when the "mechanical requirements" of the Means Test at §1325(b) do not mandate a dividend to unsecured creditors, the "good faith" obligations of 11 U.S.C. § 1325(a)(3) precluded the debtor from retaining "luxury items" while only providing a "meager projected dividend to general unsecured creditors when no dividend is required under the disposable income test."

|

Jurisdiction: 9th Circ.

Holding: The court held that Rhita Bercy, who filed a Chapter 7 bankruptcy petition, lacked standing to pursue her hostile work environment claim against her employer, the City of Phoenix. The court affirmed the district court's grant of summary judgment to the City because Bercy's claim belonged to the bankruptcy estate, and only the bankruptcy trustee had standing to sue on the claim.

Facts: Rhita Bercy, while employed at the City of Phoenix, faced offensive and discriminatory remarks from a coworker. She filed a Chapter 7 bankruptcy petition within the period of harassment. Despite being aware of her coworker's discriminatory conduct, she answered "no" to claims against third parties in her bankruptcy petition. Bercy later sued the City for violations of Title VII and Section 1981 of the Civil Rights Act, alleging a hostile work environment that continued before and after her bankruptcy filing.

|

NACBA is currently seeking nominations for the role of Circuit Leader in the 2nd, 3rd, 7th, and 8th Circuits.

NACBA Circuit Leaders play a pivotal role in providing meaningful and timely coverage of bankruptcy decisions affecting consumer attorneys and debtors within the purview of the U.S. Court of Appeals for the Federal Circuit. We are looking for individuals who are not only knowledgeable in this area but also committed to fostering a strong sense of community within their designated circuit.

If you are considering this leadership opportunity, or have a colleague in mind you would like to nominate, here are the key responsibilities associated with the role:

1. Share case law updates, bankruptcy news, and circuit announcements for the designated circuit through a weekly Circuit community post.

2. Develop custom content for discussions with fellow bankruptcy attorneys, as needed and at your discretion.

3. Provide community-related feedback to NACBA admin and the Circuit Communities Committee.

4. Recommend and implement engagement tactics, integrating the community into organizational programming, communication strategies, annual conferences, and events.

5. Seek and compile audience feedback to shape online circuit community management practices.

6. Lead Circuit Community Discussion at NACBA's Annual Convention.

In recognition of commitment as a circuit leader, NACBA is pleased to offer a waiver of the one-year membership fee (full membership benefits) in NACBA, valued at $300, as well as covering the registration fee for attendance at NACBA's Annual Convention. Our 33rd Annual Convention will be held April 24-27, 2025, in Hollywood, CA!

To express your interest or nominate a deserving colleague, please email a brief statement of interest to NACBA's Director of Government Affairs & Communications at: Krista.damelio@nacba.com by July 1.

|

The National Consumer Bankruptcy Rights Center (NCBRC) is a 501(c)(3) organization dedicated to protecting the integrity of the bankruptcy system and preserving the rights of consumer bankruptcy debtors. NCBRC provides assistance either by working directly with debtors’ attorneys or by filing amicus briefs in courts throughout the country. Consider supporting NCBRC today!

|

NACBA’s team of legislative advocates in Washington, DC assists the Board of Directors to ensure that the voices of consumer debtors and their attorneys are heard in debates about proposed changes to the Bankruptcy Code. NACBA has represented the views of consumer debtors and their attorneys not only in the halls of Congress, but also before the Executive Office of the U.S. Trustee, the Internal Revenue Service, and the Advisory Committee on Bankruptcy Rules. NACBA also maintains strong working relationships with other organizations and individuals protecting the rights of consumers. NACBA Members may participate in this process through our Capitol Hill Day event, when NACBA members gather in Washington to meet with their Senators and Congressional representatives to educate them on issues affecting debtors.

|

|

|