| February 4, 2014 | |

Cargo Trends: Georgia, Indiana, México, Milwaukee

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

Georgia Ports Cargo Tonnage Up 8 Percent in First Half FY 2014

The Georgia Ports Authority (GPA) reports its facilities statewide handled nearly 14.4 million short tons of cargo during the first half of the fiscal year that began July 1, 2013. That was up 8 percent from the first half of fiscal 2012-2013, for a total of 13.3 million tons.

According to GPA Executive Director Curtis Foltz, "Strong volumes in container traffic, bulk cargo, and auto and machinery units for the month of December contributed to this successful mid-year report."

The December container count was up 7.4 percent from a year ago to 235,311 TEUs. The GPA’s calendar year 2013 total exceeded 3.0 million TEUs for the first time ever.

Bulk cargo increased 10 percent to 325,020 tons, boosting the first half FY 2014 total to 1.35 million tons, an increase of 11.7 percent.

Auto and machinery traffic increased by 4.3 percent in December over year-ago figures to 57,171 units moved. For FY 2014 to date, the GPA’s Colonel’s Island terminal in Brunswick and Ocean Terminal in Savannah together moved 343,065 cars and tractors, a 6.8 percent gain.

"Our tremendous growth highlights the increasing importance of the ports of Savannah and Brunswick to the nation’s international commerce," said GPA Board Chairman Robert Jepson. "We are well prepared to take on even greater responsibility: We are handling 3 million TEUs a year in Savannah, but we can move up to 6.5 million TEUs without increasing our physical footprint."

In other news, the GPA will contribute $3 million to the U.S. Army Corps of Engineers for harbor maintenance dredging at the Port of Brunswick. The port authority board also approved a high mast lighting upgrade at Garden City Terminal. New, more efficient lights already have been installed over container berths 4 through 9. The third phase, for container berths 1, 2 and 3, will be completed at a cost of $1.4 million. Coupled with new lighting controls, the system delivers a 59 percent reduction in energy consumption, according to the GPA.

Ports of Indiana Shipments Increase 20 Percent in 2013

The Ports of Indiana handled 8.3 million tons of cargo at its three ports in 2013, a 20 percent increase from the year before. That made 2013 the port’s best tonnage year since 2006 and the third best in its 52-year history.

Strong shipments of coal, steel and agricultural-related products helped drive significant increases in annual tonnage at all three of the state's ports.

"Our ports finished the year on a record pace, which does create some optimism for 2014," said Ports of Indiana CEO Rich Cooper. "In 2013, our ports handled more steel, fertilizer and minerals than any year in recent history. Steel, ag products and coal make up more than 80 percent of the shipments at our three ports, so when those cargoes are up it bodes well for shipping in Indiana. It was good to see ag cargoes rebound in 2013 after the previous year's drought, and the positive trend in manufacturing creates a brighter outlook for future steel shipments."

In the fourth quarter of 2013, the Ports of Indiana handled nearly 3.0 million tons of cargo, the most for any quarter since the ports opened.

• On Lake Michigan, the Port of Indiana-Burns Harbor recorded its highest annual tonnage since 2006 and second highest since 1998 by handling 2.5 million tons of cargo. The 2013 shipments exceed the 2012 by 17 percent and the previous five-year average by 23 percent. There were increases in shipments of steel, fertilizer, road salt, coal and limestone.

• On the Ohio River, the Port of Indiana-Jeffersonville recorded its highest annual tonnage since 2006 at 1.6 million tons, up 19 percent from 2012, with increased shipments of grain, steel, oils and minerals. Fourth-quarter tonnage set a record and exceeded by nearly 80 percent the quarterly average for the previous five years.

• The Port of Indiana-Mount Vernon also finished strong in 2013 with its highest quarterly shipments ever and handled 4.2 million tons for the year – up 21 percent from 2012. Key drivers for the Ohio River port were increases in coal, grain, fertilizer, coke and minerals. During the fourth quarter for the first time, cargo shipments exceeded half a million tons in three consecutive months and was more than 50 percent higher than the average quarter in the last five years.

Mexican Port Cargo Tonnage Set Record in 2013

Mexico’s ports handled a record 287.9 million metric tons of cargo in 2013, an increase of 1.6 percent compared to 2012, according to preliminary data reported by the national port agency, Dirección General de Puertos.

Foreign trade grew by 1.4 percent, reflecting a 5.7 percent increase for exports and a 4.8 percent decline for imports. Domestic cargo also grew, by 2.1 percent.

The Pacific Coast port range accounted for 131.9 million tons ( 7.9 percent) and the Mexican Gulf for 156.0 million tons (-2.7 percent) of the cargo handled in 2013. Tonnage increases were posted by mineral bulk, non-petroleum liquid and break bulk cargo.

Reversing the upward trend of the past decade, containerized cargo fell 1.9 percent to 39.9 million tons, giving containers a 13.9 percent share of total cargo tonnage, down from 14.4 percent in 2012, but up from 9.7 percent in 2008 and just 4.7 percent in 2002.

Petroleum, though still the nation’s leading cargo by weight, continued its long-time decline, falling 4.7 percent to its lowest level in many years, 122.4 million tons. That equates to 42.5 percent of Mexico’s national cargo mix, down from 51.6 percent in 2008 and 62.3 percent in 2003.

Mexico’s so-called "commercial ports" accounted for 57.5 percent of cargo handled nationwide in 2013, with the balance going to ports specializing in bulk cargoes, such as petroleum and minerals. The commercial ports handled all of the containers and automobiles and much of the break bulk, dry bulk and non-petroleum liquids shipped through the Mexican port system last year.

Mexico’s box trade ended the year with an estimated total of nearly 4.9 million TEUs, an increase of just 0.3 percent from 2012 but enough for a fourth consecutive annual record. Manzanillo remained the nation’s leading container handler and became its first to exceed 2.0 million TEUs. Lázaro Cárdenas continued its second place ranking, just above the million-TEU level despite a drop in trade. Ranked third and fourth nationally were Veracruz (866,966 TEUs) and Altamira (597,760 TEUs). The Pacific ports collectively accounted for 67 percent of Mexican container throughput in 2012, up from 51.5 percent in 2005 and 35.9 percent in 2000.

Tops in total cargo tonnage were the petroleum-handling ports of Cayo Arcas (47.9 million tons) and Lázaro Cárdenas (32.8 million tons).

Veracruz continued its dominance of Mexico’s auto trade, importing and exporting 748,666 vehicles, or 65.6 percent of the 2013 national total. Lázaro Cárdenas ranked first on the Pacific coast and second nationally, with a record 248,984 vehicle exports and imports (up from 213,464 in 2012 and 167,219 in 2011). Overall, the nation’s auto trade fell 7.4 percent in 2013 to 1,141,316 vehicle units, as imports rose 7.6 percent and exports fell 13.6 percent.

Mexico’s cruise ports had another tough year in 2013, with declines of 9.1 percent in passenger throughput to 4.3 million and 8.6 percent in vessel arrivals to 1,619. Cruise ships visiting Mexico in 2013 carried an average of 2,681 passengers per port call, compared to 2,694 passengers in 2012, and 2,001 in 2005. The leading ports in 2013 based on passenger volume were Cozumel (2.75 million), Ensenada (487,774), Majahual (392,708) and Progreso (234,323).

See the attachment for a detailed statistical profile of Mexican port traffic for the years 2009 to 2013.

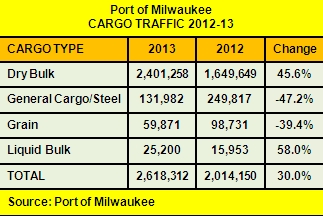

Milwaukee Cargo Volumes Climb in 2013

More than 2.6 million metric tons of cargo moved through the Port of Milwaukee in 2013, a 30 percent increase from 2012 that was due in great part to a doubling of salt deliveries. Year-on-year gains were also posted by steel, limestone, and liquid bulk cargoes, while general cargo and grain shipments were lower.

Regional weather conditions this winter season have kept up the demand for road salt this year. Several vessels delivered salt to the Port of Milwaukee in January; additional shipments are anticipated.

"Our customers know the advantages the Port of Milwaukee provides," said acting Port Director Paul Vornholt. "The port offers cost-effective and efficient transportation solutions with direct links to an Interstate highway, two major rail lines and water routes through the Mississippi River system, the St. Lawrence Seaway and throughout the Great Lakes."

The port will be investing in rail improvements and general cargo handling machinery in 2014.

The port is an economic entity of the Milwaukee city government and governed by a seven-member board of harbor commissioners appointed by the mayor with the concurrence of the Common Council. The port administers a 467-acre cargo handling complex and is the grantee of Foreign Trade Zone #41.