JW Marriott Tucson Starr Pass Resort & Spa

Tucson, AZ

May 19 - 22, 2022

|

Date & Time: Thursday, October 21, 2021 | 4-5 p.m. Eastern

Description: The panel will discuss the definition of implicit bias, our ethical and legal responsibility to prevent it, and suggest practical and affordable remedies that begin to monitor and prevent bias.

Why you should attend: Implicit bias has been identified as a potential factor in influencing advice given to clients. It is crucial to understand what it is and how to protect your clients and your firm.

Speakers: Jim Haller and David Gunn

Member price: $49

|

NACBA’s Members-Only Workshop is BACK and IN PERSON! Join NACBA November 30 - December 3, 2021 at the stunning beachfront Grand Hyatt Kaua'i Resort & Spa in Hawaii.

Early-bird registration has been EXTENDED until October 29th! You do not want to miss out on experiencing one of the most beautiful places on the planet while getting the latest tips and tools to help your clients and grow your practice. Learn more and register today!

|

As our association’s response to COVID-19 continues to evolve, our in-person events will include measures to promote safety and prevent the spread of the coronavirus. If you choose to participate in our events in person, the event environment will promote social distancing and event protocols guided by the CDC, along with other safety measures that NACBA and the event location deem necessary. NACBA's Members-Only Workshop will operate in conjunction with the State of Hawaii's requirements for all "professional" events.

Please email admin@nacba.com with any questions or concerns.

|

Where the maturity date on the vehicle pawn contract had not elapsed before the debtor filed for chapter 13 bankruptcy, she retained ownership of her vehicle, the vehicle became property of the estate, and the loan could be provided for in her chapter 13 plan. TitleMax of Alabama, Inc. v. Womack, — Fed. Appx. —-, 2021 WL 3856036 (11th Cir. Aug. 30, 2021) (case no. 21-11476) (unpublished).

|

Under the “estate replenishment” theory, post-confirmation appreciation on the chapter 13 debtor’s residence belongs to the debtor. In re Larzelere, 2021 WL 3745428 (Bankr. D. N.J. Aug. 24, 2021) (case no. 1:17-bk-34411).

|

Where neither the debtor nor the creditor presented sufficient evidence to establish or counter the three prongs of the Brunner undue hardship test, neither was entitled to summary judgment on the debtor’s adversary complaint seeking discharge of his student loan. Rosenberg v. ECMC, No. 20-688 (S.D. N.Y. Sept. 29, 2021).

|

A state default judgment lien was avoidable in bankruptcy under the court’s inherent power to police attorney conduct where the lien was security for unpaid attorney fees which were unreasonable. Moore v. Sanchez (In re Sanchez), No. 20-1267 (D. N.M. Sept. 22, 2021).

|

Current client demands for quality information, acknowledgment, and instant responses are nearly universally expected in our ever-growing 24/7, rapid-fulfillment culture. Attorneys are recognizing the importance of answering every phone call, responding warmly and clearly, and providing meaningful and understandable information to elevate client communications and increase growth.

|

NCBRC strives to impact the national conversation on bankruptcy laws and debtor rights by increasing public awareness and education and by attracting media attention to the important issues involved. NCBRC also provides assistance either by working directly with debtors’ attorneys or by filing amicus briefs in courts throughout the country.

Consider supporting NCBRC's work and donate today!

|

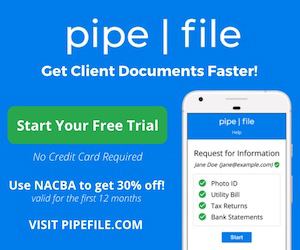

NACBA and Certificate of Service have teamed up to offer NACBA members discounted mailing services! Every user of the NACBA/COS mailing system gets the benefit of reduced pricing on per page copy costs, reduced postage, as well as the same reliability and timeliness of the Certificate of Service mailing system.

|

|

|

|