Miss 'Cheers'? Love petroleum storage and transport? We have the crossover for you!

Last month, CFCA member, Otodata, was featured on 'The Advancements TV Series with Ted Danson', to show off some of their latest advancements in the field of fuel delivery and logistics.

Click the link below to watch!

|

CFCA woud like to give a huge thank you to the following generous members for their donations to the CIOMA Memorial Scholarship Fund in honor of Pat Cullen.

Thank you to:

Ken Dewar of JB Dewar

David Levine of Ted Levine Drum Co.

Mike Downs of Downs Energy

We would also like to thank Mike Downs for his second donation in honor of Darry White's mother, wife of former CIOMA President, Ron White.

Thank you, again for your generous donations!

|

Join us July 16th, for a webinar hosted by our retirement experts at Maniaci Insurance, where they will break down everything you need to know about the CalSavers Retirement program.

As a result of COVID-19, The California Secure Choice Retirement Savings Investment Board has issued a Notice of Proposed Emergency Regulation Action to amend Section 10002(a)(1) of the CalSavers Retirement Savings Program regulations. The amendment would change the registration deadline for eligible employers with more than 100 employees from June 30, 2020 to September 30, 2020.

Make sure you know everything you need to know, before September 30th!

Save the date, now! You can email James Allison at james@cfca.energy to sign up!

|

The State of California is making PPE available for all organizations, public, nonprofit, as well as private commercial entities, to assist in their reopening of the State through Stage 3 of the Resilience Roadmap. For commercial entities, please note that this is a resource available if normal channels/local sources are not able to fulfill their PPE needs.

Please send your PPE needs for the next 30, 60, and 90 days to socoperations@soc.caloes.ca.gov and courtesy copy covid-19.taskforce@soc.caloes.ca.gov.

The deadline for submission is Friday June 12. Requests to Cal OES for PPE should be made using the attached form.

The following list of PPE supplies are immediately available for distribution:

· BYD procedure masks

· Face Shields

· Cloth masks

· 8oz liquid sanitizers

· Gel hand sanitizer 8oz bottles

It has been indicated that the listed items are in plentiful supply and will be provided free of charge. Non-listed PPE may not be available. Cal OES did indicated that they would let entities know the status of their request.

Non-listed PPE requests (such as N95/99 masks or gloves) can be included in your requests but may not be available or be provided.

|

CFCA has recently received information from member and local Californian marketer, Paul Oil, that their apparel manufacturing division has begun to produce PPE masks for use by your employees.

These masks are double layer, antimicrobial fabric that are reusable and washable. Paul Oil also takes great pride in the comfort of these masks as well as the ability to be worn for extended periods without discomfort.

These masks are made to order and can be customized with your logo, or branded logo for your station.

As another standout, these masks are CFCA member-made, right here in California!

For all members ordering custom masks, Paul Oil will lower their quantity minimum to 25. As another special benefit to CFCA members, they will charge their first responder rate of $9.95 per mask.

Paul Oil is already making masks for several CFCA members and is looking to provide this special rate to all CFCA members.

For orders, or if you have any questions, contact Mark Paul at mpaul@pauloilcompany.com.

|

FreeWire Technologies merges beautiful design with convenient services to electrify industries formerly dependent on fossil fuels. FreeWire’s turnkey power solutions deliver energy whenever and wherever it’s needed for reliable electrification beyond the grid. With scalable clean power that moves to meet demand, FreeWire customers can tackle new applications and deploy new business models without the complexity of upgrading traditional energy infrastructure.

FreeWire’s Boost Charger is a powerful battery-integrated electric vehicle charger. Easy to connect with existing infrastructure, it can be set up without costly construction or permitting. With 160 kWh of battery capacity and 120 kW output, Boost Charger is ready for current and next generation EVs. Boost Charger enables ultrafast charging using the same infrastructure as L2 chargers at up to a 40% lower cost of installation versus other fast chargers. Deliver high-quality power while significantly reducing demand charges with Boost Charger’s battery-integrated platform.

|

Since its inception, Trinity Consultants has been committed to providing superior professional training in environmental topics. Our annual schedule includes more than 200 courses, offered at locations around the country, on timely topics for environmental professionals such as environmental permitting, emissions quantification and reporting, air dispersion modeling, greenhouse gas emissions reporting and permitting, stack testing, and CEMS management.

In addition to our federally-based regulatory courses, we also offer a large slate of state-specific courses, bringing the added value of information on specific state and local programs and insights gained from our experience working with the local regulatory agencies.

Free CARB Regulatory Training in Your Area!

Do you own, operate, or dispatch heavy-duty diesel trucks in or to California? Then you need to know that the California Air Resources Board (CARB) enforces a set of air pollution regulations affecting all types of heavy-duty diesel vehicles operating in the State. If your vehicles are NOT already compliant, you need to know what to do to be compliant for 2019. And if your vehicles ARE compliant, you still may need to report to remain compliant. This course gives you the information you need about how to comply with CARB diesel regulations and how to report to continue operating legally in 2019 and beyond.

|

| |  |

After careful consideration for the guidance set forth by federal, state, and local authorities regarding the ongoing COVID-19 crisis, the PFCS and CFCA Executive Committees have made the joint decision to cancel the upcoming 2020 Pacific Fuels + Convenience Summit. This decision was not taken lightly and was made with the utmost consideration for the safety and wellbeing of our attendees, exhibitors, and dedicated sponsors.

PFCS remains committed to presenting not only an irreplaceable opportunity for personal networking, but also ensuring our continued reputation for incredible hospitality that we have earned from our key stakeholders and sponsors. We encourage all sponsors, exhibitors, and attendees to direct monetary deposits for PFCS 2020 into PFCS 2021, which will be held September 7-9, 2021. However, we will absolutely honor any refund requests, as we understand businesses are facing unprecedented financial hurdles during this challenging time.

While this development is unfortunate, our top priority is, and always will be, the best interests of the people that make up our amazing industry. While we are disappointed we could not share all we had in store for 2020, our resolve to return even better in 2021 has never been stronger.

Thank you for your understanding and patience as we continue to navigate the challenges that 2020 continues to present for our entire industry. We cannot wait to see you all in 2021.

If you have any questions, or would like to secure your current booth space for 2021, please contact Amber Palmer at palmer@cfca.energy. For any further information, visit our website at www.petroshow.com.

|

How are the sales tax prepayment rates determined?

The prepayment rate for each gallon of gasoline, aircraft jet fuel, and diesel fuel is calculated at 80 percent of the combined state and local sales tax on the average selling price of the fuel, excluding sales tax, as reported by industry publications. By March 1 of each year, we are required to establish the sales tax prepayment rates. We may adjust these rates during the year if changes in fuel prices cause fuel retailers to prepay too much or too little tax. We will notify you by special notice if this occurs.

How are the excise tax rates determined?

We are required to adjust the motor vehicle fuel and diesel fuel excise tax rates on July 1, 2020, and every July 1 thereafter, by the percentage change in the California Consumer Price Index, as calculated by the Department of Finance.

|

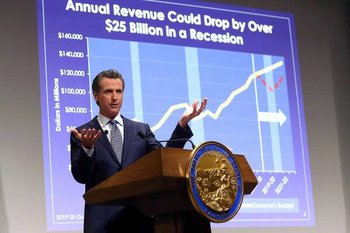

Legislators will vote on a new state budget Monday, even though they have yet to strike a deal with Gov. Gavin Newsom on a plan to close California’s $54.3 billion deficit.

The move could be largely procedural. State Senate and Assembly leaders said Wednesday that lawmakers plan to vote and then continue “productive” talks with Newsom, to meet a June 15 deadline for passing a budget or have their pay cut off.

|

Every day, nearly 18,000 diesel-powered trucks barrel along State Route 60 in Jurupa Valley, a small city 45 miles east of Los Angeles. The trucks come and go from over 40 square miles of warehouse space in the area, but a blanket of smog lingers behind.

"The air, the pollution just sits there," Brenda Angulo, a kindergarten teacher, said. Her students breathe in that "layer of thick, brown sky."

Angulo's school sits in what health experts call a "diesel death zone," an area in the shadow of a port or trucking artery where people are subject to the noxious mix of more than 40 toxic air contaminants produced when diesel combusts-including fine particulate matter so small it permeates the deepest parts of the lungs.

|

House Democrats are out with a new bill that would reauthorize the federal government's soon-to-expire surface transportation programs. Their proposal would boost current spending levels, devote a lot more money toward transit and passenger rail, and require a huge gas tax hike to pay for everything.

Last week, Rep. Peter DeFazio (D-Ore.), who chairs the House Committee on Transportation and Infrastructure, released the Investing in a New Vision for the Environment and Surface Transportation (INVEST) in America Act. The legislation would devote $494 billion over the next five years to the Highway Trust Fund, the main federal spending program for highways and public transit, and other grant programs.

"The bulk of our nation's infrastructure is not only badly outdated," said DeFazio in a press release. "The INVEST in America Act is our opportunity to replace the outdated systems of the past with smarter, safer, more resilient infrastructure."

|

|

Member News

Member News Member Benefits

Member Benefits Education

Education Upcoming Events

Upcoming Events Industry News

Industry News

.png)

.png)

.png)