|

Jurisdiction: Bankr. N.D. Ohio

Date: July 3, 2025

Holding: The court held that the debtor’s Chapter 13 plan, which substantively complies with 11 U.S.C. § 1325(a)(5)(B)(i) by providing for lien retention and payment in full, is confirmable despite the creditor’s objection seeking additional lien retention language tied to a discharge that the debtor is ineligible to receive. The objection was overruled for failing to meet its burden of proof.

Facts: The debtor purchased a vehicle financed by the creditor within 910 days before filing bankruptcy. After receiving a discharge in a prior Chapter 7 case, the debtor filed the current Chapter 13 case, making her ineligible for discharge under § 1328(f)(1). The debtor proposed a Chapter 13 plan to pay the creditor over 60 months with amended payment terms and interest rates. The creditor objected to confirmation, arguing the plan must explicitly provide that the creditor retains its lien until payment in full under non-bankruptcy law or discharge under § 1328.

|

In Conte v. Hill, No. 24-10264, the U.S. Court of Appeals for the Eleventh Circuit affirmed a bankruptcy court’s order denying a Chapter 13 trustee’s motion to modify two confirmed plans to require turnover of post-confirmation personal injury settlement proceeds. The injuries in both cases occurred post-petition. The Eleventh Circuit affirmed that plan modification remains a discretionary determination for the bankruptcy court.

|

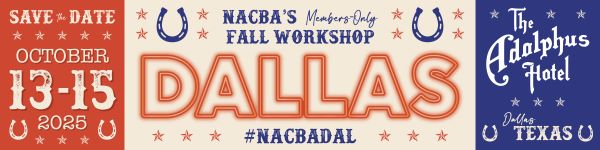

Join us October 13–15 at the iconic Adolphus Hotel, where southern charm meets timeless elegance. There’s no better time to visit—autumn in Dallas which brings cooler temps, sunny skies, and a buzz of culture, cuisine, and nightlife that perfectly complements our signature Workshop experience.

For a limited time until August 29th get NACBA's bundle deal!

Now through Friday, August 29, take advantage of special bundle pricing: Just $1,299 for full registration to NACBA’s Members-Only Workshop and a one-year NACBA membership! And only $999 for your paralegals to join NACBA and attend the Members-Only Workshop!

Here’s what you get:

✅ Members-Only Workshop Registration: Gain access to exclusive sessions on bankruptcy litigation, hands-on training, networking with peers, and insights from leading consumer bankruptcy experts.

✅ 1-Year NACBA Membership: Stay connected year-round with CLE opportunities, legislative advocacy, peer-to-peer collaboration, and resources tailored for attorneys like you.

This is your chance to get the full NACBA experience at a great value — whether you're joining for the first time or coming back after a break.

Join NACBA. Attend the Workshop. Make your next move now to grow your bankruptcy practice. Remember this special pricing disappears Friday, August 29!

|

Join us for the Bankruptcy Software Bonanza, kicking off August 18, and get a front-row seat to the tools shaping the future of consumer bankruptcy practice. Just like at our live events, you’ll have the chance to engage directly with top vendors and fellow NACBA members who actively use these products in their day-to-day practice.

Over the course of five days and ten sessions, you’ll discover:

✅ Live demos from industry-leading software providers

✅ Real-time insights from NACBA members who rely on these tools

✅ A chance to ask questions, compare platforms, and find what works for you

Whether you're looking to streamline document prep, automate workflow, manage client communication, or stay compliant — this virtual series will help you work smarter, not harder.

Can’t attend live? Your registration includes access to all session recordings.

Price:

NACBA Members: ONLY $50 for all 5 days!

Non-members: $150 for all 5 days!

Space is limited. Register today and remember, NACBA IS YOUR BANKRUPTCY PRACTICE PARTNER!

|

|

|

Date: Thursday, August 7, 2025

Time: 3:00pm - 4:30pm ET (90 minutes)

Speakers: Kelli Stanley; N.C. State Bar Certified Paralegal, The Law Office of John T. Orcutt

Michael Gouveia, Esq., Law Office of Michael Gouveia

Member Price: $35

Non-member Price: $135

Description: Part survival guide, part masterclass – “Paralegal Wisdom” will deliver real-world training and battle-tested hacks to boost your confidence, speed, and sanity in today’s bankruptcy law office.

|

Master the Fight, Win the Case with the American Bankruptcy Litigation Institute, NACBA’s premier training program designed to sharpen your litigation skills and give you the competitive edge in bankruptcy practice.

This intensive, hands-on program equips consumer bankruptcy attorneys with the tools and strategies needed to effectively litigate against creditors, servicers, and debt collectors. Whether you're looking to refine your trial techniques, strengthen your case strategies, or gain deeper insights into bankruptcy litigation, this is the training you’ve been waiting for.

The American Bankruptcy Litigation Institute will officially launch at NACBA’s Members-Only Fall Workshop, taking place October 13-15 in Dallas, Texas. This exclusive event will offer a dynamic learning experience led by top experts in the field, providing practical insights and real-world litigation tactics you can immediately apply to your practice.

Graduates of this program will receive a certificate of completion for the year and a digital badge to showcase your achievement on your email signature and practice’s website. Don’t miss this opportunity to elevate your litigation skills, expand your professional network, and gain the recognition you deserve. Secure your spot today and get in on the ground floor.

NACBA is working to bring you even more from ABLI like:

-Specialty Webinars

-Special Listserv just for ABLI participants

-Access to the experts

-Access to a specialized library of documents

|

On July 24, 2025, the National Consumer Bankruptcy Rights Center (NCBRC) and the National Association of Consumer Bankruptcy Attorneys (NACBA) filed an amicus curiae brief in the U.S. Court of Appeals for the Fourth Circuit in Goldman Sachs Bank USA v. Brown, No. 25-1439. The case concerns whether consumer debtors’ claims under 11 U.S.C. § 362(k)—seeking damages for willful violations of the automatic stay—must be resolved through private arbitration, rather than in the bankruptcy courts tasked with enforcing that stay.

|

July 31, 2025 — The National Consumer Bankruptcy Rights Center (NCBRC) and the National Association of Consumer Bankruptcy Attorneys (NACBA) filed an amicus brief in the Second Circuit in In re Goebel, No. 25-103, in support of a Chapter 7 debtor seeking a determination that over $500,000 in tax debts owed to the Internal Revenue Service (IRS) were discharged in bankruptcy. The amici urge the court to reject the IRS’s efforts to restrict the bankruptcy court’s ability to determine tax dischargeability and to reaffirm the rights of debtors to obtain a timely and final ruling on the scope of their discharge.

|

July 31, 2025 — In Humphrey v. Christopher, No. 24-1854, the U.S. Court of Appeals for the Eighth Circuit sidestepped a key question in consumer bankruptcy law: whether a debtor’s defensive appellate rights are part of the bankruptcy estate and may be sold by the trustee. Instead, the court resolved the case on procedural grounds, holding that because the debtor failed to obtain a stay of the bankruptcy court’s sale order, review of that order was statutorily moot under 11 U.S.C. § 363(m). While declining to reach the merits, the decision underscores the critical importance of seeking a stay pending appeal when challenging sales of purported estate assets.

|

Recommended by 50 state and more than 70 local and specialty bars, LawPay is proud to be the preferred payment partner of more than 35,000 law firms. Designed specifically for the legal industry, LawPay provides attorneys with a simple, secure way to accept online payments in their practice. LawPay understands the unique compliance and financial requirements placed on attorneys, which is why their solution was developed specifically to correctly separate earned and unearned fees, giving you peace of mind that your credit card and eCheck transactions are always handled correctly. For more than a decade, LawPay has made it as easy as possible for attorneys to receive payment for their services, and NACBA members receive a three month free trial.

|

One of the most popular features of NACBA membership is the ability of NACBA members to pose bankruptcy questions and get real time responses from their colleagues around the country. NACBA Listserv participants enjoy the unparalleled ability to post both the easy and hard questions to some of the best consumer bankruptcy attorneys in the nation. This listserv, which also functions as a virtual community of people doing the same type of work, is a boon for the new practitioner as well as the most sophisticated consumer bankruptcy attorneys.

|

|