The Off Highway Fuel Usage Report

Print this Article | Send to Colleague

By Brittany C. Clark

Product Manager, EROAD

Did you know there are many types of jurisdictional refund processes available for fuel tax that a motor carrier can claim, such as for fuel consumed off highway? Each jurisdiction can offer its own fuel tax refunds, which vary based upon the type of fuel used, type of equipment used, and type of road travelled on. EROAD is now automating this process to help motor carriers maximize the opportunity for the recovery of motor fuel tax consumed while driving off highway with its new Off Highway Fuel Usage Report.

If you haven’t yet taken the first step toward choosing a telematics partner, now might be the right time. With the ELD mandate on the horizon, it may be time to ditch paper records and forget about spending time researching the constantly changing record keeping rules and requirements.

EROAD’s accurate and intuitive compliance solution not only meets the requirements for ELD but also for various tax types: IFTA, IRP, and Oregon Weight-Mile (WM) tax. The EROAD solution can boost your confidence in the tax returns you are filing and significantly reduces the preparation time required to file your tax returns. It also automatically identifies exempt miles that are not subject to IFTA or OR WM tax according to individual jurisdictional requirements. Now, with the Off Highway Fuel Usage Report you can take a closer look at where your fuel is being used and reduce the amount of time and effort needed to capitalize on refund opportunities available when you drive off highway miles simply by choosing EROAD as your telematics partner.

Off Highway Fuel Usage Report Advantages

- Simplify and expedite the refund claim process by allowing you to view and extract off highway information with any filters applied

- Automatically processes vehicle trip information to capture off highway miles and calculates the off highway fuel consumed by road type category using the information provided in the fuel transaction data

- Quickly fill out and file multiple jurisdictional and refund claim types with minimal, manual effort

- Generate the individual off highway trip reports needed for recordkeeping and audit purposes

- Drill down to the individual trip details for a vehicle directly from the report.

Why do I need the Off Highway Fuel Usage Report?

Manually recording and reporting where miles are travelled and fuel is used can be time consuming, cumbersome, and often inaccurate, which makes it a less than desirable option for any motor carrier to recover fuel tax credits available. While specialized companies who conduct business in categories such as construction, logging or forestry, and farming tend to see the highest percentages of exempt mile travel, most organizations drive off highway in some capacity.

As each jurisdiction has its own set of rules and requirements, the Off Highway Fuel Usage Report was developed to be comprehensive and flexible enough to provide the level of detail needed to file an accurate off highway refund claim for jurisdictions that offer a claim for refund for fuel consumed off highway.

The Off Highway Fuel Usage Report is an out-of-the-box feature that can be used for many purposes, and is completely independent to our other tax solutions. It automatically identifies off highway miles by road type category (private, off road, toll road, construction site, and forestry road) and displays the total number of off highway miles per jurisdiction so you can make better business decisions about which off highway refund claims to research and file.

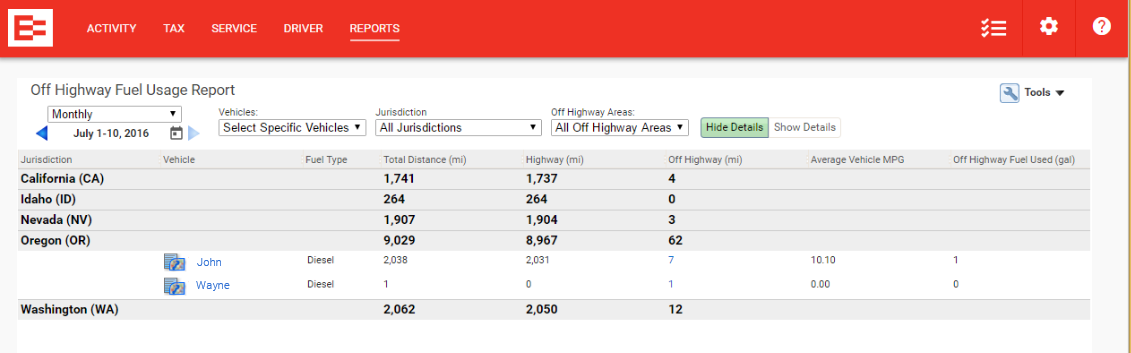

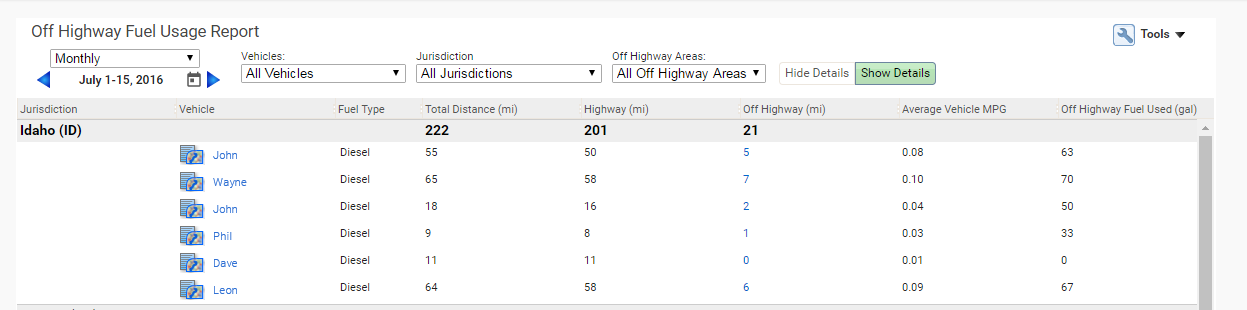

The Off Highway Fuel Usage Report displays your fleet’s off highway data per jurisdiction and vehicle, and provides a wide range of filtering options so you see only the data necessary to file a refund claim in a given jurisdiction.

With a simple click of a button, you can expand the Off Highway Fuel Usage Report to see specific off highway information for each vehicle that has accumulated off highway travel for a given jurisdiction, such as average vehicle mpg and the fuel consumed off highway.

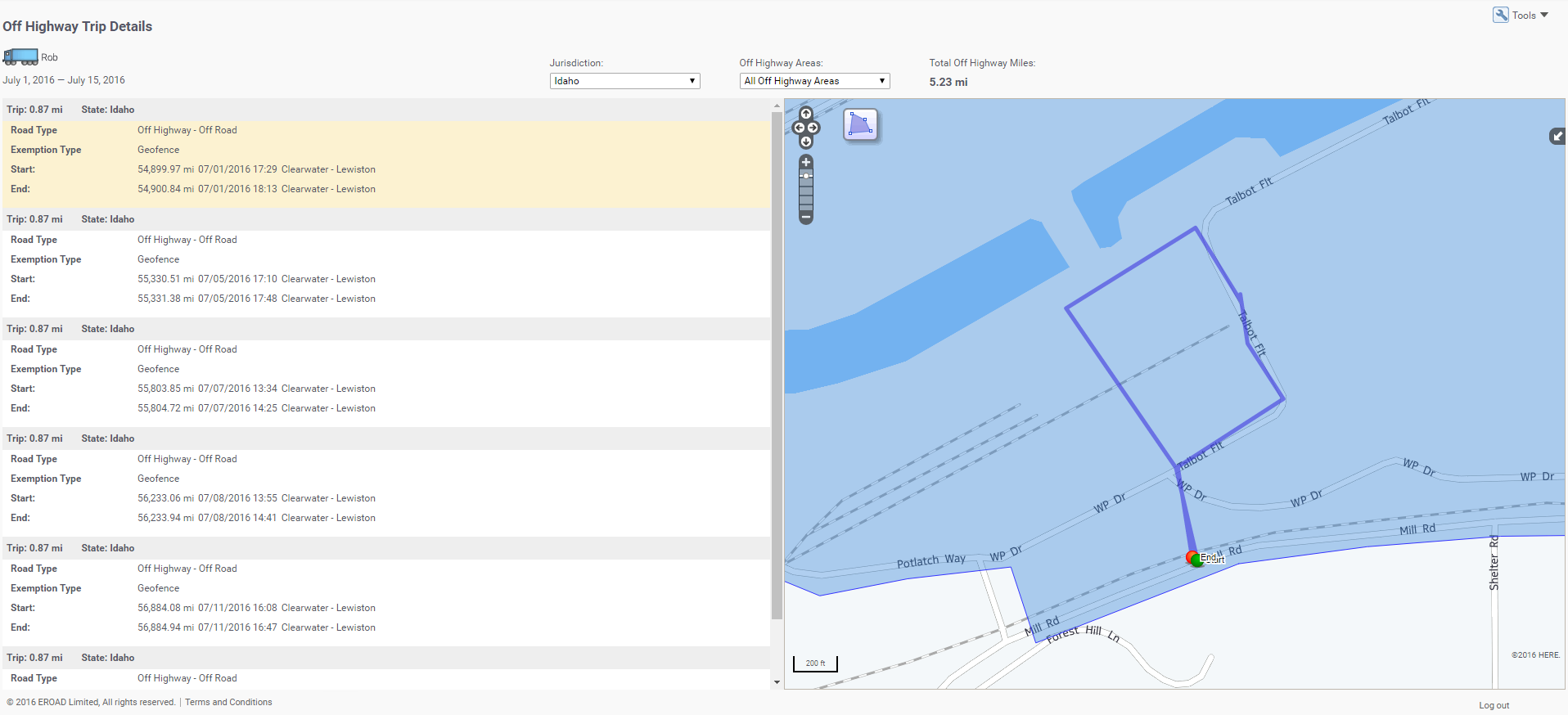

Viewing the vehicle details enables you to drill into the individual off highway trips for the vehicle with the selected filters applied. These individual trip details can be used to provide proper documentation when filing an off highway fuel usage refund claim along with the fuel transactions recorded.

Off Highway Fuel Usage Report Advantages

- Simplify and expedite the refund claim process by allowing customers to view and extract off highway information with any filters applied

- Automatically process vehicle trip information to capture off highway miles and calculates the off highway fuel consumed by road type category using the information provided in the fuel transaction data

- Quickly fill out and file multiple jurisdictional and refund claim types with minimal, manual effort

- Generate the individual off highway trip reports needed for recordkeeping and audit purposes

- Drill down to the individual trip details for a vehicle directly from the Off Highway Fuel Usage Report

Brittany Clark will be presenting a free webinar with the California Trucking Association on Off Highway Fuel Usage Reporting on Wednesday, September 7, 2016 @ 10:00 – 11:00 AM. To register, please click HERE.

Article provided by EROAD, CTA Executive Circle Club Partner. For more information about EROAD, visit www.eroad.com/solution.

The views expressed in this article reflect the views of the author and do not necessarily reflect the views of the California Trucking Association.