Rising Gasoline Prices Could be Another Obstacle for the Economy

With the recent uprising in Iraq, the U.S. is once again exposed to the risk of rising oil and gasoline prices. Oil prices are driven by many factors including supply and demand, seasonality, the value of the U.S. dollar, OPEC policy, investor and trader sentiment, and at the moment, fear of supply disruption. Historically, sharp increases in oil and gasoline prices have posed significant headwinds for our economy, but only if they last for several months. Since January, the price of West Texas Intermediate (WTI) crude oil has risen about 13%, while gasoline prices nationwide have risen about 11%. Contrary to popular perception, on a percentage basis gasoline prices rise less quickly than crude oil prices because the price of crude oil accounts for only 60%-70% of the price of gasoline.

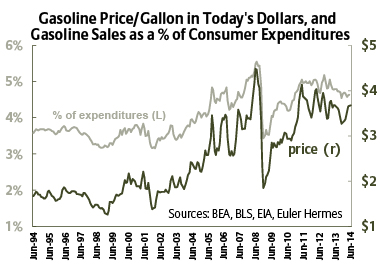

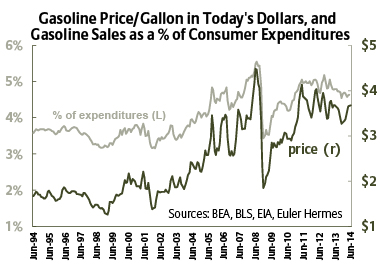

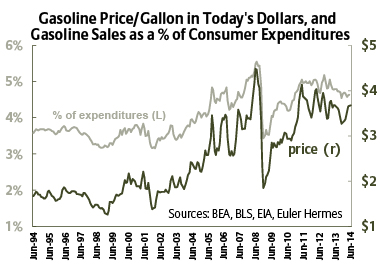

As shown in the chart below by the dark green line, the average nationwide price of a gallon of regular gasoline is currently around $3.70. In inflation adjusted terms that’s 18% below the $4.50 (in today’s dollars) reached in the summer of 2008. The current WTI price of around $107/bbl is about 28% below the inflation adjusted price of $148/bbl also reached in the summer of 2008.

So when do oil and gasoline prices start taking a bite out of the economy and business? There are two answers – one based on actual consumer expenditures, and one based on psychology. The light green line in the chart shows that currently the consumer is spending 4.6% of all expenditures on gasoline; again well below the 5.5% seen in 2008 and during the second energy crisis in 1981, but above the long-term average of 4.1%. Therefore, one could argue that high gasoline prices are already at a level which is impeding economic growth. In addition, a 10% rise in the price of gasoline translates to a diversion of 0.5% of spending to gasoline and away from the rest of the consumer economy. Since consumption accounts for around 70% of all economic activity (GDP), GDP would then fall by about 0.3%-0.4% in this scenario. However, consumers do adjust their spending patterns so the fall in GDP would more likely be about 0.2%. Since our economy contracted in the first quarter, and will likely only grow around 2% for the entire year, 0.2% could be a significant amount of damage.

Consumer psychology also plays a part in actual consumption, and the prices of oil and gasoline start to affect consumers when they reach psychologically important levels which are near recent previous highs. No one knows for sure what these levels are, but broadly speaking they are thought to be about $4.25/gal of gasoline nationwide and around $125/bbl of crude oil. Again, since current prices are not too far from these levels, it’s likely that they are impeding the economy and business to a certain extent already.

However, there are several mitigating factors which should be taken into account. First, U.S. dependence on foreign oil has dropped from about 70% of all consumption in 2005 to below 50% recently. Second, oil from Iraq accounts for less than 2% of all oil consumed in the U.S. Finally, Iraq produces around 3.3 million barrels per day (bbd), and Saudi Arabia has about 2.8 million bbd of spare capacity which could be used in the event that oil from Iraq stops flowing. Therefore, while rising gasoline and oil prices are probably already slowing business activity, the risk of further damage may be mitigated if prices don’t rise much more. Of course, since oil and gasoline prices can be sharply affected in the short-term by the sometimes irrational fear over supply disruption, those mitigating effects could be outweighed by further rapid increases in prices.

What this Means for Your Business

Rising gasoline prices cause consumers to temporarily divert spending to more expensive gasoline and away from other goods and services, slowing economic growth and business activity. Furthermore, increased energy prices contribute to business’ higher utility and transportation bills. Any business more exposed to energy costs such as trucking and airlines, among others, face higher costs, narrower margins, decreased sales, and increased risk of failure. While credit management departments are very useful for managing foreseeable risks, a credit insurance policy can help reduce unforeseeable risks, such as unrest in the Middle East causing higher energy prices, a slowing economy, and deteriorating business conditions.

What to Watch for

Gasoline prices are of course readily observable anywhere and a nationwide survey is published every day by AAA’s Daily Fuel Gauge Report. Again, the nationwide level of around $4.25 may be where significant damage is done to the economy. Both the U.S. WTI price and the global Brent price are available daily on the web, TV, radio, and print media. Watch for $125 bbl for WTI to impact the U.S. economy and around $130/bbl for Brent to start affecting the global economy.

About the Author:

Dan North, Chief Economist for Euler Hermes North America, uses macroeconomic and quantitative analysis to help manage Euler Hermes’ risk portfolio of more than $150 billion in annual trade transactions within the Americas region. After having predicted the 2008/2009 recession and its implications accurately, Dan was ranked 4th on Bloomberg’s list of the 65 top economic forecasters in 2010.

Euler Hermes provides timely analyses on this and other subjects in our Weekly Export Risk Outlook (WERO), as well as monthly and quarterly analyses on the global macroeconomy and specific countries and industry sectors. Visit the Economic Research section of our website to learn more.

www.eulerhermes.com.