| September 9, 2014 | |

Infrastructure: Latin America, Quetzal, North Carolina

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

APM Terminals Sees Need for Increase in Latin American Transport Infrastructure Investment

Speaking at trade conference in Miami, APM Terminals Vice President and Chief Financial Officer Christian Moller Laursen warned that economic and population growth rate projections for Latin America have not yet been matched by the port and transportation infrastructure investment needed to accommodate the increased logistics and trade demands this economic growth will require over the next decade.

"The latest United Nations projections see a nearly 11 percent growth in Latin America’s population to 690 million by 2025, nearly 200 million more than the current combined population of the European Union countries," Mr. Laursen said. "The total container throughput for Central and South America, in comparison, grew by only 1 percent in 2013, to 45.7 million TEUs. Brazil, Latin America’s largest economy, handled 8.6 million TEUs in 2013, approximately the same number as the Port of Antwerp, the third-busiest container port in Europe. This underperformance will only become more acute without a new and invigorated strategy to address and promote necessary infrastructure investment."

He went on to say that the cost of this port and transportation infrastructure will require significant foreign direct investment (FDI) as Latin American nations develop new strategies for the infrastructure to catch up with current and projected requirements. He emphasized the importance of developing master plans covering ports, as well as the roads and rail connections needed to efficiently link the ports with main population centers, warning that these hinterland connections otherwise will only create more bottlenecks in the future.

"Successful strategies to promote investment and partnerships with the private sector will become significantly more important to address these port and transportation infrastructure opportunities, with realistic and practical concession terms an increasingly crucial component of this process," said Mr. Laursen.

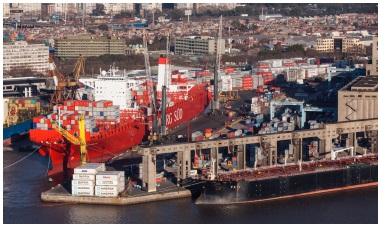

APM Terminals owns a 50 percent share in the Brasil Terminal Portuário container facility that opened last year in Santos. It has new terminal development projects underway at Moin (Costa Rica), Lázaro Cárdenas (Mexico), and Callao (Peru). It also operates terminals in Buenos Aires and the Brazilian ports of Itajai and Pecém. APM is a unit of A.P. Moller, corporate parent of ocean shipping carriers Maersk and Safmarine.

9,700 TEU container ship at APM’s T4 Terminal in Buenos Aires in August 2013 demonstrates the trend of larger vessels entering the South America trade.

Photo/APM Terminals

Guatemala: Construction Begins on Puerto Quetzal Container Terminal

Global terminal operator Grup TCB has laid the cornerstone of a container yard extension in Puerto Quetzal on Guatemala’s Pacific coast. The first phase of the improvements will be complete by the end of 2015, when the company will start operating Puerto Quetzal Container Terminal (TCQ).

Puerto Quetzal is one of four administered by the Guatemalan national port authority, Comisión Portuaria Nacional.

"This is a magnificent opportunity to modernize Guatemala’s Pacific port and to be a logistical area in Central America," said company vice president Ángel Pérez Maura.

TCQ will operate the new port terminal under a lease arrangement for 25 years. It will be capable of handling the "mega ships" passing through the enlarged Panama Canal.

In phase one, Grup TCB will invest €133 million/US$174.9 million to build a terminal with the capacity to move 400,000 TEUs per annum. It will have a yard area of 13 hectares and 350 meters of pier. The second phase will involve a yard extension of up to 20 hectares and 540 meters of pier with capacity for 700,000 containers per annum. The total investment will be €192 million/US$252.5 million. The project will create 600 jobs.

Headquartered in Barcelona (Spain), Grup TCB operates maritime container terminals in the Barcelona, Tenerife (Canary Islands), Valencia, Gijón, Paranaguá (Brazil), Progreso (Mexico), Buenaventura (Colombia), and Bahía de Nemrut (Turkey). In 2013, the company's turnover was €433 million. Its operations in port terminals exceeded 3.7 million TEUs of containerized cargo.

North Carolina Ports Retains Service Provider for its Charlotte Inland Terminal

The North Carolina State Ports Authority has contracted with ContainerPort Group, Inc., (CPG) to provide service at the Charlotte Inland Terminal (CIT).

Under the terms of the agreement, CPG will use CIT as a base for international container drayage between the Port of Wilmington and the ramps in Charlotte. With secured access to CIT, CPG Charlotte will provide customers with additional empty container yard space along with loaded container/trailer storage options, complementing CPG’s existing terminal services network.

"The Charlotte Inland Terminal is strategically situated at the crossroads of the manufacturing and distribution network serving the Southeast," said Ports Authority CEO Paul J. Cozza. "Partnering with Container Port Group enables us to offer top-notch drayage service to Port of Wilmington’s growing customer base."

The Cleveland-headquartered company operates facilities and terminals in the Midwest, Ohio Valley, and Northeast regions. It provides motor carrier and terminal services (depot, container yard, equipment maintenance, rail ramp operations) to shipping lines, railroads, shippers/receivers, and freight intermediaries with concentration on international cargoes.