Understanding CUSMA compliance

Print this Article | Send to Colleague

What Canadian exporters need to know

Despite U.S. tariffs imposed on Canada under the United States (U.S.) International Emergency Economic Powers Act (IEEPA), Canadian exporters can still benefit from duty-free access to the U.S., if their goods are Canada–United States–Mexico Agreement (CUSMA) compliant.

Despite U.S. tariffs imposed on Canada under the United States (U.S.) International Emergency Economic Powers Act (IEEPA), Canadian exporters can still benefit from duty-free access to the U.S., if their goods are Canada–United States–Mexico Agreement (CUSMA) compliant.

Being CUSMA compliant means that goods meet the CUSMA rules of origin and qualify for preferential tariff treatment.

- What this means for your business

- Over 98% of tariff lines and 99.9% of bilateral trade with the U.S. are eligible for duty-free access under the CUSMA.

- Canadian goods must be certified as compliant with the CUSMA rules of origin by the exporter or producer (this means the goods are eligible for preferential tariff treatment), and U.S. importers must claim the preference to benefit from duty-free treatment.

Ensure your product meets the CUSMA rules of origin and complete a certification of origin

- Determine your product’s HS code.

- Determine if your good meets the rules of origin (product-specific rules of origin are written based on HS codes).

- Complete a certification of origin (there is no requirement for this information to be provided on a specific form. It may be provided on an invoice or any other document.)

- Consider using a template certificate to avoid errors.

- Provide the certification of origin to your U.S. importer so they can claim the preferential tariff treatment.

- Request an advance ruling for certainty about how the good will be treated upon entry into the U.S.

- Contact a certified customs broker for additional support:

- For a directory of Customs Brokers in the U.S: Permitted Customs Brokers Listing | U.S. Customs and Border Protection

- For a directory of Customs Brokers in Canada: Customs Broker Search | CSCB National Office

For goods imported into the U.S., the final decision on the classification and tariff treatment of a good rests with the U.S. Customs and Border Protection (CBP).

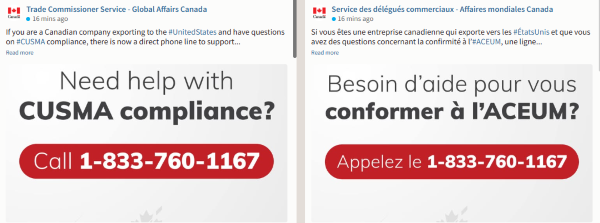

Need help with CUSMA compliance? Call our support line at 1-833-760-1167.

Additional resources

- Supporting Canadian exporters through United States tariff challenges

- Learn more about provincial and territorial support and responses to the U.S. tariff situation.

- Get answers to common questions through self-serve problem solving resources.

- Canada Border Services Agency: Exporting Commercial Goods

- U.S. Customs and Border Protection: Tips for New Importers and Exporters

- U.S. Customs and Border Protection: USMCA FAQs

Stay informed!

We're updating key resources in real time to help you navigate the evolving U.S. tariff situation.

Do business with the world

The Trade Comissioner Service helps your Canadian business succeed in international markets with export advisory services, funding and accelerator programs. With a presence in more than 160 cities worldwide, we can help you do business with the world.

Subscribe to our mailing list to receive future email notifications.

Follow us on social media: LinkedIn, X (Twitter), Facebook and YouTube