| January 27, 2015 | |

Port Traffic Trends: Georgia, Global Port Tracker, Long Beach/Los Angeles, Seattle/Tacoma

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

Savannah tops 3.3 million TEUs

The Georgia Ports Authority (GPA) ended 2014 with growth in all cargo sectors, including a 10.2 percent increase in container TEUs and a 7.4 percent increase in total cargo tonnage.

"Our deepwater ports are powerful economic engines for the state of Georgia and the nation," said Gov. Nathan Deal. "GPA's great performance over the past year is a testament to Georgia's superior logistics network, starting with port terminals that have flawlessly taken on more business while still ensuring on-time, reliable delivery."

A busy December helped to lift the Port of Savannah to 3.34 million TEUs for the year, an increase of 312,037 TEUs over 2013. GPA’s Port of Brunswick continued its dominant performance in auto and machinery trade, moving 688,575 units for the year. Combined with roll-on/roll-off trade through the Port of Savannah's Ocean Terminal, GPA moved 716,055 units in 2014, an 8.6 percent (57,190-unit) increase on the year.

"In 2014, we saw phenomenal growth in every category," said GPA Executive Director Curtis Foltz."Georgia's ports benefited from an improving retail economy, renewed strength in manufacturers' orders of raw goods, and the expanding population of the Southeast."

Break bulk cargo, such as forest products, iron and steel improved by 12 percent, or 294,466 tons, to reach 2.74 million tons. Meanwhile, bulk cargo such as gypsum, wood pellets and agricultural products saw an increase of 5.7 percent (152,987 tons) for a total of 2.81 million tons.

Counting containerized, bulk and break bulk cargo, total tonnage reached 30.39 million tons, up 2.09 million for the calendar year.

For the month of December, GPA moved a record 68,684 automotive and heavy equipment units, for a year-over-year increase of 20.1% (11,507 units). Also in December, GPA moved 277,633 twenty-foot equivalent container units, up 18%, or 42,333 units. Total tonnage grew by 12.9% (305,291 tons) to reach 2.67 million tons of cargo in December.

"Commerce has chosen Savannah as the Southeast's busiest port for containerized cargo," said GPA Board Chairman James Walters. "With construction beginning on the Savannah Harbor deepening, the Jimmy Deloach Parkway extension moving toward completion, and our continued on-terminal investment, we are solidifying our role as a logistics hub."

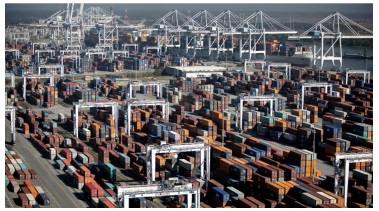

In other business, to accommodate larger than expected volume growth, the Authority board approved the purchase of 10 additional rubber-tired gantry cranes. This is an addition to a May order for 20 of the machines used to handle shipping containers on terminal. The purchases will bring Savannah's total number of RTGs to 146.

The Port of Savannah moved 3.34 million TEUs in calendar year 2014, an increase of 312,037 TEUs over 2013.

(GPA photo/Stephen B. Morton)

(GPA photo/Stephen B. Morton)

Global Port Tracker: Imports Expected to Rise as West Coast Port Issues Continue

Year-over-year import cargo volume at the largest U.S. containerized import cargo handling ports should grow during most of the first half of 2015 despite West Coast port congestion issues, predicts the monthly Global Port Tracker report released January 9 by the National Retail Federation and Hackett Associates.

"Now that a federal mediator is on the scene, we hope the mediator will be able to help the parties quickly reach a new contract so we can begin to work on solutions to the ongoing congestion issues," said Jonathan Gold, the NRF’s vice president for supply chain and customs policy. "The urgent need to end the uncertainty we’ve seen for half a year now isn’t over just because the holiday season has ended. Retailers are already starting to bring in products for the spring season, and want both labor and management to work together to bring these issues to an end."

The contract between the Pacific Maritime Association and the International Longshore and Warehouse Union expired on July 1. The lack of a contract and other operational issues led to crisis-level congestion at the ports. At the urging of the NRF and others, including AAPA, a federal mediator is currently working with labor and management on the contract negotiations.

Global Port Tracker’s conclusions are based on its survey and analysis of inbound container traffic flows at the ports of Charleston, Hampton Roads, Houston, Long Beach, Los Angeles, Miami, New York/New Jersey, Oakland, Port Everglades, Savannah, Seattle, and Tacoma.

According to Global Port Tracker, those ports handled 1.39 million TEUs in November, the latest month for which finalized numbers are available. That was down 10.7 percent from the preceding month but up 3.5 percent from November 2013. December is estimated at 1.35 million TEU, up 2.7 percent from the year before. That gave 2014 a preliminary total of 17.2 million TEUs, up from 16.2 million in 2013 and 15.8 million in 2013.

Global Port Tracker’s subsequent month forecasts: January – 1.39 million TEUs ( 1.1 percent); February – 1.3 million TEUs ( 4.8 percent); March – 1.3 million TEUs (-0.5 percent); April – 1.43 million TEUs (0.0 percent); and May – 1.49 million TEUs ( 0.6 percent).

"2014 started out with a whimper as winter weather hammered the country but it appears to have ended with a bang," said Hackett Associates Founder Ben Hackett. "Import volumes on the West Coast, despite all the problems there, were the highest since 2009. A similar picture exists on the East Coast, which had even healthier results."

San Pedro Ports Container Volume Topped 15 Million TEUs in 2014, Best Year Since 2007

The San Pedro Harbor ports of Long Beach and Los Angeles together handled container volumes totaling nearly 15.2 million TEUs in 2014. That was up 3.8 percent from the year before and the highest calendar year total since 2007 and came amid challenges arising from port traffic congestion and the ILWU contract impasse.

In detail, the data show increases from 2013 of 4.8 percent for inbound loads and 8.4 percent for empty containers and a 2.5 percent drop in outbound loads.

The December data were generally negative, particularly for outbound loads.

Puget Sound Container Volumes Reach 3.4 Million TEUs in 2014

Container volumes through Puget Sound’s largest container ports remained flat in 2014, according to numbers released jointly for the first time by the ports of Seattle and Tacoma.

Container volumes fell less than 1 percent to 3.4 million TEUs. Tacoma and Seattle’s combined volumes have hovered near 3.5 million TEUs since 2010. Last year marked the second consecutive year of decline, underscoring the competitive pressures reshaping the global shipping industry.

The two ports announced in October 2014 plans to form a Seaport Alliance. Currently in the due diligence phase, this strategic response to the competitive threats will strengthen the Puget Sound gateway and create more economic opportunities.