SB 1 Diesel Fuel Excise and Sales Tax Increases Begin November 1

Print this Article | Send to Colleague

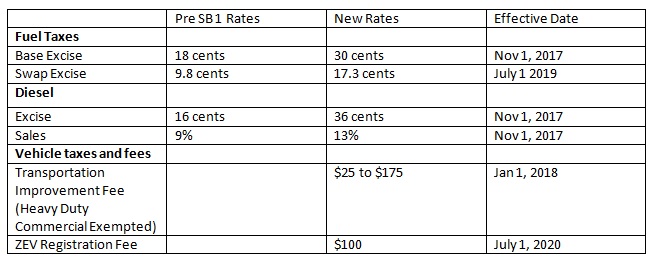

On November 1, the first of the increases to gasoline and diesel fuel taxes begin to take effect that were included as part of Senate Bill 1, the transportation investment legislation that will provide $52 billion towards California’s aging infrastructure over the next 10 years. The gasoline base excise tax will increase 12 cents, the diesel excise tax will increase 20 cents, and the diesel sales tax will increase 4%.

While these increases are tough, CTA supported SB 1 for several reasons: The trucking industry was excluded from the vehicle registration increase taking affect on January 1, 2018, no weight fee increase was imposed on the trucking industry , CTA’s legislative proposal to tie compliance with the Truck and Bus rule to a trucks registration was included, as well as the CTA’s useful life proposal which provides trucking companies regulatory certainty against any new CARB or local AQMD regulations for 13 years and 800,000 miles.

To date, CalTrans and CTC have already begun scheduling the "fix it first" transportation projects, most of which are meant to help improve the movement of goods movement throughout the state.

If you have any questions about the implementation of these taxes or for more information about CTA’s position on SB 1, please feel free to call Matt Roman at (916) 373-3570.

Below is a chart of the new taxes and fees included in SB 1 and their scheduled implementation